It’s no longer enough to simply search for a customer’s name on a sanctions list in order to meet regulatory compliance obligations.

Risk-based sanctions compliance rules – imposed in jurisdictions across the globe – ask more of compliance teams, and typically require analysts to go beyond government-issued lists, and consider a much wider range of data when making decisions. Complying with these rules also brings a number of practical considerations for organisations.

In November 2024, Ripjar and FINTRAIL hosted the Sanctions Masterclass webinar “Going Beyond the List”, assembling a panel of experts to discuss the ways that firms can harness technology to add depth to their sanctions screening processes. In that discussion, Ripjar Operational Data Science Lead Abhijith Rajan drilled down into strategies that enhance customer name searches, and how artificial intelligence (AI) tools are helping compliance teams take their screening processes beyond the limitations of traditional name matching.

Organisations tend to be conservative in the way they do sanctions screening, but there are ways that technology can help us understand things about a name.”

Abhijith Rajan, Operational Data Science Lead, Ripjar

Industry Opinions: Screening Technology Impact

The Sanctions Masterclass captured the opinions of an industry audience in a poll that focused on the specific impacts that compliance teams would like technology to have on the screening process.

The poll suggests that firms value screening efficiency and accuracy, with results weighted towards the remediation of false positives, and managing an increasingly complex and crowded regulatory environment. Scrutinising that data, Abhijith suggested that the efficiency and accuracy challenge might actually start from an over-reliance on names in the first place:

“Sometimes even names can be problematic,” said Abhijith. “You might not be allowed to screen in the script that the name is originally available in. And going from a script you might be unfamiliar with to a script you are familiar with is usually a poor process. It leads to false positives, and might end up meaning you have to build in a set of rules to assess the data.”

That challenge suggests that a new approach to screening is needed.

Traditional vs Identity-Based Sanctions Screening

Traditional screening processes, in which financial institutions attempt to match names to designations on the relevant sanctions lists, are limited for a number of reasons, including:

- Having a sole focus on the names designated on sanctions lists.

- High rates of false positives.

- The increased likelihood of missing hidden or indirect connections to sanctioned entities, especially if screening for a common name with no additional information.

Given the expanding sanctions compliance burden, the limited scope of traditional screening can expose organisations to significant regulatory risk. Abhijith raised the prospect of a better way to screen – essentially “going from names, to identities”.

In this identity-based approach, instead of focusing on names alone, compliance teams search for customer identities, capturing the vast amount of additional risk data behind every individual.

An identity-based approach to screening:

- Incorporates all available risk data.

- Reduces false positives and false negatives by capturing nuance and detail.

- Future-proofs compliance solutions by adapting to increasingly complex regulatory demands.

Incorporating Linked Data

We need to make sure that we’re challenging ourselves to be screening with more information.

Abhijith Rajan, Operational Data Science Lead, Ripjar

Identity-based screening requires compliance teams to enhance their search processes, typically by integrating technology tools. In this context, Abhijith suggested that the name can serve as a foundation for the effective application of screening technology:

“You can immediately look at a name and have a sense of what kind of rules should be applied to screening,” said Abhijith. “Then you can start to do intelligent things around screening. It gives you ways of building in technology and applying different rules for different customers.”

With that in mind, when screening for identities, financial institutions should move beyond only using traditional fuzzy matching, and seek to implement software that links names to other types of data. This might include considering name origins, or partial-name matches, but should extend across all available data types, including email addresses, customer behaviour, bank codes, and, importantly, adverse media.

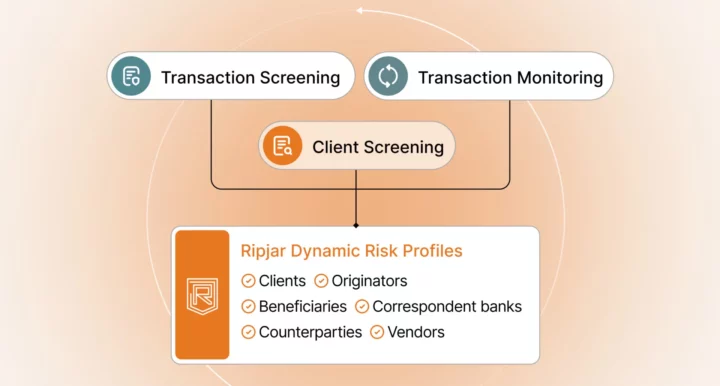

Taken in isolation, each of these data points might offer little compliance value. Linked together, on the other hand, they help financial institutions build customer identities into ‘risk profiles’, which add critical contextual intelligence, and enhance the proactive identification of sanctions risk.

Screening software that facilitates the use of linked data helps compliance teams assemble all relevant sanctions information in one place, which not only adds efficiency to risk analysis but speeds up decision-making.

Enhancing With Adverse Media

Adverse media is particularly useful in identity-based screening, not least because sanctions evasion risk may be reported by news organisations long before governments make designations on official sanctions lists.

