Since money laundering is frequently a global crime, in order to identify negative news involving their customers, financial institutions must adjust their screening solutions to capture stories from foreign media sources. However, in order to collect that data effectively, adverse media solutions must be capable of understanding a range of local language systems – a process known as multi-script language screening.

In their 2022 Negative News Screening FAQ, the Wolfsberg Group, a prestigious intergovernmental banking association, set out a range of significant multi-script language considerations. To help your organisation optimise its risk-based negative news solution and achieve compliance with jurisdictional anti-money laundering (AML) regulations, we’re taking a closer look at the details of the FAQs.

Why Do Financial Institutions Need Multi-Script Language Screening?

From a regulatory perspective, adverse media stories can be valuable compliance assets, potentially revealing customer involvement in financial crime before that information is confirmed by official sources.

Where local news organisations publish or broadcast in non-Latinate language systems, however, it may be difficult for financial institutions to match their customer’s name to negative news as a result of unfamiliar spellings, characters, or naming conventions. With this in mind, multi-script language screening represents a crucial compliance tool, enabling financial institutions to identify high risk customers in a range of local language news stories, and use the information that they provide to maintain regulatory compliance.

Key Multi-Script Language Screening Terms

In order to effectively implement multi-script language screening as part of a negative news solution, financial institutions and their compliance employees should be familiar with the following terms and concepts:

Transliteration

Solutions must be able to transfer words written in one script to another, in order to facilitate pronunciation and transcription. An example might involve a name written in the Japanese Kanji script: ‘歌川豊春’ transliterated to Latin script as ‘Utagawa Toyoharu’, or the German ‘Hans Rüdi Müller’ to ‘Hans Ruedi Mueller’.

Transcription

Words that are written in one language script may need to go through transcription in order to be written in another. Transcription typically involves a conversion system but methods can vary significantly. In practice, this means that names can be transcribed differently with different transcription methods, for example ‘Osama Bin Laden’ and ‘Usama Bin Laden’.

Translation

Where names are rendered in a foreign language, translation describes the process of capturing the meaning of that name in another language. For example, ‘Monaco Di Baviera’, which literally means ‘Nun of Bavaria’ is translated in English as ‘Munich’.

Risk-Based Multi-Script Language Screening

In a risk-based AML solution, the need to deploy multi-script language screening depends on the customers with which a financial institution does business, and the markets in which they operate. Financial authorities may also impose a regulatory requirement on the institutions within their jurisdiction to conduct effective negative news screening.

Given their potential importance in an AML programme, multi-script adverse media solutions should be developed with the following considerations:

- The capability of the screening solution to recognise non-Latinate characters, such as characters from the Cyrillic, Mandaric, or Arabic alphabets.

- The quality of the datasets, including the names of customers and media sources, that the solution can draw on in order to accurately screen against negative news stories.

- The capability of the screening solution to transliterate customer names from a native script to familiar Latin characters.

Multi-Script Screening and Compliance

Multi-script language screening can present a complex and evolving compliance challenge. Depending on regulatory requirements, financial institutions must ensure that they integrate multi-script screening effectively as part of their AML/CFT solution. This typically means taking a multilingual approach to compliance, and appointing local teams with expertise in the relevant local languages.

Financial institutions should consider the availability of foreign media sources, watch lists and technology tools in order to enhance their solution, and be aware of the minimum negative news screening requirements imposed in their jurisdiction. With this in mind, many financial institutions engage a third-party adverse media screening provider in order to implement multi-script language screening in their AML compliance solution.

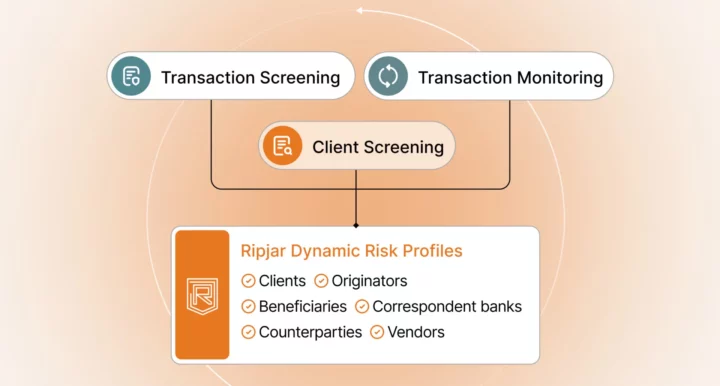

To find out how Ripjar’s multi-script language screening technology can help your business optimise its AML/CFT compliance response, get in touch today.

Last updated: 16 August 2024