Canada is a prosperous, developed nation with one of the largest economies in the world. An influential trading hub, Canada attracts a huge range of global investment interests to a marketplace worth around $2 trillion. Unfortunately, Canada’s profile also makes it a target for money launderers: federal authorities estimate that up to $113 billion dollars are laundered in Canada each year, with significant amounts of illicit funds entering the country from foreign sources such as China and Russia.

With some experts characterising money laundering in Canada as a “crisis”, the Canadian government is taking steps to bolster its anti-money laundering (AML) regulatory response. To keep pace with an evolving regulatory landscape, it’s critical that firms understand Canada’s AML regulations, and how incoming changes might affect compliance needs.

Canada’s AML Regulator: FINTRAC

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) serves as Canada’s financial intelligence unit (FIU) and anti-money laundering and counter-financing of terrorism (CFT) supervisor. Established in 2000, and headquartered in the capital city of Ottawa, FINTRAC has a mandate to “facilitate the detection, prevention, and deterrence of money laundering and the financing of terrorist activities” in Canada. It achieves this objective by ensuring that firms comply with Canada’s AML/CFT regulations and by generating financial intelligence for law enforcement investigations.

FINTRAC’s duties and responsibilities also include:

- Processing suspicious transaction reports from Canadian firms

- Protecting the personal information of Canadian persons

- Maintaining a registry of licensed money services businesses in Canada

- Researching and analysing financial data to establish patterns in AML/CFT activities

- Enhancing public understanding and awareness of AML/CFT risks

As a national financial supervisor, FINTRAC also participates in international efforts to combat money laundering. In addition to sharing information with international counterparts, FINTRAC is a member of the Egmont Group of financial intelligence units, and participates in the Financial Action Task Force (FATF), the Asia Pacific Group on Money Laundering (APG), and the Caribbean Financial Action Task Force (FATF).

Key Canada AML Regulations

Canada’s main AML regulation is the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). Implemented to address the criminal threat of money laundering and terrorist financing, the PCMLTFA has three key objectives:

- To detect and deter money laundering and terrorism financing activities in Canada, and facilitate the investigation of offences. As part of that objective, the PCMLTFA imposes record keeping and reporting obligations on firms in Canada.

- To provide law enforcement agencies with the intelligence they need to investigate money laundering and terrorism financing offences.

- To fulfil Canada’s commitments to the global fight against financial crime.

How to Comply with the PCMLTFA

The PCMLTFA requires firms to implement a risk-based compliance solution, which means that they must assess their customers to determine the level of risk they present, and then deploy proportionate AML measures. The key components of a PCMLTFA compliance solution include:

- Customer due diligence: Firms must establish the identities of their customers by performing customer due diligence (CDD), and collecting identifying information including names, addresses, dates of birth, company incorporation details, and so on. Higher risk customers should be subject to enhanced due diligence (EDD) checks.

- Beneficial ownership: Firms must also establish the ultimate beneficial ownership (UBO) of customer entities that they do business with, in order to prevent money launderers concealing their identities with shell companies or corporate infrastructure.

- Suspicious transaction screening: Firms should screen customer transactions for AML risk, which may include transactions involving high risk jurisdictions and counterparties.

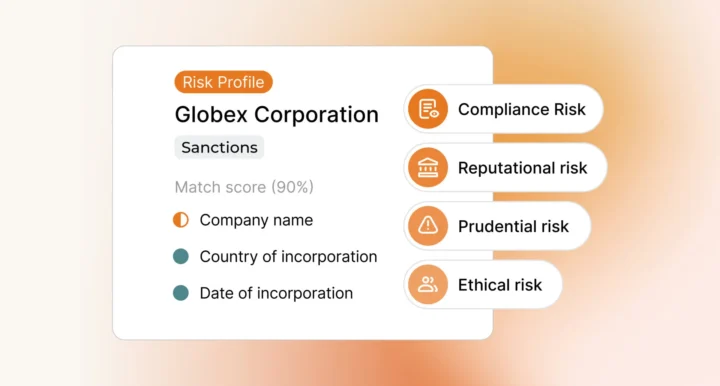

- Sanctions and watchlist screening: Firms should establish whether customers are designated on Canada’s sanctions lists (or other international sanctions lists), or are politically exposed persons (PEPs).

Adverse media screening in Canada: Since news media stories often reveal true AML risk before that information is confirmed by official sources, firms in Canada should also implement an adverse media screening solution.

Your adverse media (or negative news) screening solution should be capable of capturing data from Canadian news sources, and sources from around the world, and cover websites, blogs, forum entries, and social media posts. The solution should also integrate multi-language search functionality in order to account for regional variations in spelling, use of non-Western characters, similar sounding names, nicknames, and aliases.

Recent AML Initiatives in Canada

Canadian authorities are increasing regulatory focus on money laundering, and in particular the risks posed by virtual assets and sanctions evasion. The 2023 Federal Budget included proposals for amendments to the PCMLTFA which will broadly strengthen the country’s AML regime. The proposed changes include:

- Increased powers for law enforcement to freeze virtual assets with suspected criminal links.

- Enhanced information sharing between FINTRAC and the Canada Revenue Agency (CRA).

- A new criminal offence relating to the structuring of transactions in order to avoid AML reporting, and the criminalisation of unregistered money services businesses.

- Enhanced registration requirements for currency dealers (and other money services businesses), including criminal record checks.

- New whistleblowing protections for employees disclosing information to FINTRAC.

- New sanctions reporting requirements for businesses in the financial sector.

Russia sanctions: Canada has joined the US, UK, EU, and other Western countries in imposing economic sanctions on Russia in response to the invasion of Ukraine in February 2022. Canada’s Russia sanctions are set out in the Special Economic Measures (Russia) Regulations. In May 2023, the Canadian government issued a fresh round of sanctions against Russia, targeting 17 individuals and 18 entities linked to Vladimir Putin’s regime. With the conflict in Ukraine ongoing, Canada’s Russia sanctions are fluid and the government is likely to impose further sanctions in the future.

AML Consultation: The Canadian government recently launched a consultation on “Strengthening Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime” which will explore ways to improve AML/CFT regulations in order to address evolving criminal methodologies.

Canada AML Screening Solutions

As the Canadian government strengthens its AML/CFT regime, compliance obligations will continue to change for firms across the country. To meet new regulatory requirements, firms will need to implement AML/CFT solutions capable of not only collecting and analysing large volumes of financial data, but adapting quickly as new risks emerge.

Ripjar’s Labyrinth Screening solution gives firms the power to achieve regulatory compliance in Canada’s changing AML environment. Labyrinth Screening is capable of multi-language searches of thousands of sanctions lists, watchlists, and adverse media sources, and delivers actionable financial intelligence in seconds. Powered by next-generation machine learning technology, Labyrinth enables compliance teams to extract the most relevant risk data from search results in order to build in-depth customer risk profiles, minimise false positives and facilitate stronger, faster decision making.

Contact us to discuss how Ripjar can support your AML compliance in Canada

Last updated: 6 January 2025