However, effective adverse media screening is challenging for a number of reasons, not least because of the vast amount of complex data that financial institutions must search through to find relevant risk information, and the noise that data generates – all of which can lead to an overwhelming amount of false positive alerts.

With the Sanctions Masterclass poll suggesting that false positives are a top priority for financial institutions, Abhijith again pointed to the value of technology in enhancing the sanctions screening process with adverse media, including reducing noise, refining results, and reducing false positives.

Specific adverse media applications include:

- Creating and leveraging curated adverse media feeds that focus on relevant risk categories.

- Screening customer profiles for matches, rather than screening articles.

- Applying filters for jurisdictions, entity types, or level of activity.

- Tailoring alerts for specific industries and regions.

Incorporating Relationships

Identity screening also helps firms uncover the compliance risk presented by relationships, including not only family members of sanctioned persons, but their friends and close associates.

Abhijith emphasised the importance of using risk profiles to uncover relationship connections – an approach that leans in to the capabilities of search technology to capture data, including adverse media.

“People get married, they get divorced. You want to be able to see this information updated on a regular basis,” said Abhijith. “At Ripjar, we’re comfortable extracting information around things like close familial relationships, corporate relationships, and employee relationships from media.”

Using Ripjar’s screening platform as an example, Abhijith noted that relationships can be tracked visually in graphs or networks, or simply laid out textually as part of a customer’s profile. Even better, screening software can allow compliance teams to make connections with other sanctioned entities automatically, helping financial institutions uncover potential hidden links and networks.

Understanding AI Advantages

The need to incorporate linked data, from an expansive global landscape, represents a significant administrative burden for compliance teams, not least thanks to the increased volume of false positive alerts.

Acknowledging that challenge, Abhijith pointed to the potential of AI tools to not only broaden search reach and reduce manual effort, but to enhance detection and reduce false positive rates. Some of the the key potential benefits of AI screening include:

- Natural language processing (NLP) tools for the analysis of adverse media and other forms of unstructured data.

- Machine learning algorithms for the detection of behaviour patterns that indicate sanctions evasion.

- The incorporation of unstructured contextual data in the compliance decision-making process.

- The automation of decision-making for low-risk false positive alerts.

The benefits of AI were acknowledged in the Sanctions Masterclass audience poll, that found the vast majority of attendees see a role for AI in sanctions screening.

Managing AI Challenges

“AI is complicated. It’s not a transparent process, and very often you’ll find that even people who built the software will struggle to explain why a match has happened.”

Abhijith Rajan, Operational Data Science Lead, Ripjar

While AI holds promise for sanctions screening, it’s critical that firms also remember its limitations, including – in many instances – its lack of transparency. The transparency issue is a significant consideration in the integration of AI tools, and particularly generative AI (GenAI), in screening processes, since financial institutions must be able to explain a set of results to regulators during an investigation.

“Explainability in AI has become better, and it keeps getting better over time,” said Abhijith. “We need better transparency. The audit trails need to be very clear. Regular validation and fine-tuning of AI models is critical.”

The need for explainability was a recurring theme in the Sanctions Masterclass, with other panel members expressing a desire to see GenAI develop as a component of the sanctions screening process:

“It’s explainability and reliance,” said Parminder Turna, Wise Director of Product Compliance for Sanctions & Screening. “Explainability in AI has the same risk as placing reliance on a black box vendor. I would want to be able to sit in front of a regulator and explain how I’ve implemented GenAI. I think that’s the next hurdle.”

The limitations of AI don’t mean that financial institutions should shy away from using it in compliance contexts, but instead consider how they will implement it in a way that doesn’t compromise the integrity of their search results. To that end, Abhijith suggested that AI tools should be used with “guardrails” that ensure their validation and repeatability. These might include their integration with human oversight to balance efficiency and accountability, and ensuring that compliance teams receive comprehensive training in their use.

“Copilots are very common,” said Abijinth, referencing the way that Ripjar incorporates GenAI into its search solution. “The idea is that you have a GenAI support system that’s sitting next to you and allowing you to speed up your work. You allow AI to act as your first line analyst and give recommendations that can be adopted or rejected.”

Go Beyond the List with Ripjar

Going beyond the sanctions list means embracing the opportunities and challenges of a vast and evolving data landscape, and ensuring that your compliance team has the resources, skills, and tools they need to deliver results.

Financial institutions can make that process easier by exploring the capabilities of AI-powered screening platforms – such as Ripjar’s sanctions screening solution.

Supported by cutting-edge GenAI, Ripjar’s tool is capable of screening thousands of sources in seconds, including sanctions lists, watchlists, and adverse media. Customisable to the unique needs of an organisation, it captures and connects data from evolving risk environments, incorporating powerful screening features that add depth to customer name searches, and enrich the quality of search results, in order to facilitate stronger compliance decision-making.

Watch the Sanctions Masterclass recording to hear more from the experts

Last updated: 6 January 2025