In a financial landscape progressively embracing AI as a productivity tool, generative AI (GenAI) has the potential to be a game-changer for anti-money laundering (AML) compliance. GenAI screening tools are capable of detecting patterns and relationships within data which, in compliance contexts, means identifying and analysing unstructured data and delivering financial intelligence faster than conventional screening – without the same potential for costly false positive alerts.

However, GenAI also has its challenges. Some tools have been known to deliver unreliable results or fabricate results entirely as ‘hallucinations’, while developers are often unwilling to disclose how their platforms work, which is a problem for compliance investigations. Those issues have made many firms understandably reticent about integrating GenAI in compliance, despite its advantages.

With that in mind, the best approach to GenAI integration in compliance is one based on careful consideration of available data. Equipped with the right insight and expertise, firms will not only be able to integrate innovative new tools safely, but optimise them to deliver the best compliance results. If you’re ready to explore GenAI as part of your compliance solution, let’s look at some of the most important practical considerations of that process.

What are the possibilities of GenAI integration in compliance?

Many industry observers frame AI as a game-changer in the fight against financial crime. With the potential to reshape data management and analysis, the technology offers specific anti-money laundering compliance advantages, including:

- Automated analysis of structured and unstructured risk data

- Automated summaries of large volumes of data as concise prose paragraphs

- Identification of trends, patterns and connections within and between data sets

- Quality assurance and verification of human AML compliance decisions

The possibilities of GenAI are appealing, but it’s important that compliance teams understand its limitations, not least the potential for hallucinations, and the lack of insight into how it generates outputs. Those factors mean that risk-averse firms should take a slower approach than their peers, waiting for more industry data, and regulator guidance, before deploying new AI tools.

What do regulators think about GenAI compliance integration?

Regulatory perspectives on the use of AI in compliance vary. While some regulators are seeking to impose overarching new rules frameworks to account for the rapid uptake of the technology, others are taking more principles-based approaches. Most regulators, including the Financial Action Task Force (FATF) have acknowledged the potential for AI to make compliance both easier and cheaper, but have also urged caution, pointing specifically to the need for explainability and transparency if the technology is to have a meaningful compliance impact.

While few jurisdictions have made substantive progress towards AI-specific compliance regulation, the EU has stood out by passing the Artificial Intelligence (AI) Act in May 2024. Characterised as a landmark regulation, the AI Act will be industry-agnostic, classify AI systems by the amount of risk they present, and require proportional compliance measures. Aspects of the legislation will be implemented over the course of several years up to 2030.

Practical AI Compliance Tips

As regulators find their feet, it’s important that firms keep a perspective on the GenAI horizon and don’t miss out on opportunities, or fall behind competitors. With that in mind, CFOs and their compliance teams should think ahead about how they will integrate GenAI tools successfully within existing anti-financial crime (AFC) frameworks when the time is right.

Consider the following key practical AI adoption tips:

Think about your compliance needs

GenAI innovations hold undeniable potential, but they are not compliance silver bullets. The impact of GenAI will depend on numerous contextual factors, not least the need for firms to understand the technology’s capabilities and limitations.

GenAI tools are currently best suited to the analysis and summarisation of large amounts of data, such as the results of adverse media searches. On the other hand, the technology is not as effective at running and generating the results of adverse media searches – other AI techniques are better suited to this. That factor should inform decisions about GenAI possibilities within a given business infrastructure, and means that some firms should consider a low effort, high impact integration of GenAI, before iterating to broader applications.

Don’t rebuild from the ground up

It’s important to think about current GenAI technology as a way to enhance existing compliance systems, rather than replace them. In practice, this means that you shouldn’t be rebuilding your entire tech infrastructure from scratch to accommodate GenAI tools.

In fact, most GenAI solutions are conducive to a staged and layered approach to integration which enables firms to maintain existing AFC controls as they get used to the new technology, and before committing to new compliance strategies. This option is particularly useful for transaction monitoring processes, since firms often use both traditional, rules-based systems alongside AI overlays, running outputs through the AI tool to refine results and create better screening outcomes.

Focus on data

The principle ‘good data in, good data out’ is typically reliable in screening contexts. The higher the quality of adverse media inputs, for example, the more accurate the risk profiles that firms can create for their customers. This principle applies just as much to GenAI screening tools, meaning that firms should seek to train them on robust data sets with sufficient depth and quality.

