Ireland is a prosperous, northwestern European nation with a highly developed economy, including successful international technology, science, and financial service industries. Ireland’s global business profile has also led to financial crime risks: in 2021, Irish police revealed that they had recorded over 500 money laundering crimes in 2020, more than double the amount in 2019, and a sixfold increase in two years. To address that threat, the Irish government has committed to bolstering the powers and resources of authorities to fight financial crime and in particular to address offences such as money laundering and terrorism financing.

The increased focus on anti-money laundering (AML) and counter-financing of terrorism (CFT) regulations means that organisations in Ireland must understand the risk landscape, and be capable of achieving compliance with the relevant regulations. Prepare your organisation for criminal threats, and stay ahead of your compliance obligations with our guide to Ireland’s AML regulations.

Ireland’s AML Regulator: The Central Bank of Ireland

Founded in 1943, and headquartered in Dublin, the Central Bank of Ireland (CBI) is Ireland’s primary anti-money laundering regulator and is responsible for “effectively monitoring credit and financial institutions’ compliance with their AML and CFT obligations”. The CBI’s duties and responsibilities include:

- Providing oversight for Ireland’s financial institutions to ensure compliance with AML/CFT regulations.

- Conducting on-site inspections to verify that financial institutions are meeting their regulatory compliance obligations.

- Monitoring adoption and implementation of risk-based AML/CFT compliance procedures.

- Ensuring that financial institutions keep AML/CFT compliance policies and procedures up to date and available for inspection, and that senior management are aware of their own compliance responsibilities.

- Enforcing administrative sanctions against financial institutions that fail to comply with their compliance obligations.

As a national regulatory body, the CBI plays a role in the development of new financial regulations with the Irish government. Similarly, the CBI works with other European Supervisory Authorities (ESA) in order to foster a consistent approach to anti-money laundering regulations across the EU. Ireland is also a member of the international intergovernmental AML organisation, the Financial Action Task Force (FATF).

Key Ireland AML Regulations

The primary AML/CFT legislation in Ireland is the Criminal Justice (Money Laundering and Terrorist Financing) Act 2010, as amended by Part 2 of the Criminal Justice Act 2013 and by the Criminal Justice (Money Laundering and Terrorist Financing) (Amendment) Act 2018 – also known as the CJA 2010.

The CJA 2010 defines the offence of money laundering in Ireland and requires all financial institutions in Ireland to implement a risk-based AML/CFT solution. Key CJA 2010 compliance measures include customer due diligence (CDD), customer screening processes, suspicious activity reporting (SAR) mechanisms, the appointment of a competent compliance officer, and the implementation of employee training.

In addition to the CJA 2010, Ireland has passed several additional articles of AML/CFT-relevant legislation, these include:

- The Criminal Justice (Terrorist Offences) Act 2005

- The European Union (Anti-Money Laundering: Beneficial Ownership of Corporate Entities) Regulations 2019

- The European Union (Anti-Money Laundering: Beneficial Ownership of Trusts) Regulations 2019

- The European Union (Information Accompanying Transfers of Funds) Regulations 2017

AMLD: As a member of the EU, Ireland must transpose the European Parliament’s Anti-Money Laundering Directives (AMLD) into domestic law. The most recent directive, the Sixth Anti-Money Laundering Directive (6AMLD) came into effect on 3 June 2021.

How to Comply with Ireland’s AML Regulations

The CJA 2010 requires that firms in Ireland implement a risk-based AML/CFT compliance solution. In this context, risk-based compliance means that firms must conduct a risk assessment of customers at onboarding to establish the level of individual AML risk that they present, and then deploy proportionate compliance measures.

A CJA 2010 compliance programme should include the following measures and controls:

- Customer due diligence: Firms in Ireland must identify their customers by collecting identifying information, including names, addresses, and dates of birth. Firms must also identify ultimate beneficial owners (UBO) in order to prevent the misuse of shell companies.

- Transaction screening: Firms must screen customer transactions in order to detect suspicious activity, such as unusual transaction patterns, transactions with high risk counter-parties, or transactions involving high risk jurisdictions.

- Watchlist screening: Firms should screen customers against relevant watchlists, including PEP lists.

- Sanctions screening: Firms must also screen against international sanctions lists, such as the EU Consolidated sanctions list, to establish whether customers have been designated as sanctions targets.

Adverse media screening: In order to understand customer risk levels as comprehensively as possible, and fulfil the CJA 2010’s risk-based obligations, firms in Ireland should implement an adverse media screening solution. Adverse media is valuable to AML because risk-relevant information is often revealed by media sources before it is confirmed officially, meaning that firms can perform more accurate risk assessments and deliver better compliance outcomes.

Accordingly, adverse media screening solutions should take in sources from Ireland and around the world, including foreign language media, and cover everything from stories by established news outlets to blog posts, forum entries, and social media posts. Adverse media solutions should be capable of multi-language searches, account for regional variations in spelling, non-Western characters and conventions, and factor in the credibility of the sources.

Recent AML Initiatives in Ireland

In addition to the TFR, Ireland will also implement another EU virtual asset regulation: Markets in Crypto Assets (MiCA). A landmark, EU-wide regulation, MiCA will address the AML risks posed by certain crypto-assets, and introduce new licensing and registration requirements for crypto-asset service providers. MiCA is expected to come into effect across the EU in 2024.

In 2023, Ireland announced that it would be bidding to host the new EU Anti-Money Laundering Authority (AMLA). The bid reflects Ireland’s desire to increase its profile as a European financial centre, and international AML leader.

Next Generation AML Screening

As Ireland’s AML landscape evolves, financial institutions will need to work harder to keep up with new regulatory obligations and to address new criminal methodologies. In this environment, automated screening solutions are critical: firms must be able to collect and analyse vast amounts of customer data, while minimising false positives and making decisions quickly.

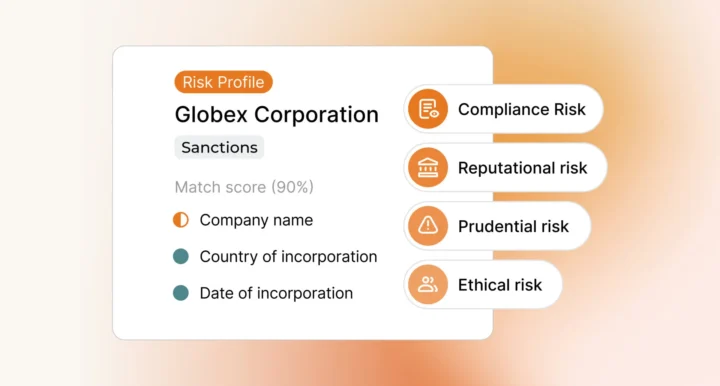

Ripjar’s Labyrinth Screening platform is designed to meet those challenges – in Ireland and jurisdictions around the world. Labyrinth Screening enables firms to search customer names against thousands of global media sources, including PEP lists and sanctions lists, in real time, and generate actionable financial intelligence in seconds. Built with next generation machine learning technology, Ripjar has also implemented AI Risk Profiles as part of Labyrinth searches: using AI Risk Profiles, firms can quickly identify and extract only the most relevant risk information about their customers, speeding up the screening process, enhancing accuracy, and ultimately enabling faster, stronger compliance decision-making.

Contact us to discuss how Ripjar can support your AML compliance in Ireland

Last updated: 6 January 2025