Human trafficking is a humanitarian crime and a significant money laundering predicate offence. In 2020, the International Labor Organization (ILO) estimated that human trafficking crimes had generated around $150 billion in profits, with 25 million victims. In response to the serious emotional and physical damage that human trafficking inflicts on individuals and communities, governments worldwide are introducing measures to detect and prevent it, along with financial regulations to identify, freeze, and confiscate the illegal profits that it generates.

Financial institutions have an important role to play in the fight against human trafficking. By targeting the illegal money that it generates, governments are hoping to engage financial institutions in the global fight against people traffickers, identifying individual perpetrators and reducing the opportunities for criminal organisations to exploit vulnerable people for profit. With that in mind, it is crucial that financial institutions understand their human trafficking regulatory responsibilities, and how to implement suitable anti-money laundering (AML) and counter financing of terrorism (CFT) measures.

What is human trafficking?

Human trafficking, sometimes referred to as migrant smuggling, is broadly defined as the criminal movement of people for exploitation. Victims of illegal trafficking include men, women, and children, who may be recruited or coerced to leave their homes and then forced into work or prostitution upon reaching their destination. Interpol defines the following categories of human trafficking:

Forced Labour

Victims are often coerced into extremely low paying jobs with poor health and safety conditions – or even into modern slavery. Forced labour jobs are often held in the agricultural, mining, fishing, and construction industries.

Forced Criminal Activity

Many migrant smuggling victims are forced to carry out crimes on behalf of third parties, including the selling of counterfeit items, begging, and drug cultivation.

Sexual Exploitation

Many victims are exploited sexually. This form of people trafficking tends to involve female and child victims who are forced into prostitution.

Organ Harvesting

Criminals may exploit the desperation of patients and donors to smuggle migrants across borders for the purposes of organ donation, with medical procedures often taking place in unsuitable and dangerous conditions.

How are human trafficking and money laundering linked?

Human trafficking is considered one of the most profitable criminal enterprises in the world, with the potential to generate significant ongoing profits for its perpetrators. As victims are forced into work, the money that they generate must be disguised before it can be introduced into the legitimate financial system. With those factors in mind, human trafficking qualifies as a money laundering predicate offence – which means that it is a criminal offence which necessitates money laundering as a subsequent, connected criminal offence.

Accordingly, most governments implement AML screening requirements in domestic legislation to deal with human trafficking as a predicate offence. For example, in the European Union, the Sixth Anti-Money Laundering Directive (6AMLD) includes it as part of its harmonised list of money laundering predicate offences. Under 6AMLD, all EU member states must treat human trafficking as a money laundering predicate offence and mandate suitable AML compliance regulations against it.

In order to comply with 6AMLD, and other global anti-money laundering regulations, financial institutions must understand how criminals attempt to launder migrant smuggling profits. With that in mind, the following types of financial activity are useful indicators that a customer may be involved in human trafficking:

- Front companies: Criminals may establish a business to disguise money derived from migrant smuggling. Common ‘front company’ examples include restaurants, bars, salons, and massage parlours.

- Funnelling: Accounts associated with human trafficking may receive payments from multiple sources in amounts just under reporting thresholds. Those funds are then immediately removed or sent to another account.

- Alternative payments: Many human trafficking payments are made via alternative payment systems including prepaid credit cards, cryptocurrencies, and mobile deposits. Alternative payment methods often serve to conceal the identity of parties involved in transactions.

- Financial behaviour: Unusual or unexpected financial behaviour may be indicative of customers attempting to launder human trafficking profits. Examples include unusual frequencies of transactions, transactions in unusually high amounts, or transactions involving high risk AML jurisdictions.

- Shared accounts: Victims of migrant smuggling may be forced to share bank accounts, or share email addresses and phone numbers.

- Transaction times: Many transactions associated with human trafficking tend to take place between 10pm and 6am.

