Adverse media screening is critical to the global fight against financial crime but in an ever-changing risk landscape, firms should always be prepared for new challenges. With that goal in mind, in 2023, Ripjar conducted research into the adverse media challenges faced by global anti-financial crime professionals, in order to derive statistical data about their concerns and expectations for the future.

News media and other online media sources such as blogs, forums, and social media posts, are particularly useful for anti-money laundering (AML) and counter-financing of terrorism (CFT) strategies because they typically reveal customers’ true risk levels before that information is confirmed by official sources. However, the adverse media landscape is constantly changing, with the pace of breaking news stories forcing firms to adjust their compliance posture quickly to manage new risks.

The scope of risk-based AML/CFT regulations means that firms must carefully consider how to implement their adverse media screening solutions, including which technology tools they should integrate, and how their strategies need to change in the short and long term. Ripjar’s State of Adverse Media Screening 2023-2024 report examines that landscape, exploring the contemporary screening challenges that firms face, and how new technology is changing compliance processes.

The report comprised a survey of 205 compliance professionals from different industries and across the EMEA region. In this article, we take a closer look at key insights from the survey, and how automated screening solutions can help firms address these challenges in 2024.

2024’s Key Adverse Media Screening Challenges

Our survey identified the following key challenges faced by respondents looking to implement adverse media screening solutions in 2024:

Resource and Budget Constraints

Effective adverse media screening requires firms to address compliance risk by allocating sufficient budget, resources, and employee focus to the relevant tasks. However, balancing screening costs with AML/CFT compliance obligations can be challenging: manual screening, for example, using internet search engines (such as Google or Bing) to check customer names, may be the cheapest approach but is typically time-consuming, inconsistent, and prone to costly human error. With almost 50% of firms believing that the challenge of keeping in step with regulatory change will increase, automated screening solutions represent a time and cost efficient alternative to outdated manual processes. However, automated tools are not necessarily a one-size-fits-all solution and must be integrated within a wider compliance infrastructure and calibrated to meet individual risk appetites.

False Positives

While adverse media screening should help firms identify risk as comprehensively as possible, the process can generate a high volume of false positive alerts as a result of similar sounding names, ambiguities in search parameters, or linguistic factors (such as non-Western naming conventions). False positive alerts can be costly since they must be remediated in order to address potential risk – a process which takes time and resources, and slows down the wider compliance function. Given that 40% of firms believe that the problem of dealing with false positive alerts will increase in 2024, compliance teams should seek to integrate technology solutions to help reduce that burden – including AI tools capable of making sense of unstructured data, and even using secondary identifiers to help resolve customer identities.

Technology and Data Integration

Adverse media screening is only as good as the technology that supports it. In practice, this means that firms must understand how tech innovations in screening will fit and function within their wider compliance infrastructure in order to meet their AML/CFT compliance obligations. Similarly, compliance employees must ensure that the data they feed into screening solutions is of sufficient quality to generate meaningful financial intelligence, and to enable effective risk decision making.

Regulatory Change

AML/CFT screening solutions are shaped by regulation. However, the global regulatory landscape is in a state of constant change as governments work to keep pace with evolving technology and criminal methodologies. This means that firms must maintain a perspective on incoming regulations, and consider how they will need to adjust their screening solutions to meet new compliance standards. In our survey, 47% of firms believed that the challenge of keeping up with incoming regulations would increase in the future.

Adverse media screening is currently an obligation in a number of jurisdictions – for example, it is included in the EU’s 6th Anti-Money Laundering Directives (6AMLD). Since adverse media screening typically involves the use of customers’ personal data, firms must also be aware of local privacy regulations, such as the EU’s GDPR.

How Will Screening Challenges Change?

In addition to revealing their key adverse media screening challenges, our survey asked firms which adverse media challenges would be most likely to increase in the future. Our respondents identified 3 top challenges:

- Keeping up with new regulations: 47%

- Managing the complexity of new technology solutions: 41%

- Receiving too many irrelevant alerts (false positives) 40%

The challenges identified emphasise the need for firms to maintain perspective on the regulatory and screening technology horizons, reviewing their compliance infrastructure regularly in order to identify potential weak points, or opportunities to strengthen.

Current Screening Strategies Being Used in 2024

The challenges outlined in the 2023-2024 report offer the following insight into the screening strategies that firms currently use to meet their compliance obligations – along with attitudes and expectations about the impact of screening technologies.

Reliance on Manual Screening

While automated screening solutions are available and accessible in 2024, a surprising 84% of firms remain reliant on manual screening processes. As noted above, the slow speed and unreliability of manual searches makes them unsuitable for fighting modern financial criminal threats, and firms using them exclusively may be exposing themselves to unacceptable levels of risk. Similarly, as competitors integrate new screening innovations, firms that rely on manual screening may see customers drop off in favour of more efficient alternatives.

