Reimagine screening with AI Risk Profiles

Review risk and make decisions faster with clear, individual profile views

See the full picture

Screening just got easier. AI Risk Profiles gather your screening results into individual profiles for people and companies, clearly highlighting relevant risk across adverse media, sanctions lists, watchlists and PEPs.

Tackling the big screening challenges

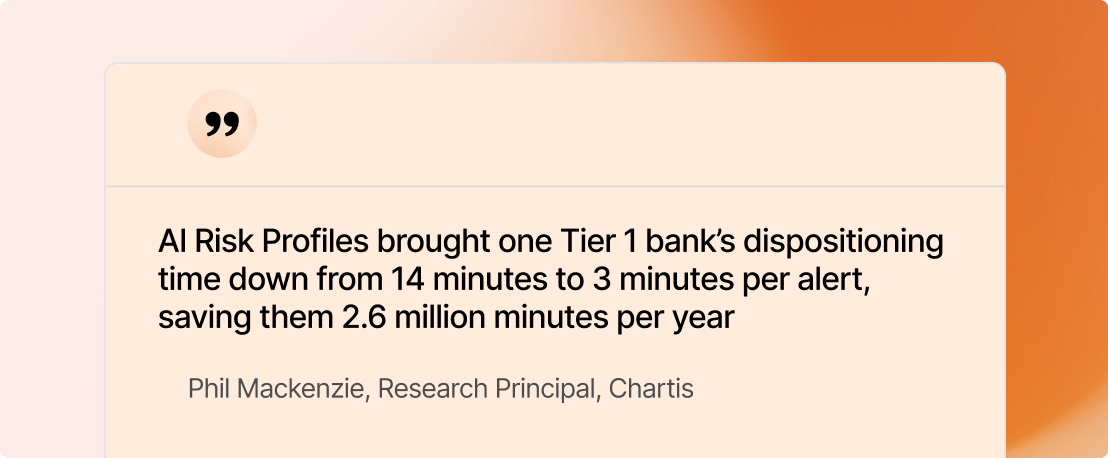

Risk screening is no easy task. Customer data can be incomplete, while media data can be noisy and unfocussed. Many screening methods generate too many false positives, struggle to achieve accuracy at scale, and put a significant time burden on analysts. AI Risk Profiles offer a new approach.

Reduction in customer assessment time

Speed up assessments for increased efficiency

Contain secondary identifiers

Enhance profile accuracy with additional identifying information

Reduction in false positive alerts

Reduce the noise with more reliable results

Supporting analysts

AI Risk Profiles are designed with analysts in mind. With compliance teams often stretched thin and overburdened with time-consuming, repetitive tasks, our AI technology helps tackle the big data, so you can use your valuable time better.

Ready to

get started?

Our experts are available to talk through your requirements, answer questions, and set up a demo.