However, it’s important to remember that screening data quality will never be ‘perfect’ and firms shouldn’t wait for it to reach that hypothetical standard before deciding to integrate GenAI innovations. Consider potential use cases for GenAI integrations and prioritise data sets that will enhance the impact of your GenAI tools. If your adverse media data quality is high, for example, focus on GenAI integrations within your adverse media screening solution, and work to optimise these.

Consider the cost of expertise

GenAI adoption represents a new cost metric which must be considered alongside the context of the wider compliance budget. While larger businesses may have the in-house resources to research and deploy GenAI tools, other firms may need to consider whether to recruit new expertise or find a partner who can help them handle the process.

The projected cost of GenAI adoption should account for the speed with which the technology is developing. Firms should think about whether in-house GenAI integration is something that can be sustained over time – an effort that will require ongoing software updates, expertise and governance refreshes, and technology upgrades.

Select an effective partner

Firms that choose a third party to help manage their GenAI adoption and integration must be confident that their partner understands their compliance needs and vision, and can grow with their business.

Given the complexity of the GenAI landscape, and its pace of change, it’s important that the partnership allows for collaboration and open dialogue. You should understand how your partner will approach the design and deployment of your GenAI tools, what training will be provided, how the technology will be managed day-to-day, and what kind of post-integration support will be available.

Validate and test

The relative unfamiliarity of GenAI as part of compliance solutions means that firms must factor the validation and testing of system outputs into the adoption and integration process. The timescale for validation and testing will vary for each individual firm but should serve to ensure that the results the new tools generate align with the needs of the business. Validation and testing will also strengthen employee skills with the new technology, build confidence, and importantly, identify problems and risks.

The validation and testing process should not be limited to the pre-adoption phase. Firms should implement an ongoing testing schedule to identify emerging problems.

Empower employees

While GenAI represents a step forward in compliance automation, human compliance employees will remain critical. Human expertise will be needed to not only validate the outputs of GenAI screening, for example, but to intervene to address problems and to explain results to third parties as part of law enforcement investigations.

With that in mind, GenAI adoption should include a focus on the training and skills of users. Effective training will not only optimise the impact of new GenAI tools but ensure that the compliance team can adapt to changes, including emergent risks and innovation opportunities.

Embrace GenAI Screening Power

It’s time for CFOs to start thinking about the possibilities of GenAI, and what integration might look like in their organisations – not just in terms of advancing compliance, but staying ahead of customer expectations. Adoption and integration of GenAI promises both opportunities and challenges but the right partner can ensure firms identify and address pain points quickly, and move forward with confidence.

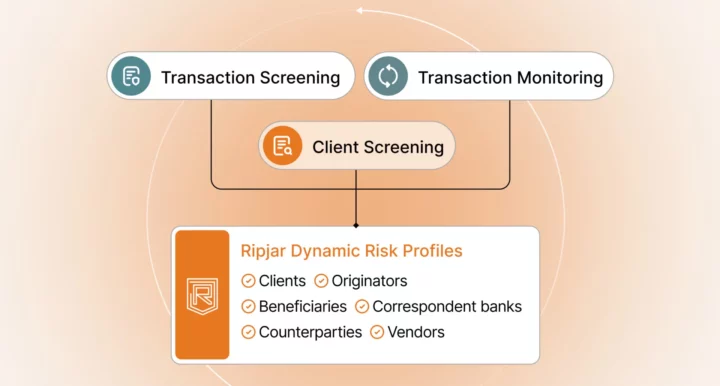

Built with cutting-edge AI and machine learning technology, Ripjar’s Labyrinth Screening system has proven compliance impact, enabling firms to conduct real-time global name searches across thousands of data sources, in multiple foreign languages, and deliver financial intelligence in seconds. Enhanced with GenAI innovation, and designed with decades of industry expertise, Labyrinth extracts the most relevant information from vast unstructured data sets, and uses that information to generate deep, detailed customer risk profiles with concise prose summaries, so your team can make stronger, faster compliance decisions.

Learn about Ripjar’s Compliance Copilot – the ultimate GenAI screening tool

Last updated: 6 January 2025