AML compliance

AI-based customer screening and monitoring for anti-money laundering compliance

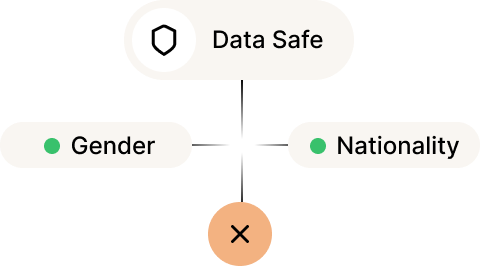

AML compliance with Ripjar

Ripjar's AML risk management solutions help you assess AML risk by screening customers, vendors, and supply chains against watchlists, PEP lists, and sanctions

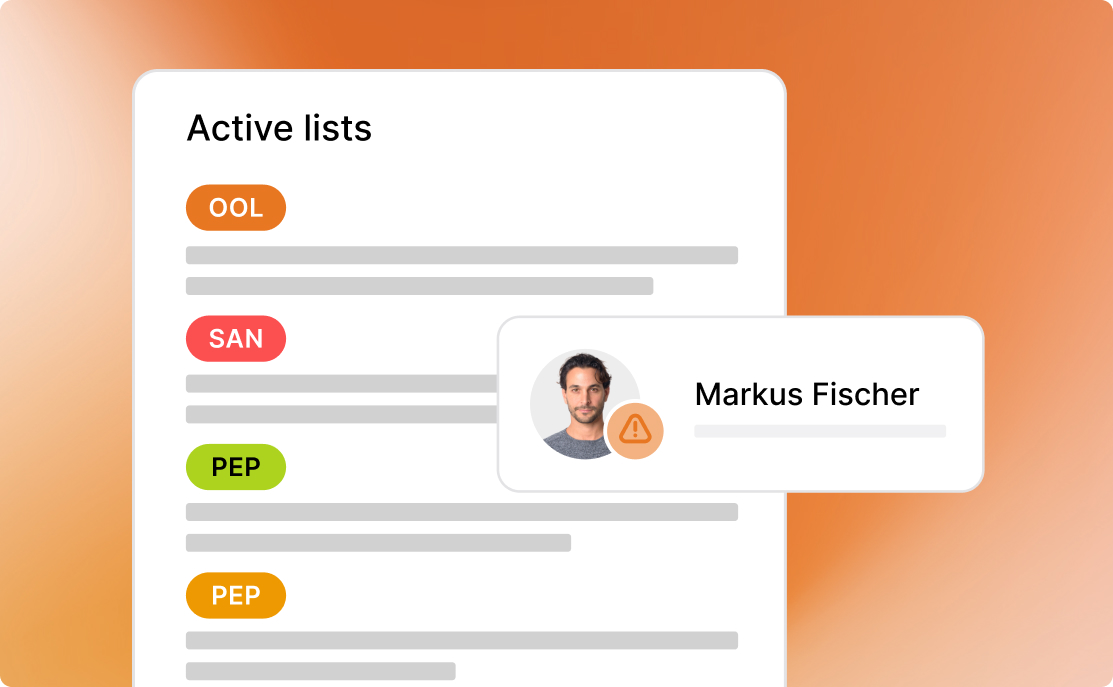

Sanctions screening

Staying on top of your sanctions screening is particularly important in a fast-changing risk environment, so Ripjar makes it easy to ensure you’re always aware of the latest sanctions affecting your customers.

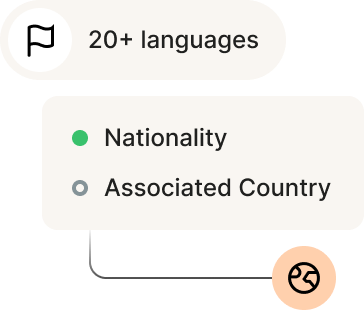

International sanctions lists

Ripjar's products support your AML compliance by enabling you to screen against lists such as the UK sanctions list, EU sanctions list, US OFAC sanctions list, and AUSTRAC list.

Real-time monitoring

Real-time monitoring enables you to quickly identify any new sanctions affecting your existing or potential customers.

