The Hong Kong Monetary Authority (HKMA) is responsible for protecting Hong Kong’s financial system. In that role, it works with the city’s banks and financial institutions to detect and address criminal threats such as money laundering, often with a focus on the integration of innovative technology solutions. The strategy is part of HKMA’s Fintech 2025 initiative and has helped make Hong Kong a global hub for regtech adoption, with around 85% of the city’s banks integrating some form of regtech to manage their anti-money laundering (AML) compliance needs in 2023.

Exploring AML Insight

The HKMA’s approach to regtech integration evolves to meet emerging risks. In 2021, the regulator published its inaugural Case Studies and Insights paper as a way of exploring the ways in which Hong Kong financial institutions are deploying technology to address AML risk, and ultimately enhancing the city’s collective response to financial crime.

In Case Studies and Insights Volume 2, published in September 2023, the HKMA included a case study which focused on the integration of an innovative, AI-powered news monitoring solution with natural language processing (NLP) technology that had helped a Tier 1 Hong Kong bank enhance its AML adverse media screening process. The study highlights the significant challenges that banks face when screening individual customers – in particular the friction and inefficiencies of collecting and analysing global adverse media, or negative news, for critical risk information.

Let’s take a closer look at the HKMA’s case study to find out how cutting-edge AI technology tools can help financial institutions in the APAC region not only address their screening challenges but boost their overall AML compliance response.

Adverse Media Screening Challenges

The risk-based approach to compliance required by the HKMA (following FATF guidelines) means that financial institutions in the country must build out risk profiles with enough information to facilitate effective decision-making about the AML risk that customers present. For international banks, this requirement entails searching customer names across a global media landscape, and dealing with a multitude of emergent screening problems that not only complicate the screening process with noise and false positive alerts, but also degrade products and services.

The case study bank implemented its screening platform to help it overcome common challenges associated with adverse media screening, including:

- Speed and accuracy: Manual screening via search engines or other methods is slow and likely to miss key risks in vast quantities of media data.

- Credibility of data: Many negative news screening solutions fail to effectively filter out low quality results from sources such as such as social media or personal blog posts.

- Misidentification and duplication: Duplication of news stories and false positive alerts can significantly affect screening speed and effectiveness, as compliance teams work through alerts to filter relevant data.

- Multi-language matching: Global adverse media screening must not only be able to detect customer names in news stories in multiple languages, but also account for the translation, transcription, and transliteration of names, plus the use of different characters, regional naming conventions, and so on.

Overcoming Multi Language Screening Challenges with AI

The Hong Kong bank needed a solution that would help it overcome the specific challenges of global negative news screening (outlined above), while generating more flexible, impactful risk data that could make a meaningful difference to its compliance performance and help it deliver services at the level expected of a Tier 1 institution.

Software integration offers a way to address many efficiency-related screening challenges since automated search algorithms are capable of processing data faster, more accurately, and in greater volumes, than manual screening. However, automation doesn’t completely eliminate multi-language screening challenges, such as the important need to identify similar-sounding names, duplicate stories, or other issues where contextual information may be required to make a decision.

While automated solutions may be able to capture data for specific risk keywords such as “crime”, “fraud”, or “bribery”, that approach may still be too sensitive, and result in an overwhelming amount of false positive alerts. The false positive rate can be critical to compliance: too many alerts, slow the compliance process to a crawl and force AML teams to remediate manually in order to build accurate risk assessments.

Natural Language Processing Software: Development and Deployment

The bank in the case study addressed its false positive challenge by integrating AI-powered NLP screening software as part of its adverse media screening solution. Working closely with the third party provider, the bank was able to refine the NLP screening software throughout its development, tailoring it to its risk environment, while also helping the provider enhance it for deployment in other financial institutions.

Natural language processing platforms are capable of analysing and understanding the data points within large volumes of unstructured data, and connecting those points in order to generate responses to questions or prompts. In the context of multi-language adverse media screening, automated NLP is useful for entity resolution: trained on media stories in different languages, NLP may accurately identify the subjects of name searches based on contextual information such as age, occupation, nationality, and other relevant risk data. Using that data, NLP makes it easier and faster for compliance teams to tackle false positive challenges, including distinguishing between duplicate stories and similar sounding names, interpreting translated content, identifying the use of nicknames, and so on.

After deploying the NLP-powered name screening software, the Hong Kong bank reported that its risk detection had “significantly improved”. The bank noted that the software enhanced its screening solution to the extent that it was identifying previously unknown risks with its customers, and had prompted compliance teams to apply enhanced due diligence (EDD) measures to resolve the emergent risks.

Choosing an NLP Vendor

Both the Hong Kong case study bank and its third party provider pointed out that the metric of success in the deployment of the NLP name screening software should not be limited to a reduction in the false positive alert rate, but should be based on a range of qualitative and quantitative metrics across large samples of data. With that in mind, the effectiveness of NLP integration is heavily dependent on the ability of the software to be customised to an institution’s risk environment: financial institutions should seek screening software that offers the greatest scope for capturing and analysing customer data, and that generates meaningful, actionable financial intelligence.

Labyrinth Screening for Faster, Stronger Decision Making

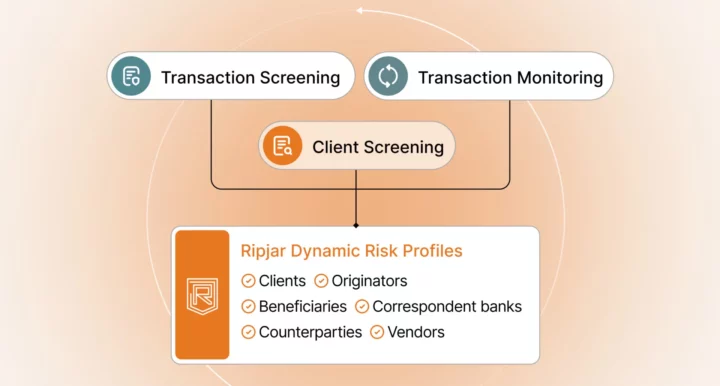

Ripjar’s Labyrinth Screening platform is designed to meet the needs of specific risk environments, offering customisable customer name searches across thousands of global media sources, sanctions lists and watchlists, in real time and in over 25 languages.

Generating financial intelligence in seconds, Labyrinth Screening is further enhanced by powerful entity resolution features which facilitate stronger compliance decision-making. The AI Risk Profiles feature extracts only the most relevant risk data from extensive global name searches, in order to build individual customer risk profiles quickly, complete with entity-specific risk data. AI Summaries is an expansion to AI Risk Profiles that employs generative AI to add a brief, impactful adverse media risk summary to each customer profile in clear, concise prose, and that can reduce the time needed for a customer risk assessment by up to 90%.

Learn more about Ripjar’s NLP-powered adverse media screening technology

Last updated: 6 January 2025