The proliferation of weapons of mass destruction (WMDs) is one of the critical security issues of the 21st century. With geopolitical tensions rising, the business community must play its part in preventing terrorist and criminal organisations not only acquiring these types of weapons, but facilitating their movement around the world.

In this climate, spotting potential proliferation financing activity is a compliance priority. This means that firms must understand the relevant regulations, and adjust their screening solutions to account for risk exposure.

What is Proliferation Financing?

Proliferation financing (PF) is the act of providing funds that support the movement of WMDs, including nuclear, chemical, and biological weapons, around the world.

Given the elevated global risk of terrorist attacks, and the challenges involved in detecting financial crimes, governments have placed regulatory obligations on businesses, and particularly on financial services firms, to help combat PF and target its sources.

PF shares characteristics with other financial crimes, specifically money laundering and the financing of terrorism, and so may be detectable via existing screening measures. Persons involved are often designated on sanctions lists, for example, or may attempt to conceal their transactions via shell companies and corporate infrastructure.

In other contexts, however, it is harder to detect PF because related transactions and activities do not necessarily share the same red flag indicators of criminality. For example, criminals may seek to bypass regulations and screening measures by transporting only legal component parts of WMDs, or by transporting “dual use” materials that may be repurposed for the construction of WMDs by end users.

The risk of PF goes beyond persons directly paying for the transport of WMDs, and extends to persons that may be providing services unknowingly. On the other hand, persons that are knowingly involved in PF often employ sophisticated evasion tactics to evade screening measures. In some cases, heavily sanctioned governments may engage in PF activity, and use state apparatus to do so.

High Risk Countries

Certain countries represent a higher PF risk than others, these include:

- North Korea: The government of North Korea is actively pursuing a nuclear weapons programme and has demonstrated a willingness to attempt to evade sanctions.

- Russia: Heavily sanctioned by multiple countries since the invasion of Ukraine in 2022, Russia is attempting to evade restrictions by importing dual use materials for use in military weapons technology.

- Iran: The government of Iran has demonstrated an ongoing desire to develop a nuclear weapons programme.

- China: China has demonstrated a desire to expand its own nuclear arsenal, and has facilitated other countries’ evasion of sanctions, including North Korea and Russia.

- Syria: Under its previous government, Syria was known to have deployed chemical weapons, and financed its acquisition of WMDs via the sale of oil and petrochemicals.

Global Regulatory Response

Governments around the world are increasingly framing PF as a serious criminal risk, however, other than designation in sanctions programmes, dedicated PF regulations lag behind those applicable to similar financial crimes, such as money laundering and terrorist financing.

However, the Financial Action Task Force (FATF) has raised the issue of PF in its anti-money laundering (AML) and counter-financing of terrorism (CFT) recommendations. In 2020, it imposed new obligations on members to identify, assess, and mitigate PF risks. These obligations are set out in the FATF’s Guidance on Proliferation Financing Risk Assessment and Mitigation.

In light of the FATF’s strengthened focus on PF, the United Kingdom has led the international community in taking regulatory action. In 2021, for example, the UK government conducted its first National Risk Assessment of Proliferation Financing (NRAPF). Given the UK’s status as an international financial hub, the NRAPF suggested that the UK government put regulatory measures in place to address PF risk.

Accordingly, in 2022, the UK government amended the Money Laundering and Terrorist Financing Act to introduce new PF identification and risk screen requirements. The UK has also applied strict liability to sanctions breaches, meaning that penalties may be applied regardless of knowledge or intent behind the violation.

While the US has not taken any major regulatory actions to combat PF, other than strengthening existing sanctions, the Financial Crimes Enforcement Network (FinCEN) has released advisories to help firms spot PF criminal activities. Similarly, the US Treasury released its own National Proliferation Financing Risk Assessment in 2024.

Proliferation Financing Penalties

Firms that break PF rules and regulations face serious financial and even criminal consequences.

In the UK, for example, under the Money Laundering Act, the Office of Financial Sanctions Implementation (OFSI) has the authority to impose unlimited fines, and prison sentences of up to 7 years for PF rules breaches. Those penalties may be imposed in addition to existing sanctions rules, under which OFSI can fine companies up to £1 million, or 50% of the value of the offending transaction (whichever is greater), and name and shame companies publicly.

Regulatory Risk to Financial Institutions

Banks and financial services organisations are on the front line in the fight against PF, and may be exposed to compliance risk in numerous ways. Key examples of PF risk include:

- Layered transactions: Persons designated on sanctions lists may route transactions through multiple accounts in order to obscure their origin and evade screening measures.

- Dual use materials: Companies trading in dual use materials, particularly technology such as aerospace components or microelectronics, pose an elevated PF risk.

- Shell companies: Criminals may attempt to use shell companies or complex corporate infrastructure to obscure the origin and destination of PF-related transactions.

- Missing or incorrect transaction details: Criminals may intentionally withhold or misspell PF-related transaction details in order to evade AML/CFT scrutiny.

