When an individual is elected to political office, or becomes a government employee, they may be classified as a politically exposed person (PEP). Anti-money laundering regulations in jurisdictions around the world require banks, financial institutions, and other obligated entities, to screen for politically exposed persons (PEPs) because of the elevated criminal risk that they present.

What are Politically Exposed Persons?

Politically exposed persons are individuals who, as a result of their political appointments or roles, are more likely to be exposed to, and be involved in, financial crimes such as corruption, bribery, money laundering, and the financing of terrorism. Since they often have access to large amounts of government funding, and may be able to evade anti-money laundering (AML) or counter-financing of terrorism (CFT) controls, PEPs pose an elevated regulatory compliance risk. Accordingly, firms must screen their customers to determine their status as PEPs as part of their Know Your Customer (KYC) processes – and adjust their compliance response accordingly.

While the PEP classification is often applied to elected officials and government employees, the term extends to cover military employees, members of the judiciary, or any individual with a prominent public or state-related function – along with their friends and family members.

Types of PEP

While there is no codified global definition, the Financial Action Task Force (FATF) defines a politically exposed person as ‘an individual who is or has been entrusted with a prominent function’. The FATF sets out requirements for PEP screening in its AML/CFT recommendations, and organises PEPs into three broad categories:

Foreign PEPs: Political figures, government employees, or prominent public figures in foreign countries may be designated as Foreign PEPs.

Domestic PEPs: Domestic PEPs may be political or public figures from the same country as their bank or service provider.

International PEPs: Not all PEPs are political or public figures. Certain employees with senior management positions at international or state-owned organisations may be classified as international PEPs. This classification is sometimes referred to as ‘heads of international organisations’ (HIO).

Relatives and close associates: Individuals that are close friends or family of PEPs may also present significant AML/CFT risk because of their proximity and potential involvement in financial crime. With that in mind, the FATF also sets out a PEP-adjacent category known as ‘relatives and close associates’ (RCO). Given their regulatory similarity to designated PEPs, RCOs should be subject to the same AML/CFT compliance measures.

PEP Screening Risk Categorisation

Not all politically exposed persons present the same level of compliance risk. When screening for PEPs, it is useful to organise customers into risk categories in order to deploy an efficient, and effective, compliance response. PEP risk categorisation should take into account the customer’s level of influence, their access to funds, and available opportunities for them to become involved in crimes. With that in mind, PEPs may be organised into the following risk categories:

High risk: Heads of state, political party leaders, members of parliament, military generals, heads of judiciary and law enforcement, directors of central banks

Medium risk: Senior government, military, law enforcement employees, senior civil servants and state-owned business directors, senior religious figures, senior diplomatic employees such as ambassadors

Low risk: Provincial, state-level, and local government employees, mayors, councillors.

Global PEP Regulations

The global PEP landscape includes the following notable regulatory regimes:

North America: The US, Canada and Mexico all mandate international PEP screening in their domestic AML/CFT legislation. However, since the Patriot Act (Section 312) mandates only the screening of Senior Foreign Political Figures (SFPF), firms in the US are not automatically required to conduct domestic PEP screening (although most do as a matter of best practice).

South America: Most South American countries require PEP screening for all categories of PEP. However, some countries are exceptions: in Chile, Venezuela, and Guyana, for example, there are no requirements to screen international PEPs, but foreign and domestic screening should take place. In Suriname, firms are required to screen only for foreign PEPs. By contrast, in Brazil, which deals with high numbers of informal financial activities, companies must screen against all PEPs.

It is worth noting that high levels of government and local government corruption affect South American countries and firms should reflect that consideration in the AML measures they deploy to handle the relevant transactions. Nicaragua and Panama, for example, currently feature on the FATF greylist.

Europe: PEP screening requirements are mandated across most European countries either through EU legislation in EU member-states, or legislative alignment in non-EU states. Turkey is a notable exception since it has no requirements for PEP screening.

Despite generally robust AML/CFT regulations, some European countries warrant increased PEP caution. Albania and Malta, for example, are currently included on the FATF greylist.