Tech Integration

Given that 90% of firms want to increase their use of screening automation, it’s likely that there will be integration challenges in the coming years. 39% of surveyed firms identified the integration of new screening technology into existing infrastructure as their biggest challenge – which means that compliance teams will need to carefully consider how a given innovation adds value to their organisation. Similarly, firms will need to think about whether new technologies match their budgetary needs and risk appetite, and whether they should be run internally, or by a third party service provider.

Evolving Capabilities

While automated compliance solutions offer enhanced accuracy, efficiency and speed, recent innovations, in particular artificial intelligence and machine learning tools are revolutionising the adverse media screening landscape. Large language models (LLM) and generative AI (GenAI) appear to hold particular promise, with the potential to screen vast amounts of data in seconds and extract the most relevant information. It can be overwhelming to consider how the potential application of AI will impact screening processes since both its regulatory implications and screening capabilities have not been fully tested.

For example, in our survey, 70% of firms were confident that LLMs will be able to identify high-risk individuals. That statistic clashes with many current experiences of LLMs, many of which generate incorrect outputs, or even fabricate responses to certain prompts. What’s clear is that GenAI used in a screening setting must be developed specifically for the task and thoroughly tested to ensure accuracy of output – not all LLM technology will be appropriate for screening use without significant constraints being put in place.

Regardless of industry attitudes, the clear regulatory potential of AI technology, and the current pace of advances, means that industry focus on integration of screening functions will increase in the short to medium term.

How Automation Will Change Adverse Media Screening in 2024

Despite the challenges currently facing tech integration in adverse media screening functions, there are plenty of ways in which automation can have a qualitative impact, and enhance the compliance process. Key areas in which automation is likely to have an impact on adverse media screening in 2024 include:

Skills Shortages

The compliance function can place a significant amount of pressure on employees, in particular in the finance sector, where regulations often carry strict penalties. The ‘Great Resignation’ has seen skilled employees leave finance roles in positions around the world, with firms struggling to make up the shortfall. Automated screening tools can directly address that challenge by bringing speed, accuracy, and efficiency to the process, reducing the potential for human error, and freeing up compliance employees from tedious manual work, such as data entry, for more valuable assignments.

Data Analysis

AI technologies such as LLMs are effective at interpreting unstructured media data in multiple languages, which is essential in adverse media screening. However, they are not suited to identity-matching and other key screening requirements. With the right mix of AI and machine learning techniques, firms can sort through this risk-related data in seconds, summarising and formatting the information in order to enable stronger, faster decision-making.

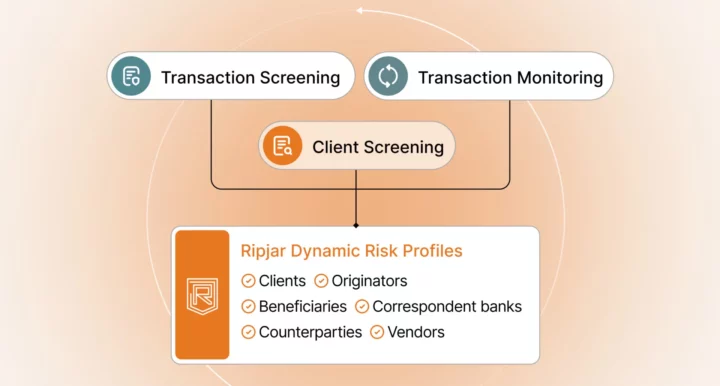

Risk Profiles

With the benefit of machine learning and natural language processing technology, AI screening tools can be tasked with extracting the most relevant data about subject entities, and then using that data to build unique risk profiles for each customer. Enriched with specific depth and detail, customer data not only helps to identify true risk, but reduces the potential for false positives by helping to distinguish customers with similar or exact-matched names. In the same way, AI tools can help firms account for multilingual screening challenges, including non-Western naming conventions and characters, or the use of nicknames or aliases.

Labyrinth Adverse Media Screening

Ripjar’s Labyrinth Screening platform is a powerful adverse media screening solution built on next generation machine learning technology. Capable of searching thousands of global adverse media sources across multiple languages, including news stories, blog and social media posts, sanctions lists, and watchlists, Labyrinth Screening generates actionable financial intelligence in seconds, helping compliance employees make faster, stronger decisions about customer risk.

Labyrinth also incorporates AI Risk Profile technology, extracting the most relevant risk data about subject entities in order to resolve ambiguities and reduce false positive alerts. Our AI Risk Profiles solution uses intuitive AI to remove noise from customer name searches. The technology addresses the challenge of common and high profile name matches, and of duplicated story subjects, while adding secondary identifiers to each profile so that compliance employees have the information they need to assess risk at their fingertips.

AI Summaries is a new feature available within AI Risk Profiles that uses GenAI to add a clear, concise summary of adverse media risk to each customer profile, resulting in a 90% reduction in customer assessment time.

Manage your screening challenges with Ripjar’s advanced adverse media screening technology

Last updated: 6 January 2025