The Swiss Financial Market Supervisory Authority (FINMA) is responsible for regulating Switzerland’s anti-money laundering (AML) and counter-financing of terrorism regulations, and for providing supervision for the country’s banks and financial institutions. FINMA is a prominent international regulatory body: Switzerland’s reputation as a global banking destination stretches back hundreds of years, and Swiss Banks are some of the wealthiest in the world, holding an estimated $6.5 trillion in assets.

FINMA: Background

Switzerland’s banking industry is known for its confidentiality, and has developed a reputation as a destination for criminals attempting to hide illegal money. In particular, criminals have sought to exploit Switzerland’s traditionally-permissive financial anonymity rules and high levels of discretion for banking customers – which include the deployment of technological measures to conceal identities. In 2021, the Tax Justice Network ranked Switzerland at 3 on its Financial Secrecy index, and at 5 on its Corporate Tax Haven index, estimating that money hidden in Swiss banks amounted to over $21 billion. Global regulators have picked up on the financial criminal trends affecting Switzerland, with the Financial Action Task Force (FATF) highlighting numerous AML/CFT deficiencies in its Mutual Evaluation Reports (MER).

In response to the threat to Switzerland’s financial system, and to global financial markets, the Swiss government introduced the Swiss Financial Market Supervisory Authority in 2007. Established under the authority of the Anti-Money Laundering Act (AMLA), FINMA is an independent regulatory body and was a merger of the Federal Office of Private Insurance, the Federal Banking Commission, and the Anti-Money Laundering Control Authority.

What Does FINMA Do?

FINMA has a mandate to ‘supervise banks, insurance companies, financial institutions, collective investment schemes, and their asset managers and fund management companies’, and to ensure ‘that Switzerland’s financial markets function effectively’. In order to achieve those objectives, FINMA engages in the following activities:

Issuing licences: Individuals and companies that wish to engage in financial market activity in Switzerland must obtain an operating licence from FINMA. Different types of licence are available for different types of application, but each involves strict qualification criteria.

Regulatory supervision: FINMA supervises all ‘licensed banks, financial institutions, insurance companies, collective investment schemes and their asset managers and fund management companies’ in Switzerland. Following its mandate, FINMA’s objective is to protect customers from the effects of insolvency or malpractice, and to ensure that Switzerland’s financial markets function effectively.

Implementation of legislation: Where it finds evidence of noncompliance or violations of Swiss law, FINMA has the authority to conduct investigations of the persons involved and ‘use all the means of enforcement available’ under Swiss law to implement the relevant supervisory legislation.

Developing regulations: In addition to its supervisory and enforcement roles, FINMA participates in regulatory projects, under the authority of Switzerland’s Federal Department of Finance (FDF) and the State Secretariat for International Finance (SIF). FINMA engages in regulation in order to meet its supervisory objectives, and issues ordinances and circulars to announce new regulatory rules.

Switzerland’s AML Law

Switzerland’s principle AML/CFT law is the Federal Act on Combating Money Laundering and Terrorist Financing in the Financial Sector, which is also known as the Anti-Money Laundering Act (AMLA). Introduced in 1997, the Act represents the legal basis for combating money laundering in Switzerland, and imposes a variety of reporting, record-keeping, and monitoring obligations on banks and financial service providers.

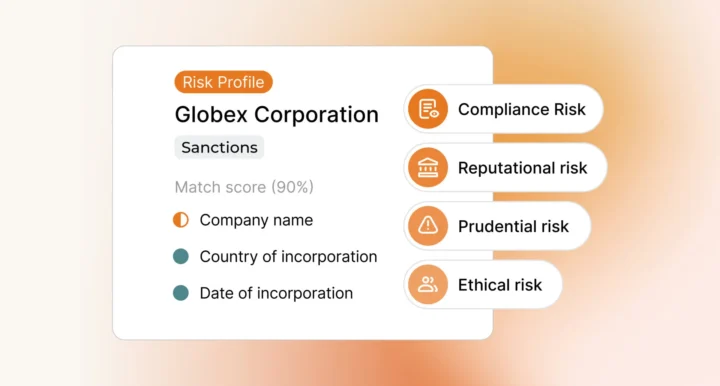

As a Financial Action Task Force (FATF) member-state, Switzerland’s AML/CFT regulation mandates a risk-based approach. This means that financial service providers in Switzerland must assess the criminal risk that each customer presents, and then deploy a proportionate compliance response, with higher risk customers subject to more intensive AML/CFT measures.

Under AMLA, banks must put the following AML/CFT measures in place:

Customer due diligence: Banks in Switzerland must establish the identities of their customers by requesting certain documentation, including passports, driving licences, birth certificates, and company incorporation documents.

Transaction monitoring: Certain financial behaviour may indicate money laundering activity. Accordingly, banks must monitor customer transactions for suspicious activity and report such activity to FINMA.

Sanctions monitoring: Customers that are subject to international sanctions may seek to use Swiss bank accounts to conceal their connection to illegal money. With that in mind, banks in Switzerland should screen their customers against the relevant sanctions and watchlists, including the Swiss sanctions list, and the United Nations sanctions list.

PEP screening: Elected officials and government employees also pose elevated AML/CFT compliance risks and banks should screen customers to find out if they are politically exposed persons (PEP).

Enhanced due diligence: Since criminals may be drawn to the financial opportunities presented by the Swiss regulatory environment, banks in Switzerland must be prepared to deploy enhanced due diligence measures effectively for high risk customers. Enhanced due diligence involves more rigorous scrutiny of a customer’s identity, including obtaining more detailed identifying documents, performing more intensive checks into business relationships, and establishing the source of customers’ wealth and funds.

Adverse media: Illegal financial activity involving Swiss banks often attracts the attention of investigative journalists – and criminals that use Swiss bank accounts to launder money are often exposed in the media before that information is confirmed by government authorities. With that in mind, banks should integrate adverse media monitoring as part of their AML/CFT solution in order to capture changes to a customer’s risk profile as soon as possible.

It is important for banks to consider the Swiss banking industry’s risk landscape, and adjust their adverse media solution to capture relevant breaking stories quickly and efficiently. Important factors include the geographic source of the media, its credibility, reporting bias, and financial institution’s own risk appetite.

FINMA Recent Developments

In response to concerns about the transparency of its banking system, FINMA has been working to enhance Switzerland’s AML infrastructure.

Mutual Evaluation Report: The FATF’s most recent Mutual Evaluation Report (MER) on Switzerland, released in 2016, outlined several areas of concern, with the following key findings:

- The majority of Switzerland’s money laundering risk derives from offences committed abroad.

- Many Swiss financial institutions do not implement due diligence measures satisfactorily for existing customers.

- The number of suspicious transaction reports generated by Swiss institutions is insufficient, and reports tend to be prompted by external information.

- FINMA needs to make further progress in imposing noncompliance sanctions that are sufficiently dissuasive.

In 2020, FATF released an update on Switzerland’s progress in addressing areas of concern raised in the 2016 report. It upgraded Switzerland’s compliance performance in several areas but stressed that more progress was needed.

Cyber-attack reporting obligations: In 2022, the Swiss government indicated that it would introduce an amendment to the Federal Act on Information Security relating to the reporting of cyber-attacks. Under the proposal, banks and financial institutions in Switzerland would be obliged to report cyber-attacks to FINMA with penalties of up to CHF100,000 for noncompliance.

Get in touch to learn how Ripjar can help you with FINMA compliance.

Last updated: 16 August 2024