The European Banking Authority (EBA) released new guidelines on sanctions screening in November 2024. Scheduled to come into effect across the EU on 30 December 2025, the guidelines set out the regulator’s expectations for how financial institutions (FIs) should implement governance, policies, procedures, and controls for their sanctions screening solutions.

With less than 6 months left before the new compliance requirements come into effect, it’s critical that obligated entities prepare, by reviewing and uplifting existing screening measures or developing new measures. In this post, we’ll explore that process in more detail.

What are the EBA guidelines?

The EBA’s November 2024 guidelines actually comprise two sets of guidelines, and apply in the following ways.

1) Guidelines for All Financial Institutions (EBA/GL/2024/14)

The first set of guidelines concern all FIs in the EU; banks, credit institutions, investment firms, and so on. The guidelines specifically focus on governance and risk management systems for sanctions compliance, and require FIs to:

- Implement and maintain up-to-date sanctions compliance policies, procedures, and controls.

- Establish a clear, well-defined governance structure and allocate responsibility (including to senior management) for sanctions compliance.

- Conduct a sanctions risk exposure assessment to inform decisions on the controls and procedures necessary to establish effective sanctions compliance controls. The EBA has stated that this assessment should “be based on a sufficiently diverse range of information sources”.

- Implement regular training programmes to ensure compliance teams are able to identify, assess, and manage sanctions compliance risk.

2) Guidelines for PSPs and CASPs (EBA/GL/2024/15)

The second set of guidelines concern payment service providers (PSPs) and crypto-asset service providers (CASPs). They focus on bringing these FIs under the scope of existing sanctions compliance regulations when handling specific types of transactions, including transactions involving crypto-assets. The guidelines require PSPs and CASPs to:

- Choose and implement reliable sanctions screening solutions, and test their reliability regularly.

- Define the dataset that they will be screening against the EU sanctions list and, where relevant, national restrictive measures.

- Ensure that their sanctions screening measures are capable of verifying designated names on sanctions lists, managing the inherent risks involved in the screening process, and addressing the risk that customers engage in sanctions evasion strategies.

Preparing Your Screening Solution for Compliance

With the implementation date now on the horizon, it’s time for FIs to prepare their compliance teams, and adjust their screening solutions.

Here are the key stages in that process.

1. Align policies and procedures

Conduct a gap analysis to determine how your existing sanctions screening framework measures up against the EBA guidelines. Focus on identifying weaknesses in governance, technology, training, and documentation.

2. Update investigative steps

Following any updates to your screening policies and procedures, codify the steps your compliance team will take when investigating sanctions alerts. For example, set thresholds for escalating sanctions name matches, and define responsibilities within the compliance team.

3. Documentation of compliance process

Ensure your compliance process is fully documented, with an option to log the reasons for compliance decisions in a centralised and secure location. Your compliance documentation may be critical to subsequent investigations by law enforcement agencies, and so your decisions, and the information on which they were based, must be explainable and readily available for audit.

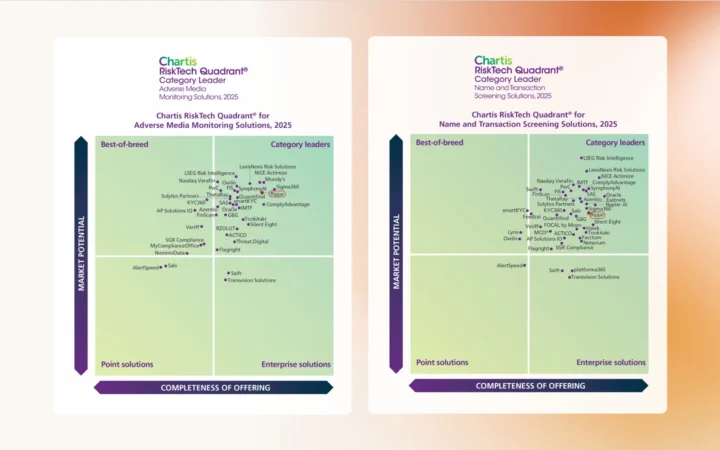

4. Invest in technology

For most FIs, manual screening methods will not be capable of meeting the EBA’s screening requirements. In order to achieve compliance, FIs should invest in screening technology capable of searching thousands of global sanctions lists and watchlists, along with other critical risk data sources such as adverse media stories, beneficial ownership lists, and politically exposed persons (PEP) lists.

Given the scope of the new screening obligations, many firms will find value in AI-powered screening tools capable of advanced analysis of huge volumes of unstructured data, and of making connections between risk data points that human compliance teams and manual tools might miss.

5. Train people and test processes

Your screening technology is only as good as the human compliance experts managing it. Develop a training schedule to familiarise compliance team members with new screening policies and procedures, and new screening technology integrations. Similarly, perform regular testing to identify weak spots in the new compliance process.

6. Risk-based review

Implement different levels of review for higher-risk sanctions alerts, such as those involving high-risk jurisdictions. While a sanctions list check may be sufficient for routine transactions, higher risk alerts may warrant enhanced due diligence, including supply chain risk screening and global adverse media searches.

Stay Ahead of Sanctions Risk with Ripjar One

With the EBA’s new sanctions screening guidelines imminent, it’s up to you to make sure your team is ready, by putting the right people, the right policies, and the right tools in place.

Powered by next-generation AI, Ripjar One is designed to help FIs manage that challenge, and take on an increasingly complex sanctions landscape.

Consolidating static and dynamic risk data seamlessly, including sanctions lists, adverse media, beneficial ownership registers, and transaction alerts, Ripjar One is a comprehensive screening solution that empowers compliance teams to make faster, stronger compliance decisions, identify risks more effectively, and optimise compliance outcomes for both their businesses and their customers.

Learn more about our global sanctions screening technology.