Supply chains are critical to the global corporate landscape, but any reliance on a third party also comes with a level of regulatory risk, which firms must factor-in to their compliance solutions.

From breaches of anti-money laundering (AML) and counter-financing of terrorism (CFT) rules to institutional corruption, cyber-security failures, and human rights abuses, the consequences of third party risk can be just as damaging as internal regulatory failures – not least because incidents often also inflict reputational damage. Third party risks are not a low-priority issue: a focus on cybersecurity risk alone reveals that up to 98% of organisations worldwide have had a business relationship with a third party vendor that has suffered a data breach.

Awareness and understanding are key to identifying and managing third party risks, and to implementing effective mitigation measures. In this post, we’re going to examine some of the key pain points associated with third party risk management, and how firms can deal with them.

Supply chain risk

Most organisations are comfortable managing the challenges of their immediate risk environment, including carefully calibrating their screening and monitoring solutions. When it comes to the risk environments of their suppliers, however, identifying threats becomes more complicated.

Supply chains typically cross multiple borders and multiple risk environments, which complicates the risk assessment process. Not only do firms have to think about a higher volume of threat vectors, but take steps to ensure that their suppliers are operating in compliance with the relevant regulations. The complexity of a supply chain magnifies the compliance challenge: cross-border chains carry a higher likelihood of regulatory disparity, while multiple different entities make different internal compliance approaches more likely.

Key supply chain compliance risks include:

- Suppliers that operate in high risk industries, such as shipping or payment services.

- Suppliers that operate in jurisdictions with lower AML regulations.

- Sanctions designations against persons or countries within, or connected to, a supply chain.

- The presence of politically exposed persons (PEPs) within supply chain companies, or connected to them via friends or close associates.

The principles of supply chain risk management are similar to those applied to customers. That means firms must implement suitable supply chain due diligence measures, along with screening and monitoring processes, in order to assess and establish risk as accurately as possible.

Reputational risk

We’ve focused on the regulatory risks that supply chains pose, but third party risk is not just about legal consequences – it also includes reputational damage. In fact, reputational damage can occur even in cases where there is no technical breach of law, and can hurt a firm just as much as a financial penalty.

In some contexts, the mere existence of a business relationship between one entity and another can be enough to create a negative public impression, regardless of whether a client organisation has broken compliance rules. With that in mind, reputational damage is often a result of negative environmental, social, and governance (ESG) factors, which may include:

- Carbon emission levels

- Preservation of biodiversity and natural habitats

- Ethical labour practices

- Workplace diversity, equity, and inclusion

- Health and safety practices

- Corruption

- Human rights abuses

The consequences of reputational damage can be difficult to predict, but may translate to customer boycotts, adverse media stories, and increased regulator attention. The sheer diversity of reputational concerns can be a particularly problematic factor for corporate entities with large global footprints, or with extensive supply chains. Reputational risks can be managed in the same way as other compliance concerns but, again, may require firms to extend the scope of their screening and due diligence measures.

Ongoing due diligence

The supply chain and reputational risks listed above represent ongoing compliance concerns, and mean that firms must factor them into their risk-based compliance solutions. In practice, this means treating third party relationships in a similar manner to business relationships, including performing due diligence in order to inform risk assessments.

Where conventional customer due diligence (CDD) measures help firms verify that customers are who they say they are, supply chain due diligence helps to verify that suppliers are meeting the standards that they claim to be. Supply chain due diligence is often a compliance pain point because it involves an intensive manual collection process of third party documents and information such as:

- Company names, addresses, tax numbers and incorporation documents

- Beneficial ownership details

- Historical financial data such as tax reports

- Internal risk assessment data

- Internal financial data such as cash flow, debts, and liabilities

- Regulatory environment information and historical AML/CFT compliance records

Supply chain due diligence should take place at the start of the supplier relationship and should be refreshed on a regular schedule to capture changes in a supplier’s risk profile. Ideally, that ongoing due diligence should be supported by peripheral compliance measures, including adverse media screening, and sanctions and watchlist screening.

Stay ahead of third party risks

Third party risks typically require firms to expand the scope of their compliance solutions, rather than taking a different approach to existing screening, monitoring or due diligence. That need adds volume to the compliance burden – a factor that can put unsustainable pressure on firms that rely on manual techniques to establish risk, such as searching for customer names on Google, or manually entering names into sanctions lists or PEP lists.

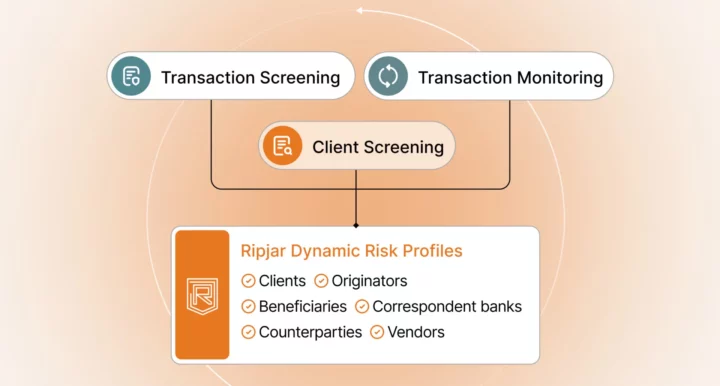

Fortunately, compliance teams have options for mitigating the challenges of third party risk, not least by supporting or (where possible) replacing manual processes with automated software tools. Automated screening software adds valuable speed to tasks that would have taken hours to complete manually, and high detail accuracy which reduces the potential for human error.

Most importantly, automated third party risk screening enables firms to dramatically boost the scope of their searches to a truly global scale. Automated name searches, for example, can cover thousands of global data sources, including news reports, sanctions lists, watchlists and more, delivering actionable intelligence in seconds, and helping firms make faster, stronger compliance decisions about every third party relationship.

Transform your third party risk screening with Ripjar

Last updated: 17 February 2025