In an increasingly crowded adverse media landscape, location data associated with news stories can be particularly useful to compliance teams when it comes to accurately matching customer names and addressing compliance threats.

Given the clarity that it can provide, many firms are now integrating location data as a secondary identifier, in addition to identifiers such as dates, times, and monetary amounts. Location data has the potential to significantly enhance the customer screening process, offering a far greater level of coverage at scale for adverse media name searches.

Location-enhanced name searches can represent a valuable advantage in a challenging adverse media environment – not least in reducing the cost of false positive alerts triggered by the sheer volume of news stories. With that in mind, it’s time for compliance teams to explore the potential of location data to transform the accuracy and efficiency of their screening process.

What is location data?

When firms screen customers against adverse media, they use certain identifiers to help match names against stories, and develop a more accurate understanding of compliance risk. Location information is one of those identifiers: by extracting location data from stories, compliance teams increase the likelihood of a correct name match, and so enhance their anti-financial crime (AFC) compliance response.

Even when location data is only a small component of a given story, it may carry significant screening value. For example, if a search for a customer living in Scotland triggers an alert from a local news outlet, such as “The Cheltenham Echo”, it is unlikely that the story in question will be about the same person given the localised, southern-Midlands focus of the source, and so can be quickly remediated as a false positive.

It’s easy to underestimate the prevalence (and potential) of location data in media stories. Around 95% of media articles include some location component that carries value for compliance risk assessment. In this context, the term ‘location data’ may include:

- Places referred to in the story itself

- The place in which the story itself was filed

- The place of media publication

- The physical location or headquarters of the media outlet

Ripjar’s AI Risk Profiles feature, available as part of the Labyrinth Screening platform, offers further insight into the value of location data. Around 99% of AI Risk Profiles that include adverse media articles contain location information.

By using location data in combination and context with other indicators, compliance teams can significantly enhance its value in the name-matching process, and ultimately, in the accuracy of screening results.

What screening problems does location data solve?

Navigating the vast landscape of adverse media is a significant screening challenge. Firms must sort through huge volumes of data to find relevant risk information, while managing the associated noise, including duplicate stories or stories about people with similar names – all of which can drastically increase the false positive alert rate. Some of the most common location challenges include:

- Frequent travellers: High profile customers, such as politicians, may travel around the world frequently and generate numerous news stories in the locations that they visit. This can confuse name searches and make it harder for compliance teams to get to the meaningful risk data that they need.

- Name variance: Adverse media stories concerning the same topic may duplicate references to the same location, creating extra work for screening solutions: “Oxford’, for example, may also be referred to in stories as “Oxfordshire”, “Oxon” and “OX”.

- Punctuation: Some location references include lots of punctuation, such as Manhattan, New York, New York. Complexity of punctuation may make it hard for screening solutions to identify the meaningful data.

By implementing context-driven searches which incorporate location data, compliance teams can cut through that screening noise, reduce false positives, and enrich their customer risk profiles.

Criminal methodologies

Location data isn’t just a ‘nice to have’ option for compliance teams. As criminal methodologies evolve, and regulators respond, firms must be able to keep up with a constantly evolving risk environment, embracing screening innovation wherever possible to meet compliance expectations..

With this challenge in mind, location data takes on an added significance – not just as a secondary identifier but as an integral component of compliance strategy, capable of transforming the accuracy and effectiveness of the name search process.

Regulatory trends and requirements

Beyond adverse media screening applications, financial regulators are zeroing-in on the potential of location data in wider compliance.

Since 2020, the US Office of Foreign Assets Control (OFAC) has required obligated entities to implement IP address geolocation screening measures, along with location-screening considerations as part of due diligence, for virtual currency firms. OFAC set out its location screening expectations in its paper: Sanctions Compliance Guidance for the Virtual Currency Industry. Similarly, in June 2024, the US Bureau of Industry and Security (BIS) added addresses to its watchlists, essentially prohibiting trade with entities at the designated locations.

It goes without saying that location data has always been critical in the enforcement of international sanctions, including OFAC’s programmes against Iran, Cuba, Venezuela, and so on. As that data becomes more available, and more functional, it’s likely that authorities around the world will seek to integrate it further into screening requirements – with adverse media screening a priority.

Who can benefit from location data screening?

All firms with anti-money laundering (AML) compliance concerns may benefit from integrating reliable location data into their screening process since it promises an extra layer of accuracy and confidence for the risk assessment process, while reducing the time and cost associated with false positive alert remediation.

Firms with particularly large retail client bases, stretched across multiple locations, may find even greater value, not least in enhancing the trust relationship between users of a particular platform and secondary service providers associated with it. In these contexts, identity matching must be more discerning to ensure it functions effectively at the largest scales.

Travel aggregation sites, for example, offering products and services in multiple global locations will benefit significantly from that enhanced trust metric. Online accommodation exchanges will be able to enhance the trust and confidence between both guests and hosts, while simultaneously offering expedited onboarding and smoother payment processing. Meanwhile, retail banks and B2C tech companies that trade internationally also stand to benefit from enhanced location screening capabilities.

Like regulators, industry bodies have begun to pick up on the potential advantage of location data. Events like TrustCon, for example, offer forums where experts can discuss innovations, including advanced adverse media screening.

Next Generation Location Screening with Ripjar

With screening solutions powered by industry-leading AI technology, Ripjar is harnessing the power of location data to keep our clients at the cutting edge of financial crime compliance.

