On 10 January 2024, the UK government amended its money laundering regulations to change the treatment of certain politically exposed persons (PEP). The changes come amidst a wider Financial Conduct Authority (FCA) review of PEP regulations: the review was initiated following a series of incidents in which domestic politicians and public figures were denied banking services, purportedly as a result of the anti-money laundering (AML) risk that they posed.

We examined the UK’s PEP screening controversy in our previous blog. In this update blog, we’re going to look at the reasons behind the regulatory amendment, how UK domestic PEP screening now differs from non-domestic PEP screening, and how the wider PEP review may change the landscape further.

What Has Changed in UK PEP Screening?

Under the UK’s risk-based AML regulations, banks must apply enhanced customer due diligence measures (EDD) to PEPs, and their relatives and close associates (RCA), because of the potential money laundering risk that they pose. Following amendments to the Money Laundering Act, UK PEP screening requirements now differ in their treatment of domestic and non-domestic PEPs.

UK banks must now treat domestic PEPs as “inherently lower risk than non-domestic PEPs” as a “starting point”, and “apply a lower level of enhanced due diligence to domestic PEPs”. The government suggested that the change will mean that domestic PEPs (and RCAs) will now not have to deal with the “potentially disproportionate” demands of PEP screening, unless “other risk factors” mandate further scrutiny.

Why Have the Rules Changed?

In 2023, a number of UK politicians and their family members reported that they had been unfairly denied banking services, or had their accounts closed, as a result of their PEP status. In some cases, the PEPs complained that the action had been taken as a way to penalise their political affiliation: for example, Nigel Farge claimed that Coutts bank (part of the NatWest group) closed his account because of his position as founder of Reform UK. Farage subsequently received an apology from the bank.

The UK government responded to the PEP controversies by passing the Financial Services and Markets Act 2023, which committed the FCA to a review of the treatment of domestic PEPs in the UK. When announcing the amendment in January 2024, the government referenced the “legitimate concerns” of UK PEPs that had “encountered problems accessing financial services due to their status”, and said that the amendments would ensure that firms take “a proportionate and risk-based approach to the treatment of domestic PEPs”.

UK PEP Screening Challenges

The Financial Action Task Force (FATF) defines domestic PEPs as persons that have been entrusted with their functions “domestically”, while “non-domestic” covers “foreign PEPs”, “international organisation PEPs”, and their RCAs (as defined by the FATF).

The UK government does not go into great detail about the differences in screening domestic and non-domestic PEPs. The press release guidance emphasises that a “lower level” of due diligence is now required for domestic PEPs, but doesn’t define that level. The press release is also vague about what constitutes a higher level of due diligence, suggesting only that it “often takes the form of potentially disproportionate or overly frequent requests for information about personal financial matters”. Similarly, the government doesn’t define the “other risk factors” that might entail a higher level of enhanced due diligence for domestic PEPs.

Some observers have pointed to a lack of rationale behind the government’s decision to treat domestic PEPs differently. There is no inherent reason, for example, why a domestic PEP may pose a lower AML risk than a non-domestic PEP, especially since domestic PEPs are themselves always “non-domestic” to foreign jurisdictions.

With those points in mind, the government may issue further guidance on the treatment of domestic PEPs as the FCA review continues.

PEP Screening in the UK: Next Steps

The FCA’s review of UK PEP regulations is scheduled to be complete by the end of June 2024. The review is focusing on whether financial institutions are following its PEP guidance, and on whether that guidance remains appropriate.

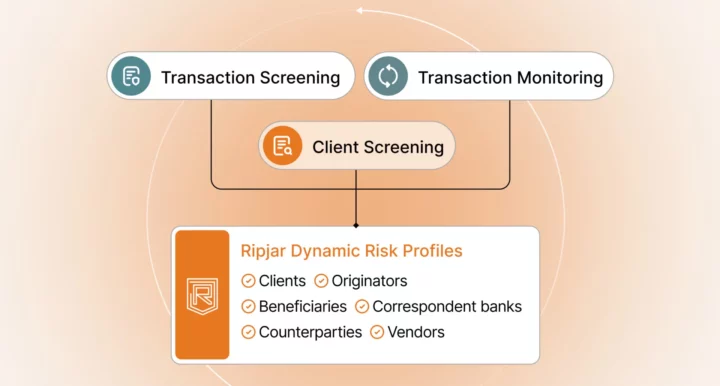

Given the change in PEP screening rules, and the ambiguities in the guidance (outlined above) it’s crucial that UK banks and financial institutions build flexibility into their PEP screening solutions. Powered by cutting-edge AI technology, Ripjar’s Labyrinth Screening platform offers exactly that kind of flexibility, with the potential for compliance teams to tailor customer name searches to their risk environment, and generate actionable AML data in seconds from thousands of global sources – including PEP lists, sanctions lists, and adverse media stories.

Labyrinth Screening is built to supercharge customer name searches, making PEP screening faster and easier. For greater customer screening speed and efficiency, Labyrinth’s AI Risk Profiles feature enables compliance teams to build detailed profiles of each target entity, extracting only the most relevant risk information from vast amounts of unstructured data. Similarly, the recently-launched AI Summaries expansion uses generative AI (GenAI) to deliver a clear, concise summary of adverse media risk information, reducing risk assessment time by up to 90%.

Find out more about how Ripjar can help you screen for customer AML risk

Last updated: 6 January 2025