The Netherlands has the 17th largest economy in the world by GDP and attracts an array of international businesses, including a growing number of innovative fintech service providers. As a global financial hub, the Netherlands has also become a target for money launderers and other financial criminals, who seek to exploit the country’s financial system. To meet that threat, the Netherlands’ government implements a robust anti-money laundering (AML) and counter-financing of terrorism (CFT) framework, with significant penalties for firms that fail to comply. Dutch authorities emphasise their focus on regulatory compliance: in 2021, for example, Dutch Bank ABN Amro reached a €480m settlement with prosecutors after an investigation uncovered significant AML compliance failings.

AML regulations in the Netherlands represent an ongoing challenge. To ensure your company avoids penalties, it is important to understand the Netherlands’ AML/CFT infrastructure, and what it takes to achieve compliance.

What is the AFM?

The Netherlands’ primary financial regulator is the Authority for the Financial Markets, known as the Autoriteit Financiële Markten (AFM). Established in 2002 as a replacement for the Netherlands’ Securities Board, the AFM is an independent administrative authority that operates under the control of the Dutch Minister of Finance.

The AFM is responsible for supervising Dutch financial entities to ensure their compliance with AML regulations in the Netherlands. In that capacity, the AFM oversees the entire financial sector and its products and services, including “savings, investment, insurance, loans, pensions, capital markets, asset management, accountancy and financial reporting”. In order to achieve its supervisory objectives, the AFM has the authority to conduct inspections of Dutch financial institutions and, where necessary, enforce regulations by issuing warnings, filing reports with law enforcement agencies, and imposing fines and penalty payments.

The AFM shares its responsibilities with the Dutch central bank: De Nederlandsche Bank (DNB). The two entities work closely together, often sharing information. While the AFM focuses on supervising businesses in the Netherlands, and “promoting fair and transparent financial markets”, the DNB focuses on providing prudential supervision.

In conjunction with the DNB, the AFM is also responsible for issuing licences to all financial institutions that operate in the Netherlands. Firms in the Netherlands that wish to obtain a licence must meet a set of qualification criteria and complete the relevant application process.

Key AML Regulations in the Netherlands

The Netherlands’ main article of AML regulation is the Anti-Money Laundering and Anti-Terrorist Financing Act, known as Wet ter voorkoming van witwassen en financieren van terrorisme – Wwft. The Act requires financial institutions in the Netherlands to take a risk-based approach to AML – as mandated by the Financial Action Task Force (FATF) which means they must perform risk assessments of individual customers and implement a range of compliance measures, including:

- Identity verification: Firms in the Netherlands must establish and verify the identities of their customers as part of the customer due diligence process (CDD) in order to conduct an effective risk assessment. The identity verification process requires the collection of information such as names, addresses, dates of birth, and official company documentation.

- Beneficial ownership verification: The CDD process should extend to the beneficial ownership of customer entities. Beneficial ownership checks are required to ensure that customers are not using corporate infrastructure or shell companies to conceal financial crimes.

- Transaction screening: Firms in the Netherlands should screen customer transactions against the relevant risk data sources, including beneficial ownership registries, politically exposed person (PEP) lists, and sanctions lists.

- Adverse media: Firms in the Netherlands should screen customers against global adverse media sources which may reveal changes in risk profile before that information is confirmed by official sources. Depending on risk exposure, it may be necessary to implement adverse media screening on a global scale, with name searches conducted in a range of foreign languages.

Anti-Money Laundering Directives: As a member of the EU, the Netherlands must implement the anti-money laundering directives (AMLD). The AMLD are released periodically by the European Parliament and include a range of updated AML/CFT measures that member states must transpose into domestic legislation. The latest directive, the Sixth Anti-Money Laundering Directive (6AMLD), came into effect in June 2021, introducing the following AML/CFT measures:

- A harmonised list of 22 predicate offences for money laundering, including the 2 new offences of environmental crime and cyber-crime.

- An expansion of the criminal scope of money laundering. Under 6AMLD, aiding and abetting money laundering now also falls under the definition of the offence of money laundering.

- An extension of criminal liability for money laundering to legal persons. In practice, this means that companies (including management and senior executives) may be held liable for money laundering offences committed by individual employees.

- An increase in the criminal penalty for money laundering. Under the new rules, money laundering offences must carry a minimum prison term of 4 years.

- New ‘dual criminality’ rules to facilitate the joint prosecution of money laundering offences in different countries.

Recent AML Developments in the Netherlands

The AFM and the DNB keep firms in the Netherlands up to date with the latest AML/CFT regulatory developments. Key recent updates include:

- Enforcement actions: The AFM publicises enforcement actions and the monetary penalties that it imposes for compliance failures. In June 2022, the AFM imposed compliance penalties on Revo Capital Management amounting to over €150,000 for infringements of the Wwft.

- Ukraine sanctions: Following Russia’s invasion of Ukraine in February 2022, the DNB published guidance for firms in the Netherlands regarding new sanctions against Russia and Russian individuals.

- Fintech: The AFM and the DNB publish guidance and recommendations regarding the regulations of fintech products and services, including cryptocurrencies and cryptocurrency service providers. In 2019, for example, both regulators called for the introduction of an international regulatory framework for cryptocurrencies, and for a national licensing regime for cryptocurrency exchanges. In June 2022, the EU announced it had reached an agreement on a Europe-wide crypto regulation framework, known as Markets in Crypto Assets (MiCA).

Next Generation Risk Management in the Netherlands

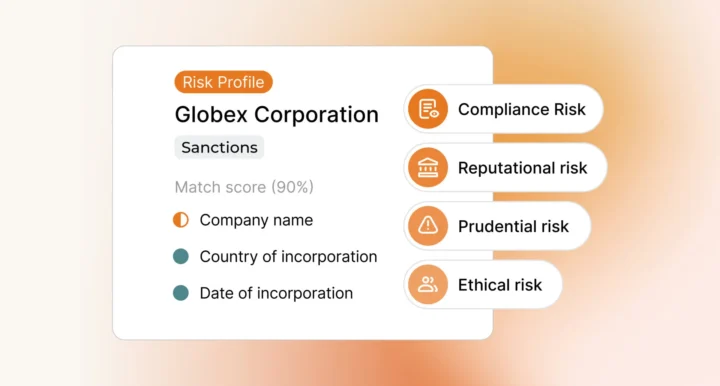

Ripjar’s Labyrinth Screening platform can help firms in the Netherlands reduce their compliance burden and streamline their screening processes. Labyrinth Screening enables firms to search thousands of risk data sources, including foreign news sources, in real time, in 21 languages. Incorporating next generation name matching technology, Labyrinth Screening enables you to react to changes in legislation or emerging criminal methodologies quickly and efficiently and be informed as soon as your customers’ risk profiles change.

Contact us to discuss how Ripjar can support your AML compliance in the Netherlands

Last updated: 16 August 2024