Asia: PEP screening requirements are highly divergent across Asian countries. While most larger (and some smaller) Asian countries have screening requirements for all categories of PEP, many, including China, Japan, South Korea, and New Zealand, require companies to screen only foreign PEPs. In Uzbekistan, there are no PEP screening obligations.

It should be noted that North Korea is on the FATF’s blacklist, and should be treated with extreme caution when deploying AML/CFT measures. Similarly, Cambodia, Myanmar, and the Philippines feature on the FATF greylist.

Middle East: While many Middle Eastern countries, including the Gulf states, and Israel require screening for all PEP categories, other countries in the region diverge. In Syria, for example, companies must screen only domestic and foreign PEPs, while Iran requires only foreign and international screening.

It is worth noting that Iran, like North Korea, is on the FATF’s blacklist and should be treated with caution. Similarly, Pakistan and Syria are on the FATF greylist.

Africa: Like Asia, African countries diverge on PEP screening regulations. Most African countries require screening for all categories of PEP, or at least foreign and domestic PEPs, but there are exceptions. In Angola, for example, companies are not required to screen for domestic PEPs, and in Tanzania, South Sudan, and Algeria, companies are not required to screen for domestic or international PEPs.

Many African countries deal with high levels of government corruption and several feature on the FATF greylist. Current African greylist countries are: Botswana, Burkina Faso, Mauritius, Morocco, Senegal, South Sudan, Uganda, Yemen, and Zimbabwe.

How to Comply with PEP Screening Regulations

PEP screening is built on effective KYC: companies must collect and analyse as much information as possible about their customers in order to determine their PEP classification. In practice, this means integrating an AML/CFT software solution capable of managing vast amounts of relevant risk data quickly and accurately. With that in mind, effective PEP screening should involve the following measures:

Customer identification: Companies must perform suitable due diligence in order to identify their customers and determine whether they should be classified as politically exposed persons.

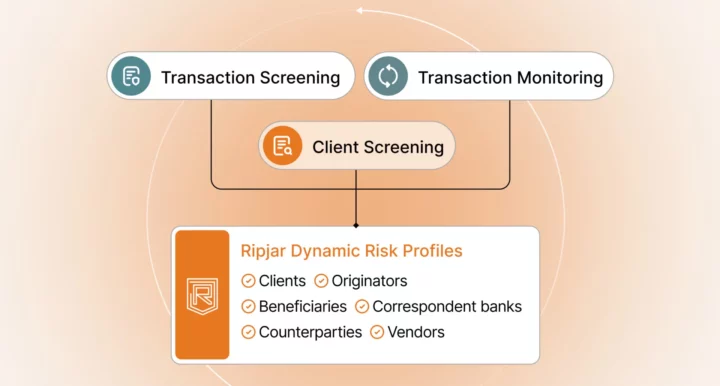

Transaction monitoring: As high risk customers, PEPs’ transactions should be scrutinised for suspicious activity, including transactions in unusual amounts, or transactions with high risk jurisdictions.

PEP list screening: Certain jurisdictions issue PEP lists which companies may use to name-match customers. Companies may need to screen PEP lists in foreign jurisdictions to match foreign customers.

Sanction screening: Politically exposed persons that commit financial crimes and other violations of international law may be subject to economic sanctions. The relationship between PEPs and sanctions screening is an important AML/CFT consideration: firms should seek to match PEP names to the relevant sanctions and watch lists.

Adverse media: PEPs that are involved in financial crimes may feature in adverse news media before that information is confirmed by official sources. Accordingly, companies should integrate adverse media screening in order to capture negative stories that involve their PEP-classified customers.

Recent PEP Regulations

Global PEP regulations vary significantly by jurisdiction so it is important that companies understand their compliance responsibilities. The EU has taken steps to harmonise its PEP regulations, with the implementation of the Fifth and Sixth Anti-Money Laundering Directives (5AMLD/6AMLD). In particular, the Fifth AMLD set out requirements for member-states to compile, and make public, a functional PEP list that included both the names of PEPs and details about their public function.

5AMLD was implemented across the EU on 10th January 2020. 6AMLD, which harmonised PEP screening requirements across all EU member-states (amongst other AML/CFT measures), came into effect on 3 June 2021.

Get in touch to learn how Ripjar can help you implement effective PEP and compliance screening

Last updated: 31 December 2024