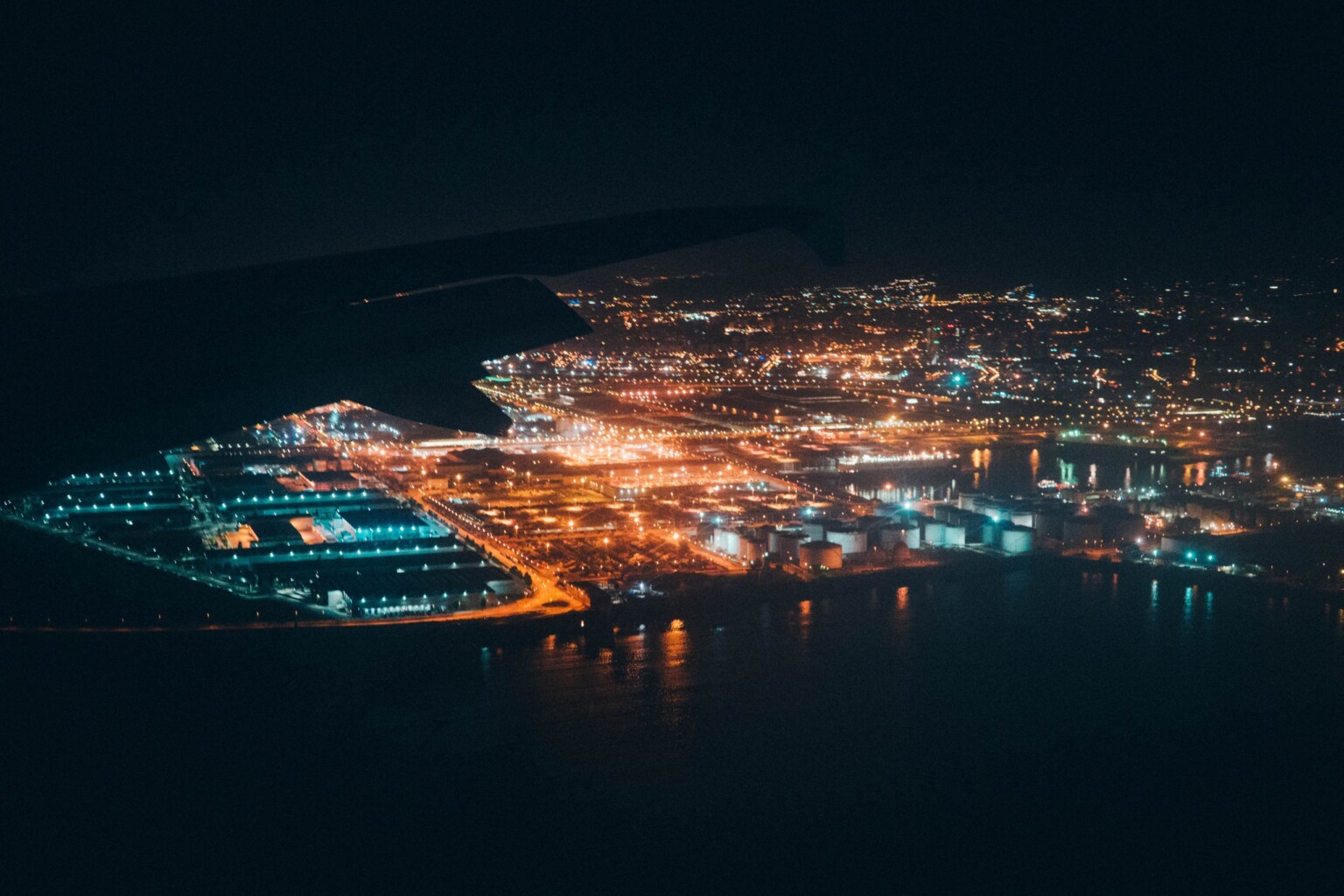

- Transaction locations: Transactions that take place in areas located a long distance from the residences of account holders or in busy public transport hubs.

- Accommodation payments: Human traffickers may pay for hotels, apartments, and other lodgings near known migrant smuggling routes such as ports or large urban areas.

- Money remittance payments: Unusually high use of money remittance services or online payment services to a country of prior residence with no logical explanation.

Human trafficking AML screening

In order to detect attempts to launder the profits of human trafficking, financial institutions must screen their customers at onboarding and throughout the business relationship. Following Financial Action Task Force (FATF) guidance, firms may take a risk-based approach to screening, deploying more intensive screening measures for customers that pose a greater AML risk.

Accordingly, an effective human trafficking AML screening solution should include the following measures:

Adverse Media

Many criminal activities are uncovered by journalists and revealed in news media before official confirmation by authorities. Companies should seek to screen their customers for involvement in adverse media stories that involve human trafficking. Adverse media solutions should cover a range of global media sources and be able to match names across different languages and naming systems.

Watchlists

As a result of their criminal activities, human traffickers often appear on global sanctions lists and watchlists. With that in mind, companies should implement a robust sanctions and watchlist screening process to match customers on sanctions lists and watchlists as soon as they are designated.

Transaction Screening

Many indicators of human trafficking are associated with transactional activity. Accordingly, companies should screen transactions for those indicators, verifying customer identities, matching names to watchlists, and identifying relevant risks in order to capture potential compliance issues.

Human trafficking AML best practices

Stopping criminals laundering the proceeds of human trafficking requires the collection and analysis of a huge amount of data. In practice, financial institutions must integrate an effective software solution to meet their regulatory responsibilities, capable of screening customers quickly and efficiently, and managing the challenges of cross-border compliance, including name-matching across different language systems.

With that in mind, screening solutions for AML should prioritise the following factors:

Sharing of Information

Financial institutions should share information pertinent to human trafficking risk. Some jurisdictions, such as the UK, mandate information sharing as part of their domestic AML/CFT legislation. The FATF has released a guide to private sector information sharing, setting out recommendations for how financial institutions might share customer information, and what information is pertinent to share for AML/CFT purposes.

Information sharing not only helps financial institutions to combat global human trafficking but increases the collective accuracy of screening measures.

Customer Identities

Effective customer screening should be built into the Know Your Customer (KYC) process. Financial institutions must establish and verify the identities of their customers in order to understand their financial activity and match their names accurately to watchlists or adverse media. In contexts where customers engage with financial services online, financial institutions should use digital identifiers such as dual factor authentication.

Depth of Information

People trafficking can be difficult to spot because of its similarity to normal, legal financial activities. To discern human trafficking activity with sufficient accuracy, financial institutions should seek to add depth to their data collection processes with automation. In addition to speed, efficiency, and accuracy, automated data collection and analysis enables firms to enrich their KYC data with peripheral identifying information and move faster to address compliance alerts as they emerge.

Get in touch to learn more about how Ripjar can help you with AML screening

Last updated: 16 August 2024