Supply chains are integral to modern business, enabling the flow of goods and services across borders and ensuring that firms and markets around the world continue to function smoothly. However, while supply chains deliver the resources and connections that organisations require, they also expose them to an increased degree of third party criminal risk.

While a firm may be confident that it understands the immediate compliance risks that it faces – from its customers and its industry sector – it may be much less familiar with the risks that suppliers and other third parties along the supply chain face. Many anti-money laundering (AML) and counter-financing of terrorism (CFT) regulations require firms to take steps to ensure that third parties involved in their supply chains are not involved in criminal actvitiy – or face both criminal and reputational penalties.

To detect and address the AML/CFT risks associated with third parties, check out these 6 key considerations for enhancing your supply chain compliance performance.

1. Map Supply Chain Risk Exposure

To manage supply chain risk, firms must understand not only who their suppliers are, but who those suppliers are working with. In practice, this means achieving a greater level of visibility into the component nodes of your supply chain, including the transport routes, manufacturing plants, storage facilities, and managerial personnel that it involves. Firms should assess each of those components in detail in order to determine the AML/CFT risk that they present, and then track them on an ongoing basis to capture changes in that risk profile.

Relevant supply chain risk factors include:

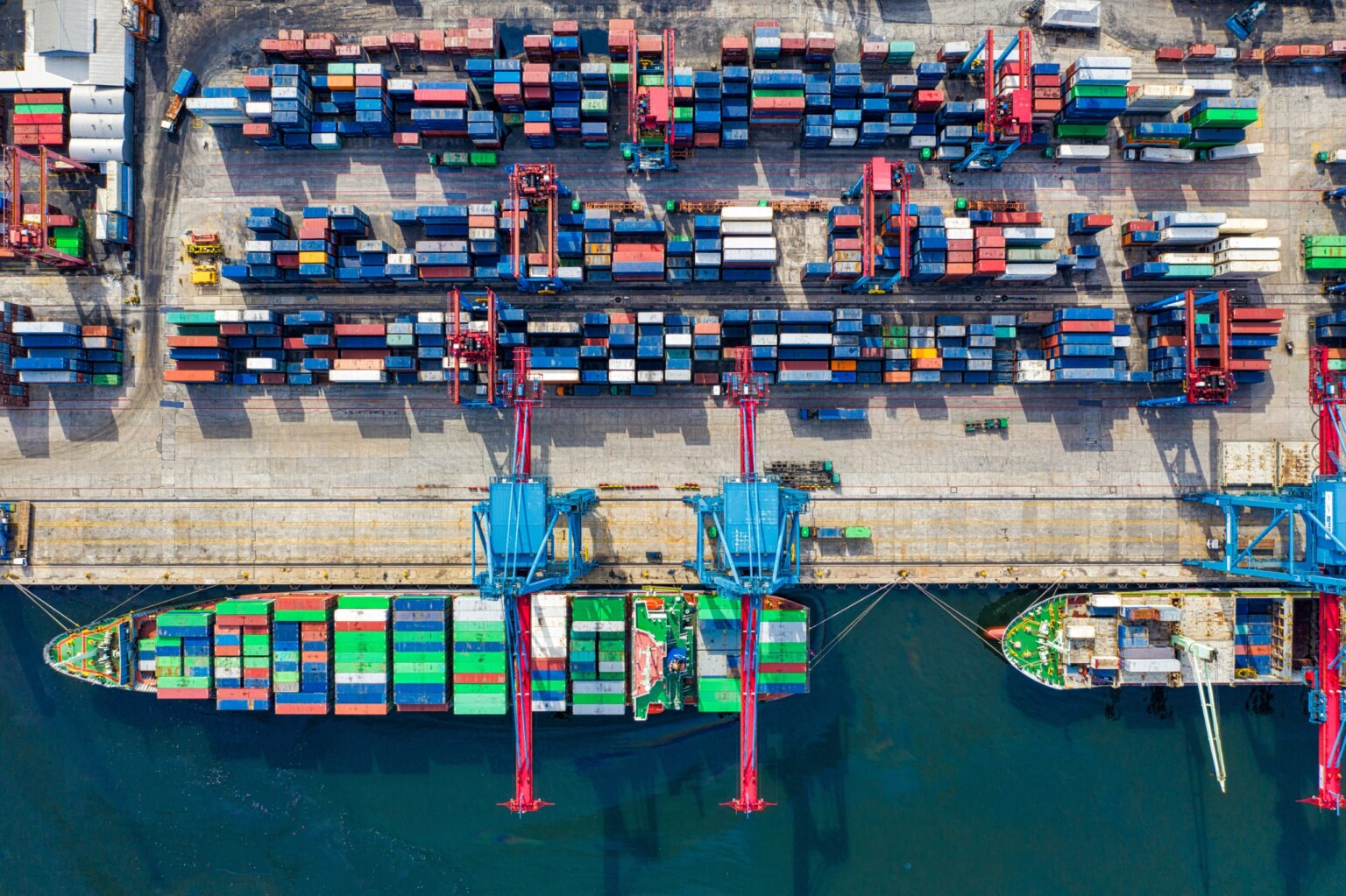

Operational risk: The industry in which a third-party operates will affect the level of AML/CFT risk that it presents. Examples of high risk industries include payment services, art, shipping and logistics, each of which may offer criminals opportunities to commit crimes such as money laundering.

Geographical risk: Supply chains that cross borders may come into contact with high risk AML/CFT jurisdictions.

Sanctions risk: Cross-border supply chains carry an increased risk of international sanctions compliance concerns. Firms should screen persons involved in their supply chain against relevant sanctions lists on an ongoing basis.

Corruption risk: Foreign supply chains are often vulnerable to corruption, stemming from transactions involving politically exposed persons (PEP). With that in mind, firms should be aware of the political risks that their supply chain entails, and whether changes to the political landscape have affected that liability.

2. Understand Criminal Methodologies

Supply chains are vulnerable to a variety of criminal risks, with criminals having developed sophisticated methods to evade AML/CFT controls and exploit regulatory blindspots. When implementing an effective risk management solution, it’s important that you understand the methodologies that criminals use to target supply chains. These include:

- Misrepresenting goods on official documentation or letters of credit

- Misrepresenting the value or quality of goods being transported

- Transporting illegal goods

- Unauthorised unloading of goods

3. Build a Risk Management Solution

Firms that have a perspective of their supply chain risk liabilities should develop and implement a risk management framework in order to respond to potential AML/CFT alerts. The framework should align with a firm’s risk appetite, allow it to gauge the impact of the potential risks, predict the likelihood of those risks becoming a reality, and set out the compliance measures that will be used to deal with them.

