In Ripjar’s recent “Secrets to Effective Adverse Media Screening” AI masterclass, our speakers discussed what financial institutions need to consider when designing and deploying an effective adverse media solution. With over 90% of attendees conducting it, either manually or automated, it is clear that adverse media screening is a key pillar of customer due diligence.

Although simple in theory, implementation can lead to large numbers of irrelevant hits. With 41% of attendees stating that adverse media false positives are one of their greatest challenges, firms need to be smarter about how they deploy their resources to target risks.

Tech-led tools and automated solutions can help reduce manual efforts and meet regulatory requirements. When implemented correctly, adverse media screening brings many benefits:

- Meeting regulatory requirements to identify high-risk clients and counterparties

- Identifying potential reputational risk issues

- Acting as an early warning system for potential risk exposure

Considerations for implementation

Using traditional, unstructured adverse media databases and search engines means reading, digesting and interpreting information in a manner which is time-consuming, costly, and may lead to making decisions without the best available information. With over one third of masterclass attendees currently conducting adverse media screening manually, the move to an automated solution is often not a simple matter of ‘plug-and-play’. Considerations include:

The risk-based approach

The risk-based approach recognises that the risk profile of firms’ offerings and customers varies widely, and risk mitigation measures need to be proportionate. Industry guidance from the Wolfsberg Group highlights the need for a proportionate screening approach directly linked to a firm’s size, geographical presence, customer type and products offered. For example, what is right for a domestic financial institution versus a large global firm may not be the same. Firms should use their risk appetite and expectations from senior management and regulators to map their approach to how they screen customers. For example, do they want to know everything about all clients or only financial crime-focused information for those who are high-risk?

Is there a “one size fits all” approach?

With over 16% of attendees stating that managing regulatory change over multiple jurisdictions was a challenge, the integration of adverse media screening could be less complex if you have a single global process. Where possible, the solution, approach and process should be global-led with adjustments for various jurisdictions. For example, if one jurisdiction requires only high-risk clients to be screened, and another requires screening for all clients, the tool and process can be the same but the ‘who’ and ‘what’ you screen can be different.

The who, what and when

Given the vast extent of unstructured data available, defining the sources you use for the clients you wish to screen is crucial. These can be categorised into buckets:

- Collated structured data e.g. Dow Jones sanctions and PEP lists

- Collated unstructured data e.g. Factiva media database

- Uncollated unstructured data – much of the rest of the web

You can target the sources used for screening by leveraging other data points you have. For example, if you have a UK client that only trades domestically you may only screen them against UK sources, however, if you have an international client trading globally you may want to screen them globally to get a full picture of potential risks.

Other considerations include:

- When should screening be conducted (e.g. daily, weekly or trigger-based)?

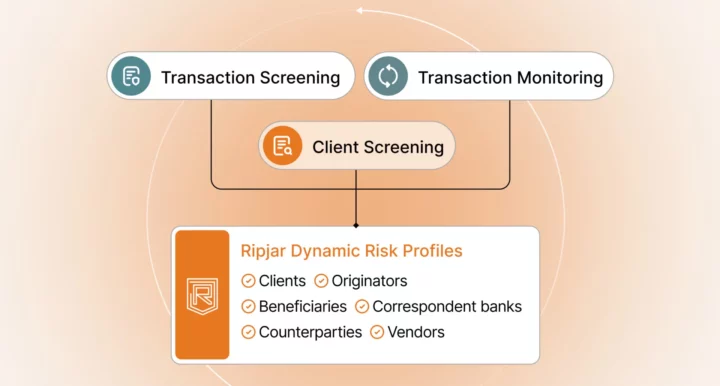

- Who is screened (e.g. all customers or only certain groups? Customers only, or also UBOs, counterparties, suppliers etc.?)

- How is screening conducted (e.g. periodic, batch, or ongoing)?

- Which findings are relevant (e.g. certain types of predicate offences or reputational issues may be irrelevant)?

- Which media sources are credible (e.g. newspaper articles, online forums, blogs, social media)?

