UK challenger banks have transformed the financial sector with innovative products and services that offer greater flexibility than their ‘brick and mortar’ counterparts. Research suggests that the value of the challenger bank market will continue to grow rapidly, reaching an estimated global value of $471 billion by 2027. However, the opportunities that challenger banks bring also represent new regulatory challenges with disruptive services increasing the risk of money laundering and other financial crimes.

Challenger Bank AML Vulnerabilities

An FCA review has found that UK challenger banks may be struggling to meet that regulatory challenge, with some failing to effectively implement important anti-money laundering (AML) measures and controls. Initiated in 2021 and published in April 2022, the review identified a rise in the number of challenger bank Suspicious Activity Reports (SAR), raising concerns “about the adequacy of these banks’ checks when taking on new customers”.

The FCA review involved 6 unnamed challenger banks that were relatively new to the financial market and which had a collective customer base of over 8 million people. While the FCA praised the advantages of the challenger banks’ “innovative use of technology” to speed up standard customer identification and verification processes, it also raised areas of concern, including:

- Failures to conduct adequate checks on customer income and occupation

- Failures to apply enhanced due diligence measures consistently for high risk AML alerts

- A lack of sufficient detail in customer risk assessments

- Ineffective management of AML alerts

The review highlights the need for challenger banks to match their innovative fintech capabilities with a safety-minded approach to their AML responsibilities. FCA Executive Director, Sarah Pritchard, emphasised that point, stating that challenger banks remain “an important part of the UK’s retail banking offering” but that their benefits cannot entail a “trade-off” with AML compliance.

The Importance of Customer Data

AML compliance, and the due diligence and screening processes that it involves, may be especially complex for challenger banks since their appeal to customers is their speed, simplicity, and flexibility.

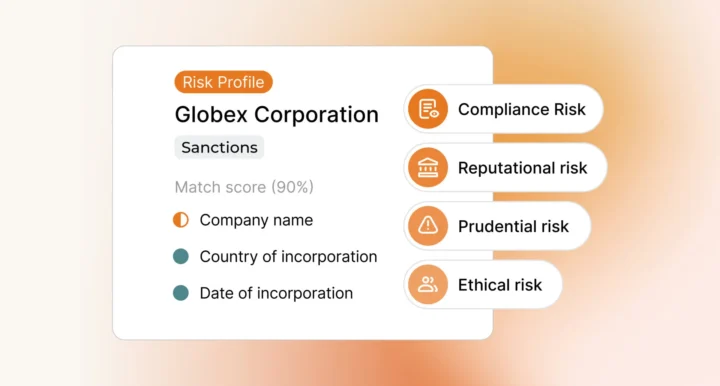

The FCA’s review suggests that challenger banks’ AML problems are attributable to a lack of quality customer data with which to build accurate risk-profiles and make important compliance decisions. When challenger banks struggle to meet their data collection and risk management needs, they are forced to compromise the advantages of their products and services by diverting resources to AML compliance – or risking regulatory penalties.

Challenger Bank AML Solutions

Many challenger banks manage their AML obligations by building bespoke risk management solutions – but often encounter difficulties balancing their compliance responsibilities with a focus on delivering fintech innovation. AML regulatory environments are complicated further by the constantly changing threat landscape, in which new criminal methodologies emerge, and new legislation is implemented constantly.

Fortunately, challenger banks have options when it comes to meeting their due diligence and risk assessment obligations. Rather than relying on a potentially-vulnerable and untested bespoke solution, challenger banks may instead draw on the expertise of established, industry-trusted platforms with dedicated CDD and EDD resources and multi-faceted AML and KYC screening tools.

Built on smart technology, automated AML compliance solutions enable challenger banks to be proactive about threats, integrating customer data from sources across the world quickly and efficiently, and adapting in real time as the risk landscape changes. Trusted AML solutions may include multiple language screening capabilities, helping challenger banks better manage CDD and EDD for international customers without generating unmanageable amounts of false positive alerts.

Learn more about our AML compliance solutions for challenger banks: contact us today

Last updated: 16 August 2024