Third party business relationships change constantly as a result of economic conditions, new technologies, or political upheaval, which means that your supply chain’s risk exposure also changes. In order to stay on top of emergent risks, you’ll need to implement a persistent monitoring solution for every relevant aspect of your supply chain so that you can detect changes when they happen and make adjustments to your risk management solution in a timely manner.

4. Conduct Supply Chain Due Diligence

Like all risk-based AML/CFT procedures, supply chain due diligence should be an important part of your risk management solution. In addition to understanding who is involved in your chain from end-to-end, you’ll need to verify that information to properly assess your compliance risk exposure. In practice, effective supply chain due diligence means gathering the following information on third parties:

- Identifying information such as supplier names, addresses, company incorporation documents, and beneficial ownership details.

- Financial information such as cashflow, expense details, growth projections, and debts and liabilities.

- Historical financial performance.

- Regulatory environment and AML/CFT compliance performance.

5. Recognise Red Flags

Once your supply chain risk management solution has been implemented, it’s important that your compliance employees understand how to spot the relevant indicators of AML/CFT threats. Key red flag characteristics of supply chain risk include:

Corporate structures: Suppliers that have needlessly complex corporate structures present a higher risk of money laundering. Red flags include the use of shell companies or incorporation in a high risk country.

Online activity: Suppliers that do not have a website, or that have an unusual online presence that does not match their business operations.

Trading behaviour: Suppliers that trade in goods that do not match their business profile or that engage in needlessly complex trade deals.

Trade routes: Suppliers that organise their shipments in needlessly complex routes between their ports of origin and destination.

Documentation: Suppliers that submit insufficient documentation for their shipments or that submit documents with inconsistencies or deficiencies.

Transactional activity: Suppliers that make frequent or last-minute changes to their financial arrangements, or that engage in unusually high or low volumes of transactions.

6. Screen for Adverse Media

Given the global nature of supply chain relationships, firms should seek to stay informed about AML/CFT risks by screening for adverse media involving third party business relationships. Adverse media is such a good indicator of AML/CFT risk because its information flows are not restricted by borders, jurisdictions, or government protocol, and stories may be broken before their confirmation by official sources.

Adverse media screening solutions should be set up to capture information about suppliers from foreign language news sources and should integrate multi-language name matching tools to account for variations in name spelling or the use of non-Latinate characters. With that in mind, it is often useful for firms to integrate smart AML software tools that enhance their adverse media solution with automated speed and accuracy, and the capability to monitor breaking stories in real time.

To find out how we can help your business implement an effective supply chain risk management solution, get in touch today.

Last updated: 16 August 2024