Alerts to ensure compliance

With the risk of significant fines for non-compliance, Ripjar's AML risk management products ensure you adhere to the latest sanctions and are alerted to any relevant updates.

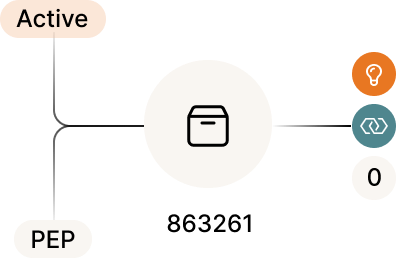

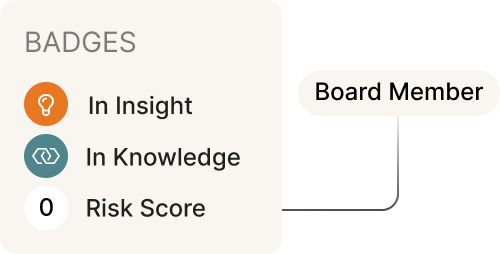

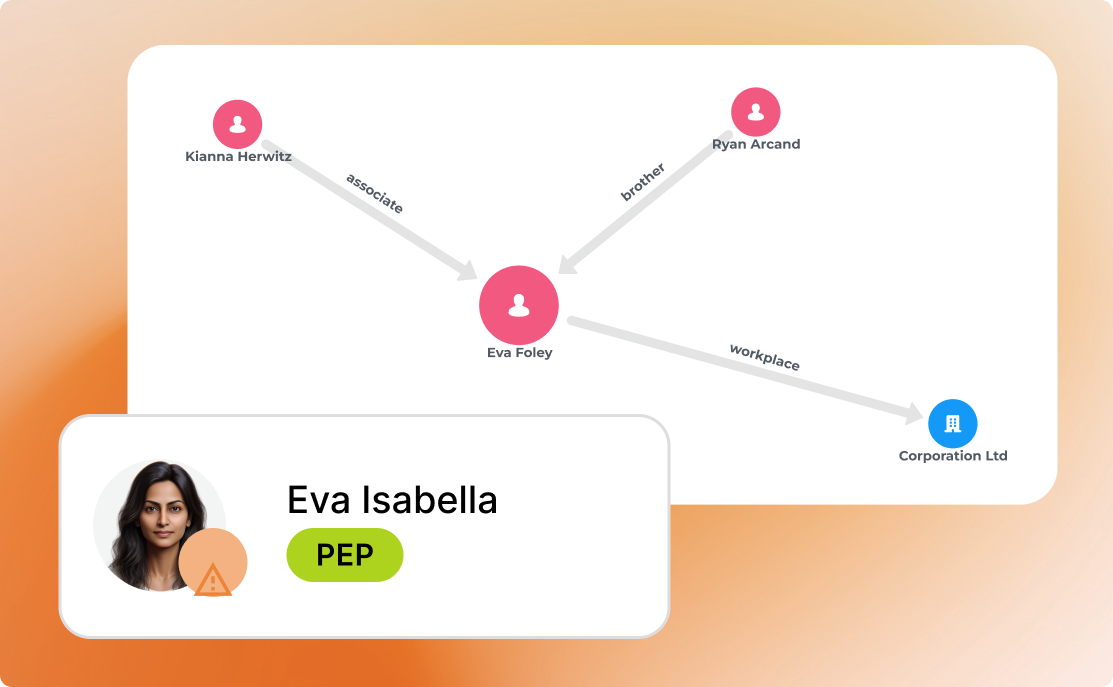

Politically exposed persons

Anti-money laundering regulations around the world require screening for politically exposed persons (PEPs) because of the increased criminal risk that they present.

Adverse media screening

Adverse media screening has become a critical component of AML processes, and having an effective system in place is vital. For example, the EU's 6th Anti-Money Laundering Directive (6AMLD) mandates systematic checking against adverse media - specifically to detect the 22 predicate offences which often precede money laundering.

Trusted by global businesses

Ready to

get started?

Our experts are available to talk through your requirements, answer questions, and set up a demo.