Banks and financial institutions need all the help they can get to stay ahead of global criminal threats such as money laundering and terrorism financing. In an evolving financial landscape, customer screening represents the best way to achieve anti-money laundering (AML) and counter-financing of terrorism (CFT) goals, enabling firms to build accurate, up to date risk profiles, and then deploy the appropriate compliance measures to deal with any alerts.

Effective customer screening should be more than just a simple name search process, and it will be necessary to think carefully about your solution in order to optimise compliance outcomes. In practice, this means implementing a rigorous screening process with expansive, global scope, and then analysing the collected data accurately and efficiently, minimising administrative friction for both compliance employees and customers.

To get the most out of your customer screening, let’s take a closer look at 5 key ways to improve the process.

1. Find a reliable data provider

The reliability of your data provider is a critical AML/CFT concern. While it’s important that a provider delivers enough data to build out a customer risk profile, the quality of that data should also be a priority. Poor quality data that omits certain risk characteristics or customer attributes, is likely to prevent you from zeroing in on customer identities efficiently. This increases the possibility of false positive AML/CFT alerts, inevitably slowing down the subsequent remediation process.

The timeliness of customer screening data is also critical. Make sure your provider is delivering current information, regularly and reliably updated with the latest adverse media, sanctions, and watchlist data. Outdated risk data represents a significant compliance risk as it increases the chance of missing true positive alerts which may expose your firm to criminal liability.

2. Enhance customer experiences

Your customer screening process needs to be robust enough to detect a spectrum of risks, and to ensure you meet your regulatory obligations. However, the greater the level of scrutiny during onboarding (and throughout the business relationship) the greater the potential friction customers will experience when using your products and services – as a result of false positive alerts, delays, and administrative requests.

One of the most effective ways to reduce screening friction is to prepare customer screening data properly. In practice, this means organising and categorising data, and identifying data anomalies or discrepancies (even in official sanctions lists) which might reduce screening accuracy. Technology offers a huge advantage for data preparation: in addition to speed and accuracy, AI screening software can help intuitively identify relevant data points for easier AML categorisation and analysis, and so create smoother experiences for customers on the front-end.

3. Manage unstructured data

Effective customer screening requires the collection and analysis of large amounts of unstructured data. As opposed to the highly organised data available from official sources (such as sanctions lists), unstructured data is unformatted, often extremely text-heavy, and located across multiple sources. Adverse media, for example, in the form of news stories, websites, social media posts, and more, represents a valuable unstructured data source. However, that lack of structure complicates the adverse media screening process: firms may generate significant noise during searches of common names, leading to an increase in false positive alerts.

To manage unstructured data, firms must integrate technology capable of identifying and organising relevant data points and managing the level of ambient noise that the process generates. This means integrating software capable of making or at least facilitating intuitive decisions about data: in the case of adverse media, that means being capable of dealing with multiple language systems, non-Latinate characters, variations in spellings, duplications, and other translation and transliteration challenges.

4. Conduct effective risk assessments

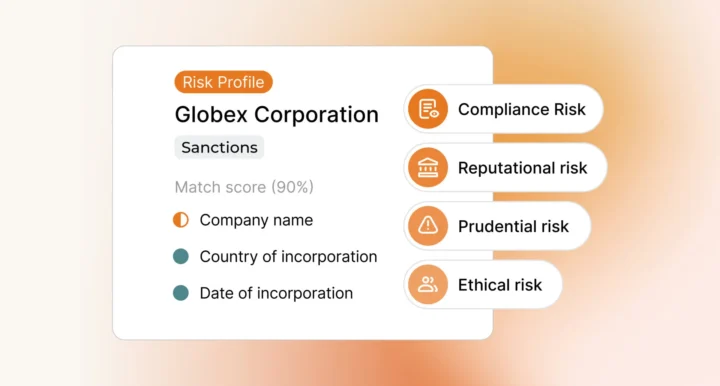

Following Financial Action Task Force (FATF) guidelines, most regulators require firms to take a risk-based approach to AML/CFT as a way to balance compliance budgets and resources with regulatory obligations. In this context, ‘risk-based’ means that compliance processes, such as customer screening, should be deployed in proportion to the risks that a company faces, with higher risk customers subject to greater AML/CFT scrutiny. The inherent challenge of the risk-based approach is accurately determining individual customers’ risk levels, which requires firms to perform a risk assessment during onboarding.

In addition to static, identity-focused customer due diligence (CDD) data such as names, addresses and business locations, customer screening helps firms conduct ‘real time’ risk assessment, incorporating the latest relevant information. Customers may recently have been designated on sanctions lists, elected to political positions, or become involved in criminal investigations as reported by domestic or foreign news organisations. Customer screening offers a way to make that data available for risk assessments, and on an ongoing basis throughout a business relationship.

5. Integrate technology solutions

The pace of the modern financial landscape effectively rules out the possibility of manual customer screening, but finding a suitable technology solution that fits your firm’s unique business needs, and risk appetite, can be daunting. Your solution needs to be flexible enough to accommodate changes in regulation and emerging criminal methodologies, and at the same time, robust enough to manage vast amounts of data and achieve satisfactory levels of compliance performance.

With that challenge in mind, Ripjar’s Labyrinth Screening platform was developed with the power to undertake global data screening tailored to your firm’s risk environment. Labyrinth screens customer names against thousands of data sources, in real time, delivering up-to-date, actionable intelligence in seconds. In a complex and changing risk environment, Labyrinth Screening uses cutting-edge machine learning technology to build risk profiles from structured and unstructured data sources, including name searches in over 20 foreign languages, and natural language processing tools to deal with translation and transliteration challenges.

Discover what compliance professionals in UK banks and financial institutions are saying about adverse media screening: download the report

Last updated: 3 February 2025