Finland is a wealthy northern European nation with one of the largest economies in the world, and an industrial landscape backed by strong global trade connections. While international investment has contributed to Finland’s prosperity, it has also attracted criminals who seek to exploit the country’s financial system to commit crimes such as money laundering and terrorism financing. In 2022, Finnish authorities investigated almost 4,000 cases of financial crime, up 10% on 2021 and with costs estimated in excess of €197 million.

The Finnish government has implemented strict regulations to help detect and prevent money laundering, terrorism financing, fraud, and other financial crimes – and firms operating in the country must be able to achieve compliance in order to avoid significant penalties and fines. To help your organisation meet its compliance obligations, read our quick guide to Finland’s anti-money laundering (AML) and counter-financing of terrorism (CFT) regulations.

Finland’s Financial Supervisory Authority: The FSA

Finland’s financial regulator is known as the Financial Supervisory Authority (FSA) or Finanssivalvonta (Fiva). Headquartered in Helsinki and operating in conjunction with the Bank of Finland, the FSA’s stated mission is to ensure “the stable operation of credit, insurance, and pension institutions and other supervised entities” that operate in the country, in order to protect “the stability of the financial markets”.

In that supervisory role, the FSA ensures that organisations comply with Finland’s AML regulations. The FSA has the power to collect and analyse customer and transaction data from financial institutions, perform inspections of supervised entities, and issue penalties and fines in the event of compliance violations. The FSA may also work with the Finnish police as part of financial crime investigations.

Finland is a member of the EU and of numerous international economic organisations, including the Financial Action Task Force (FATF). Accordingly, the Finnish FSA also adopts the AML standards and best practices set out by those entities, and participates actively in the global fight against financial crime.

Key Finland AML Regulations

Firms in Finland must comply with the country’s main anti-money laundering legislation: the Act on Preventing Money Laundering and Terrorist Financing, often referred to as the Anti-Money Laundering Act (AMLA). The Act aligns Finland with international AML/CFT compliance standards, and sets out AML/CFT legal requirements with the following objectives:

- Preventing money laundering and terrorist financing

- Facilitating the detection of money laundering and terrorist financing

- Tracing and recovering the of proceeds of crime

Following FATF recommendations, AMLA mandates a risk-based approach to money laundering, which means that firms in Finland must perform risk assessments to establish the level of money laundering risk that individual customers present, and then deploy compliance measures proportionate to that risk.

Finland’s AMLA is supported by a number of additional financial regulations, including:

- The Act on Virtual Currency Providers

- Government Decree on Customer Due Diligence Procedures and Risk Factors in Preventing Money Laundering and Terrorist Financing

- Government Decree on Politically Exposed Persons

- Act on the Bank and Payments Accounts Control System

- The Criminal Code of Finland

Anti-Money Laundering Directives: As a member of the EU, Finland must implement the EU Parliament’s Anti-Money Laundering Directives (AMLD) in domestic law. Issued periodically, the AMLD set out new AML/CFT standards, often relating to emerging criminal threats or advances in technology. The latest directive, the Sixth Anti-Money Laundering Directive (6AMLD), came into effect across the EU on 3 June 2021.

How to Comply with Finland’s AML Regulations

Under the risk-based approach, firms in Finland must implement certain key measures and controls as part of their AMLA compliance solution. These include:

- Customer due diligence: Firms in Finland must establish and verify their customers’ identities via suitable customer due diligence (CDD) in order to perform accurate risk assessments and build effective customer risk profiles.

- Beneficial ownership: To prevent the misuse of shell companies and corporate infrastructure, firms must establish the ultimate beneficial ownership (UBO) of customer entities.

- Transaction screening: In order to detect criminal activity, firms in Finland must screen customer transactions for red flag indicators of money laundering, such as transactions involving high risk jurisdictions or counter-parties.

- Watchlist screening: Firms in Finland should screen customers against international sanctions lists or other watchlists, such as politically exposed persons (PEP) lists, in order to accurately establish AML risk.

Adverse Media Screening in Finland

In order to establish true risk, firms must build an understanding of the AML risk that their customers pose as quickly and comprehensively as possible. This means conducting adverse media screening to reveal unknown risks or to capture changes in risk, quickly and accurately.

Adverse, or negative news, screening requires firms to screen customers against media sources from Finland and around the world. The screening process should include news articles, websites, social media posts, forum posts, and more, in a range of languages. Accordingly, an effective adverse media solution should incorporate multi-language screening, and account for anomalous factors such as regional variations in spelling, non-Western characters and naming conventions, nicknames, and the use of aliases.

Recent AML Initiatives in Finland

Under EU directives, Finland will implement the upcoming Markets in Crypto Assets (MiCA) and Transfer of Funds (TFR) regulations. Both regulations introduce new AML/CFT compliance obligations for financial institutions that handle virtual assets, including reporting and record-keeping requirements. Finnish authorities have recently increased their focus on virtual asset money laundering; in late 2022, the FSA revealed that it was conducting an investigation into Finnish virtual currency providers’ links with international service providers that had encountered operational problems.

Finland is also enforcing EU sanctions against Russia in response to the invasion of Ukraine in 2022. While the EU has issued several rounds of sanctions against Vladimir Putin’s regime, the situation remains fluid, and it is likely that further sanctions will be imposed in the future. Firms operating in Finland should be prepared to adjust their sanctions screening processes to account for new risks.

Next Generation Technology for AML Screening in Finland

As Finland adapts to changing EU AML regulations, and manages new criminal threats, financial institutions must stay ahead of their compliance obligations. In practice, this means collecting and analysing vast amounts of structured and unstructured financial data, and making important compliance decisions quickly. In an environment where accuracy and speed are critical, effective AML screening represents a significant administrative challenge.

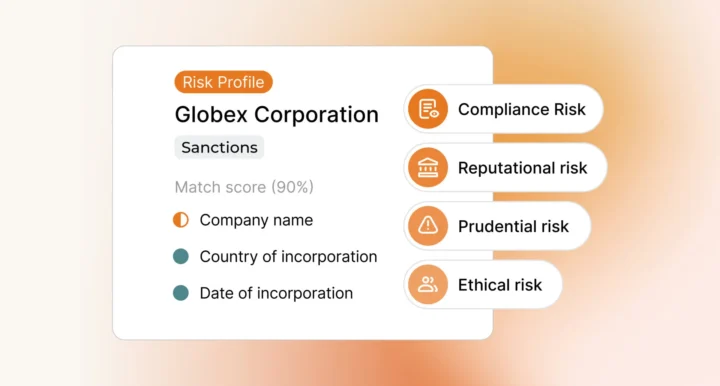

Ripjar’s Labyrinth Screening platform is a fast, flexible screening solution designed to help firms navigate AML compliance in Finland and around the world. Labyrinth Screening enables firms to screen customer names against thousands of global media sources, including news sites, sanctions lists, and watchlists, and generate meaningful, up-to-date, financial intelligence in seconds. Powered by next-generation machine learning technology, Labyrinth Screening also allows compliance teams to build extensive AI Risk Profiles for customers, identifying and collating only the most relevant risk data in order to minimise false positive alerts, save time and money, and help facilitate strong decision-making.

Contact us to discuss how Ripjar can support your AML compliance in Finland

Last updated: 6 January 2025