- High risk countries: Transactions that involve parties in high risk AML/CFT territories (such as those listed above) carry an elevated PF risk.

- Cryptocurrency: The anonymity of cryptocurrency transactions puts them at a higher risk of involvement in PF activity.

Third Party Risk

PF activity typically involves firms’ relationships with third party organisations, such as shipping and transportation companies. With that in mind, PF compliance screening should go beyond a singular focus on companies in the financial sector, and include relationships up and down the supply chain.

That means screening measures should account for the complexity of supply chains, and the potential for regulatory disparity across international borders. Key third party and supply chain risk factors include:

- Persons designated on global sanctions lists.

- Companies trading in dual use materials.

- Suppliers operating in high risk industries, such as shipping.

- Suppliers operating in high risk jurisdictions.

- Persons designated on politically exposed persons (PEP) lists.

While third party risk factors may not necessarily result in direct regulatory violations, firms that are revealed to have relationships with third parties that are exposed as being involved in PF often incur reputational damage.

Implementing a Proliferation Financing Risk Management Strategy

The scale and complexity of PF risk means that firms should carefully consider their compliance posture, and, ideally, integrate an AML/CFT screening solution to help them manage their threat environment.

An effective PF risk management strategy should involve the following measures and controls:

Screening during onboarding

Firms should establish new clients’ PF risk levels as quickly and as accurately as possible. This means conducting robust customer due diligence (CDD), and applying suitable screening measures during onboarding, with a focus on sanctions designation, and designation on PEP lists. The screening process should be global in scope, which means searches should be conducted in multiple languages, and include scrutiny of other critical risk indicators, such as adverse media stories.

Beneficial ownership

As part of the due diligence process, firms should aim to establish the beneficial ownership of client companies in order to account for the possible misuse of shell companies or complex corporate structures as a means to disguise PF activity.

Continuous monitoring

Following onboarding, firms should continuously monitor their clients for PF risk in order to account for changes to risk profiles over time. This means maintaining a regular screening schedule with a focus on updates to sanctions lists, suspicious transaction patterns, changes in company ownership, and emerging adverse media stories.

Risk scoring and segmentation

PF screening should be risk-based. With that in mind, firms should seek to establish a risk scoring system to enhance their risk assessment process, with higher scores applied to higher risk jurisdictions, industries, and transactions, or to persons designated as PEPs. Similarly, audience segmentation – the process of grouping audiences by risk characteristics – can help compliance teams conduct risk assessments more efficiently.

Sanctions and watchlists

Effective sanctions and watchlist screening is a critical component of PF compliance. Firms must implement sanctions solutions that capture domestic and international sanctions designations, and listings on the relevant watchlists.

Adverse media

Changes to a client’s risk profile may be revealed by the media before they are confirmed officially. With that in mind, PF screening should include automated adverse media searches, in multiple languages, and with sufficient scope to capture third party risk.

Going Beyond the List

Given the global scale of PF, it’s critical that compliance solutions “go beyond the list”, which means going further than simple sanctions and watchlist name searches, and instead building out the most complete risk profile possible for each client.

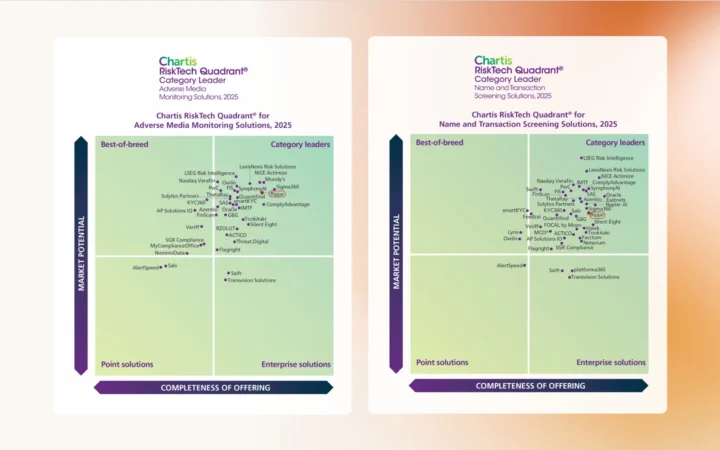

That means leaving manual screening processes behind and, instead, implementing automated AML/CFT screening tools with powerful name search and identity matching capabilities. The tools that you choose should be able to screen against thousands of data sources, in multiple languages, while accounting for sanctions evasion tactics, disparities in spelling and naming, and the possibility of PF risk emerging from third party relationships and PF-adjacent activities. With those factors in mind, and the need to manage vast amounts of customer screening data, it’s worth leaning into the efficiency benefits of AI-enhanced search technology, which can not only boost the accuracy of PF screening results, and reduce false positives, but support stronger compliance decision-making.

To learn more about the benefits of advanced screening technology for proliferation financing compliance, get in touch.