Money launderers must disguise the origin of their illegal funds in order to avoid the anti-money laundering (AML) and counter-financing of terrorism (CFT) measures put in place to detect them. That requirement often leads to the use of third parties, so-called ‘money mules’ who are engaged to help launderers move funds between accounts. Money muling is an increasingly serious global problem: in 2021, an international investigation led by Europol, INTERPOL, and the European Banking Federation identified over 18,000 money mules, and led to the arrest of 1,803 people involved in criminal enterprises valued at a collective €67.5 million.

In response to the money laundering threat, in August 2022, INTERPOL launched its #YourAccountYourCrime campaign, an initiative to address money muling and remind financial institutions and the general public of their responsibility to keep their accounts safe from criminal misuse. With global authorities focusing on the detection and prevention of money muling, it’s more important than ever for financial institutions to understand what the crime entails and how to prevent it.

What is a money mule?

Money mules are people that conduct transactions on behalf of criminals in order to thwart AML/CFT controls and, in doing so, evade regulatory scrutiny. A money mule may be asked to receive money into their bank account or transfer money from their account to another, or may simply open a bank account in their name that other persons then use to move illegal funds.

While a small number of money mules may handle physical cash on behalf of money launderers, the vast majority of money muling takes place online. A Europol study revealed that over 90% of money mule transactions are related to cybercrimes and types of online fraud.

While money mules may act in exchange for commission or a fee, they may also be elderly or financially vulnerable people, such as immigrants or the unemployed, who have been coerced or incentivised into working on behalf of criminals. When they are recruited, some money mules may not be aware that they are acting on behalf of money launderers and end up participating in money laundering without initially realising they are involved in a crime.

The #YourAccountYourCrime campaign highlighted several key money mule recruitment methods:

Employment scams: A criminal may contact a prospective money mule with the offer of employment. In most cases, the ‘employee’ has not applied for the job and the money launderer ‘employer’ does not offer any details about their company or the proposed role on offer.

Romance scams: Prospective money mules may be contacted via social media or dating websites by money launderers posing as romantic partners.

Investment scams: Money mules may be contacted online with details of a lucrative investment scheme or quick, ‘no strings’ cash payments.

Identity theft: Money launderers may assume the identity of employees of banks or courier companies, or even acquaintances or relatives, in order to get individuals to hand over personal account details.

In person: Some money mules may be approached in person by money launderers.

How does money muling work?

Once recruited, money mules are used to handle illegally-obtained funds and typically receive their instructions over email or through social media messaging services. Money mule tasks may involve:

- Opening a bank account (or multiple bank accounts) under their own name.

- Establishing a company under their own name.

- Receiving money into one of their bank accounts or transferring money to a third party bank account.

A money mule may be only a single component in a much larger and more complex laundering operation in which criminals introduce their illegal funds to the legitimate financial system through multiple entry points. After the money mule has moved the funds through the financial system, criminals will withdraw the cash in its laundered state.

How can financial institutions detect money muling?

Financial institutions must develop risk management solutions capable of detecting customers that are being used as money mules, and remain vigilant for certain financial behaviours. Red flag indicators that customers may be involved in money laundering include:

- Customers that are unwilling or unable to pass customer due diligence checks.

- Customers that are unfamiliar with the source of the funds moving through their account.

- Multiple IP addresses associated with a single online bank account.

- IP addresses originating from high risk money laundering jurisdictions.

- Transfers of funds to and from high risk money laundering jurisdictions.

- Deposits of funds into a bank account that are withdrawn rapidly.

- Unusual patterns of transaction that do not match a customer’s risk profile.

From a regulatory compliance perspective, in order to detect and prevent money muling, firms should take a risk-based approach, assessing each customer individually and implementing the following AML/CFT measures and controls:

- Know Your Customer: Firms should implement suitable Know Your Customer (KYC) processes at onboarding and throughout the customer relationship in order to build accurate risk profiles. As part of the customer due diligence (CDD) process, for example, firms should establish and verify customer identities by requiring the submission of official documents such as passports and driving licences.

- Beneficial ownership: In addition to CDD, firms should establish the beneficial ownership of customer entities. If a money mule has opened a shell company on behalf of a third party, firms must take steps to identify the real owners of that company and ensure that its accounts are not being used to launder money.

- Source of funds: Money mules often handle large amounts of cash on behalf of money launderers. Firms should attempt to establish the origin of a customer’s funds to ensure that they have obtained the money in a manner that aligns with their wealth profile.

- Transaction screening: Money mules may engage in transactions on behalf of persons that have been targeted by economic sanctions or that are politically exposed persons (PEP). Accordingly, firms should screen transactions against the relevant sanctions and watch lists to reveal potential risk liability.

- Adverse media screening: Information about a customer’s involvement in financial crime may be revealed by news media before it is confirmed by official sources. Accordingly, firms should screen customers for their involvement in adverse media stories, including stories from foreign news outlets.

Next generation risk screening

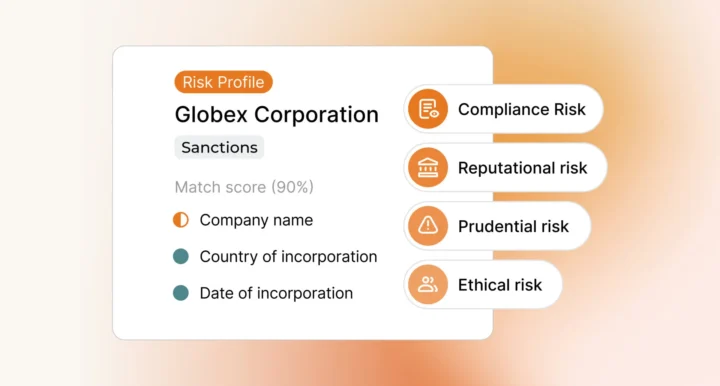

In order to detect and prevent money muling, firms must be able to collect and analyse large amounts of customer data quickly and efficiently. Ripjar’s Labyrinth Screening platform enables your firm to search thousands of data sources in real time, including adverse media screening in 21 languages. Labyrinth Screening incorporates next generation machine learning technology to process complex structured and unstructured data so that your firm knows as soon as possible when your customers’ risk profiles change.

To learn more about how Ripjar can help your firm deal with money mule risks, contact us today.

Last updated: 16 August 2024