Looking for the right solution

Before procuring a solution, understand your organisation’s screening processes thoroughly. Assess if processes are heterogeneous or uniform to help assist implementation. Define your requirements and map them against the solutions and expertise that a vendor can bring, to address any gaps in your framework. Vendors will not understand your internal process flows so it is important you know how the tool will integrate with existing tools and processes, and can determine if you have the right internal skills to support implementation.

The people are important

Nearly 20% of masterclass attendees noted that finding the right resources and skills to deal with the outputs of adverse media screening was a key challenge for them. When managing alerts, people need to be good at both identifying the key risks within an alert and understanding the materiality of these risks in the context of the relationship that you have with that client. Rather than a specific background or role experience, prioritise hiring people with good analytical, critical thinking and communication skills.

The devil is in the detail

When firms look at the tools employed to assist with screening, they must have well-defined and structured parameters; otherwise, they risk returning too many irrelevant findings or missing vital information.

Think about the matching criteria

There are many different properties that can be used to generate an adverse media screening match. Adding new variants increases the opportunity for effectiveness, but it can also reduce efficiency. The broader your parameters, the more likely the system will find a relevant risk, but with a greater chance of being inundated with a lot of false positives.

Having the capability to consider various factors such as culture, script and origin, and ensuring the accuracy of matches is crucial. Depending on data quality, flexibility becomes essential; data might contain errors due to operator mistakes or intentional name alterations by the client. Having access to diverse matching variations is vital in such cases. Comprehensive matching requires the availability of multiple options to accommodate varying data qualities and scenarios. By considering additional identifiers such as entity type, gender, age or date of birth, nationality, and location can further streamline results.

The positives of false positives

False positives can be useful – if you understand what is driving false positives you can use this to provide feedback and correlate the outputs to the risks you want to see. You should also look at false negatives to identify if you are missing information that is relevant and could directly impact your risk. Reviewing these to understand why certain information is being picked up and some isn’t is key in balancing efficiencies vs risk mitigation.

Driving efficiencies

Getting the balance right in optimising outputs is often an iterative process but there are some steps firms can take to make a more immediate impact.

Decrease the fuzziness

The obvious answer is decreased fuzzy matching levels but, with many screening systems, this can have an impact on effectiveness. You need to decide what level of recall you expect and the relevance of matches you expect to see, and balance this accordingly. Test different matching levels and see which returns an optimal number of results without missing true hits.

Reduce the volume of data

Conduct targeted screening by defining the client segment you wish to screen against the types of risks you are interested in. This customisable approach enables tailored risk management by segment and risk interest. You can also reduce the volume of alerts by deduping clients at name level, creating ‘whitelists’ or being smarter about how you deal with larger global names who may trigger more alerts than other clients.

Improve the data

Continuously enhancing your adverse media screening quality involves refining attributes. This includes addressing name rarity, eliminating aliases, and mapping relationships mentioned in articles, such as familial ties, to ensure comprehensive profile accuracy. These measures are a value-adding way to refine and optimise screening results.

The power of AI

The conflict of doing too much with artificial intelligence (AI) and machine learning (ML) versus not doing enough is the dichotomy for many financial crime professionals today. With only 10% of masterclass attendees currently using it for adverse media screening, it is clear that there is much more scope for its use.

Alongside more traditional ML and AI, new generative AI models are able to solve broad sets of problems, creating more opportunities for its use, such as Ripjar’s Compliance Copilot. There is a huge potential in having these types of AI and ML support analysts in reviewing cases and becoming more efficient by finding more relevant information without being bogged down in unrelated information.

When deciding which is the right approach, you may conclude it is not just one type of ML or AI that you want to use; it might be a blend of different approaches to tackle the right tasks in the right way. Once you implement your chosen solution(s) you need to ensure you build the right model governance to ensure that bias does not creep in, and to showcase to the regulator and your internal stakeholders how it works and how it is performing. You will also need to consider how to keep it relevant and determine what your long-term plan is to retrain and update it as applicable.

Conclusion

Whatever solution you implement for adverse media screening, it is important that it drives the right outcomes for the risks you are trying to identify and manage. Understanding the scope of who and what you screen, optimising the technology that you use to reduce false positives, and having the right skills to manage the outputs are key considerations when deploying adverse media screening.

Watch the full AI Masterclass recording now

Last updated: 6 January 2025