In the latest upgrade to the Labyrinth Screening platform, we integrated additional enhanced location data analysis capabilities, designed to help compliance teams build out rich, detailed customer risk profiles and significantly reduce the potential for false positive alerts. Our screening technology integrates AI algorithms to identify and extract relevant information from both structured and unstructured data sources, and facilitate faster, stronger compliance decisions.

Labyrinth’s location data analysis also offers valuable flexibility, automatically adjusting name match scores based on the population of a given location. A search for “John Smith” in Cheltenham, for example, would deliver a higher score than a search for “John Smith” in London, given the disparity in population and the lower number of “John Smith” names in the former location. The system combines that feature with frequency of names appearing in media screening results to determine the likelihood of a correct match, and assign an accurate score.

Labyrinth Screening Location Test Results

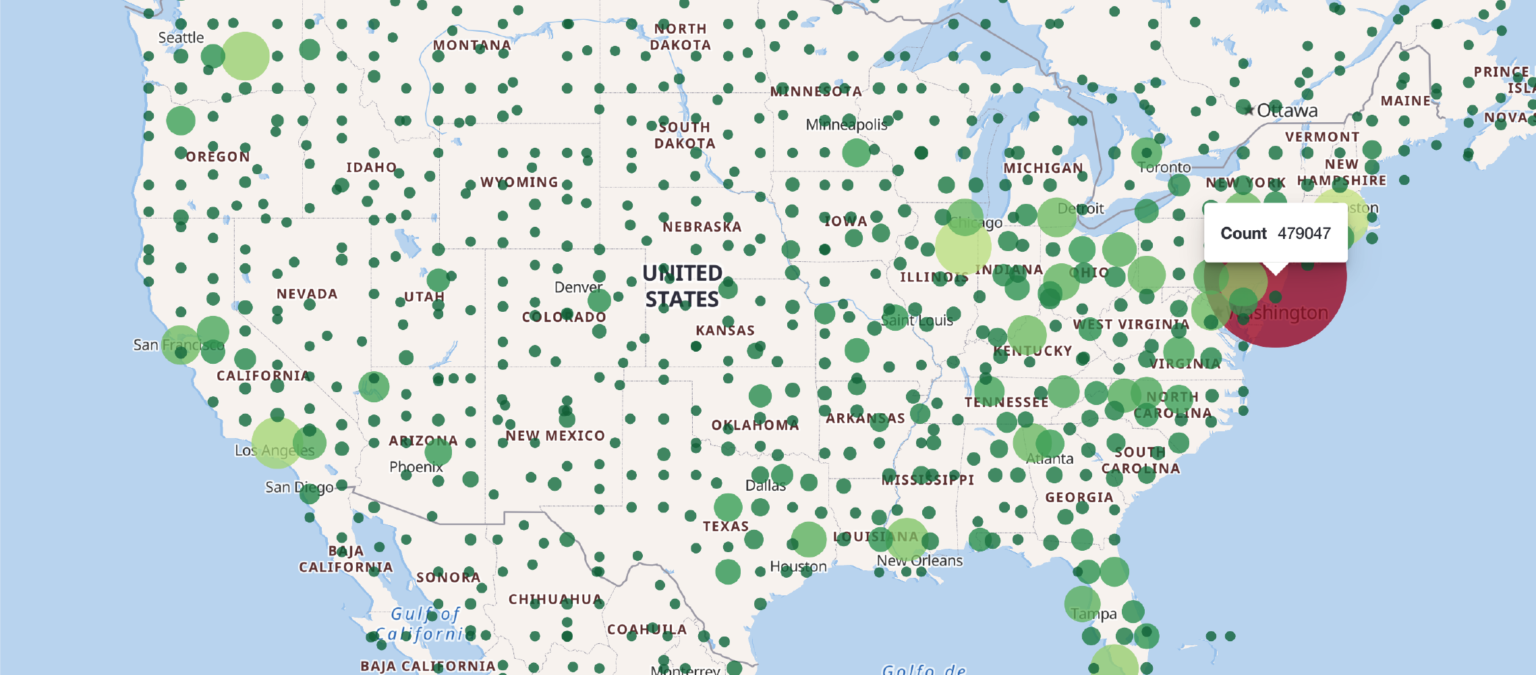

Our location data identifiers are achieving real-world screening results, at scale, in a complex and challenging adverse media landscape. In an early trial by a US-based technology company involving 1.2 million people registered with address data, location-enhanced Labyrinth Screening achieved over 90% true positive accuracy in its top screening hits.

The company highly values internal trust between its service providers and its clients, and so needs as smooth a screening process as possible, that preserves the user experience. The trial demonstrated Labyrinth’s capacity to deliver that type of media screening at scale. In the riskiest 3,000 of the customer names screened, the upgraded system revealed the following AML compliance risks:

- The manufacture of illegal or controlled drugs

- Organised criminal trafficking of drugs

- Attempted murder

- Prostitution of a minor

- A charge of armed robbery and aggravated battery causing harm

Using a combination of location data and name-frequency, the upgraded Labyrinth Screening process not only delivered a higher rate of exact identity matches but enabled the tech company to permanently remove many of the highest risk accounts.

Discover the possibilities of location-enhanced customer name screening

Last updated: 6 January 2025