Financial compliance shouldn’t be a box-ticking exercise: by monitoring and screening customers and transactions in accordance with regulations, firms can actively contribute to the global fight against financial crime and make financial systems safer from activities such as money laundering and terrorism financing. The earlier that financial crime risks can be detected, the more likely it is that firms can adjust their compliance framework, prevent crimes from happening in the first place, and reduce any potential damage.

Adverse media – or negative news – is one of the best early-warning signs of anti-money laundering (AML) and counter-financing of terrorism (CFT) risk because criminal activities may be revealed in news stories (and other online sources such as blogs or social media posts) before they are confirmed officially. That forewarning allows firms to establish the AML risk a particular customer presents faster than they would have by relying on other compliance processes such as customer due diligence (CDD).

In order to use adverse media screening as an early warning of risk, it’s important that firms understand what to look for when searching for customer names, and why the resulting data is so valuable for regulatory compliance.

Let’s take a closer look at the reasons why adverse media screening is such a useful early warning mechanism.

Categorising Risk

The adverse media landscape holds a wealth of potentially relevant risk data which can be used to make crucial compliance decisions. The utility of that data as an early warning can be further enhanced by organising adverse media stories into categories, and then assessing their relevance to a firm’s risk appetite. At Ripjar, for example, we organise adverse media into risk categories including:

- Bribery and corruption: Activities including active and passive bribery, extortion, embezzlement, influence peddling, misuse of power, and blackmail.

- Corporate malfeasance: Transgressions perpetrated by officers of an organisation, including financial deception, negligence, anti-competitive practices, and a range of unethical activities such as discrimination or unfair labour practices.

- Financial crime: Major financial crimes including insider trading, fraud, market manipulation, and large scale tax evasion.

- Predicate crime: Crimes that generate illegal proceeds that must be laundered, including drug trafficking, people trafficking, theft, forgery, cyber-crime, and illegal gambling.

- Reputational risk: Activities that may be legal or illegal and that negatively affect a customer’s reputation, including environmental damage, workforce exploitation, animal welfare, and unethical trade practices.

- Sanctions and embargoes: The risk of being sanctioned by governments or international organisations like the United Nations.

- Terrorism and terrorism funding: Membership or financial support for terrorist groups, and incitement to commit terrorism.

While adverse media categorisation isn’t a magic bullet for managing risk, it’s a particularly useful way of determining effective compliance responses quickly. By better understanding the type of risk they face early, firms may be able to increase the impact of their compliance response and optimise the outcome.

Anticipating Criminal Activity

As governments introduce new regulations, and criminals find more sophisticated ways to exploit financial systems, banks and financial service providers must keep pace. With that in mind, one of the primary reasons to screen for adverse media is to ensure that your organisation is able to spot criminal risks on the horizon.

While customers may not yet be charged with crimes, or even involved in criminal investigations, breaking media stories and other forms of online content often reveal business ventures and relationships, financial difficulties, or political changes that will alter the risk landscape and that will lead to criminal risk in the future. Similarly, new sanctions designations may be anticipated via stories that expose customer connections to countries and individuals designated on sanctions lists. Supplemented by additional compliance data, including the relevant CDD information, adverse media can help firms gauge risk before a criminal threat manifests.

Avoiding Compliance Fines

Compliance violations have serious consequences, not least significant financial penalties which may impede a firm’s ability to continue doing business. Not all compliance penalties are created equal, and they vary by the type and severity of violation: money laundering the proceeds of drug trafficking, for example, may incur a greater fine than proceeds from other predicate crimes. Similarly, fines may vary by jurisdiction: in the UK for example, money laundering fines are unlimited, while US AML compliance penalties may reach $1 million or 1% of the assets of the offending institution (whichever is greater).

Depending on a firm’s risk appetite, adverse media screening represents a way to spot and avoid potentially damaging compliance fines. It’s therefore vital that firms stay up to date with the latest regulatory changes as they pertain to compliance fines. In the UK, for example, recent regulatory changes introduced strict liability for sanctions violations, which means that fines may be imposed regardless of a firm’s awareness of customer wrongdoing. The sanctions landscape evolves constantly, and adverse media screening should be a priority for any firm seeking to stay ahead of new designations and costly fines.

Avoiding Reputational Damage

Adverse media does not just act as an indicator of potential AML risk: in situations where firms have ethical priorities or responsibilities, it may also serve to prevent reputational damage. While involvement in financial crime has always entailed a degree of reputational risk, the nature of the modern media landscape means the resulting damage is often more acute: stories can be published quickly by news organisations and shared widely between users of social media sites. Managing reputational damage is difficult in a perpetually-connected world, so the better firms are at spotting incoming risks, the easier it is to prevent.

It’s worth bearing in mind that reputational risk is becoming a significant priority thanks to the rise of environmental, social, and governance (ESG) concerns, which include issues like labour disputes, climate change, and workplace equity. Not only is the public becoming more sensitive to ESG issues, but governments are beginning to regulate associated practices. As that dynamic continues, the importance of early risk detection will also increase, with firms incentivised to address reputational risk with the same speed and efficiency as traditional criminal risks.

Maintaining Ongoing Vigilance

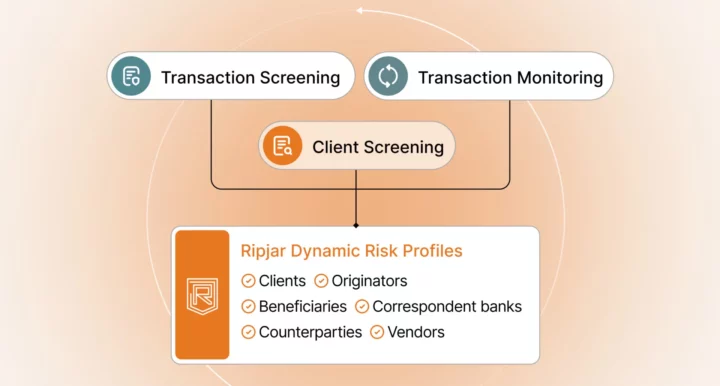

The early detection of risk is crucial in an effective compliance framework. In practice, however, firms should monitor and screen for risks on an ongoing basis as a way to manage an evolving compliance landscape in which new criminal methodologies and new regulatory obligations emerge regularly. Unfortunately, not all compliance solutions give firms the capability to implement ongoing monitoring and screening, and instead rely on analogue CDD processes, and manual adverse media checks, sometimes conducted via search engines.

Ongoing screening, and early risk detection, requires firms to implement technology solutions capable of managing large amounts of data (including adverse media) from sources around the world. Ripjar’s Labyrinth Screening platform was created with this requirement in mind: powered by machine learning technology, Labyrinth enables firms to screen millions of adverse media sources, sanctions lists, and watchlists in real time, and delivers actionable intelligence in seconds. With name search functions in over 20 foreign languages, Labyrinth ensures your organisation has the capability to detect changes in risk as soon as possible, and adapt quickly when the risk landscape changes.

Learn more about our adverse media screening capabilities: contact us today

Last updated: 3 February 2025