In July 2022, the Hong Kong Monetary Authority (HKMA), Hong Kong’s primary financial regulator, published its second Hong Kong Money Laundering and Terrorism Financing Report (ML/TF report).

The HKMA compiles the report following the recommendation of the Financial Action Task Force (FATF) that jurisdictions identify the financial crime risks that they face and deploy suitable risk mitigation measures. Hong Kong is home to some of the world’s largest banks and financial institutions and holds total assets worth around HK$26.4 trillion. Since the city has developed its status as international finance, trade, and transportation hub, the ML/TF report is an important feature of Hong Kong’s anti-money laundering (AML) and counter-financing of terrorism (CFT) framework. The HKMA points out that, while the city’s “longstanding strengths” bring advantages, they also attract criminals that seek to abuse and exploit the financial system.

The first version of the ML/TF report was released in 2018 while the second version was completed in 2021: the 2021 report reflects the ways in which the financial landscape has “continued to evolve” in relation to new threats and influences and, in particular, to new technologies. In his introduction to the 2021 report, Hong Kong’s financial secretary, Paul MP Chan, outlined the new risks facing the city’s banks and financial service providers, including those posed by virtual assets – along with the “robust and effective” responses the regulator has implemented in order to deal with them.

Hong Kong Money Laundering Predicate Offences

The ML/TF report examined the criminal detail behind Hong Kong’s money laundering activity from 2016 to 2020. As part of that examination, the report broke down the Hong Kong authorities’ money laundering investigations by the type of predicate offence involved – that is, the illegal activity that generated the funds that criminals needed to launder.

According to the report, between 2016 and 2020, 9197 money laundering investigations were initiated in Hong Kong for the following predicate offences:

- 72.6% for fraud related crimes

- 19.2% for no identified predicate offences

- 1.4% for drug related crimes

- 1.2% for corruption

- 1.2% for tax crimes

- 0.93% for robbery, burglary, theft, and blackmail

- 0.8% for goods smuggling (eg, illegal wildlife trading)

- 0.4% for seriously gambling offences

- 0.3% for loansharking

- 0.2% for vice

- 0.04% for human smuggling and trafficking

- 1.3% for crimes not listed above

When compared to 2018, the 2021 report suggests that Hong Kong’s money laundering threat landscape has not changed significantly in terms of methodology. While there was an increase in the number of money laundering investigations, that change is likely a result of the increased amount of online transactions caused by Covid-19 restrictions and the influx of new financial services provided by virtual banks.

While the typologies of predicate offence remained broadly unchanged, the HKMA noted that criminals were increasingly “taking advantage of the online platform” in order to commit fraud – a trend partly motivated by pandemic-related factors and the emergence of new technologies such as virtual assets. The HKMA noticed other changes in criminal behaviour emerging from the pandemic, including the increase in drugs transported into Hong Kong via air and sea – as a result of land-based travel restrictions.

Banking Challenges

The 2021 report focuses on the specific money laundering threats against Hong Kong’s banking system, emphasising the sector’s increasing reliance on digital payment channels and remote customer onboarding as risk factors. With that in mind, major money laundering threats to Hong Kong’s banking sector in 2021 included

- Online fraud (and fraud related to Covid)

- Corruption and tax crimes

- Remote onboarding (virtual banks and conventional using online)

- Mule accounts

- Payment systems new payment methods

Virtual Assets

The report notes that the rapid increase in the use of virtual assets (VA), such as cryptocurrencies, poses ‘significant ML/TF risks to the international financial system’ – and to Hong Kong, which is described as having ‘significant VA activities’. The threat posed by VA is predominantly a result of their anonymity and decentralisation of cryptocurrency transactions, and lack of safeguarding compared to fiat currencies. Data suggests that the number of financial crimes involving VA has increased in Hong Kong, with 739 cases reported in the first 8 months of 2021, compared to 494 in the entirety of 2020.

The report found that the money laundering risks associated with VA in Hong Kong primarily affect trading platforms or cryptocurrency exchanges, which allow international money launderers to access services anonymously or use mules to conduct transactions on their behalf. Similarly, criminals are able to conceal the source of the funds they use on exchanges by using anonymous wallets – further complicating subsequent efforts by law enforcement during ML investigations.

The report also cited crypto ATMS, ICOs, and peer-to-peer trading platforms as potential ML vulnerabilities but noted that the risk they posed in Hong Kong was limited.

Addressing Hong Kong’s Money Laundering Challenges

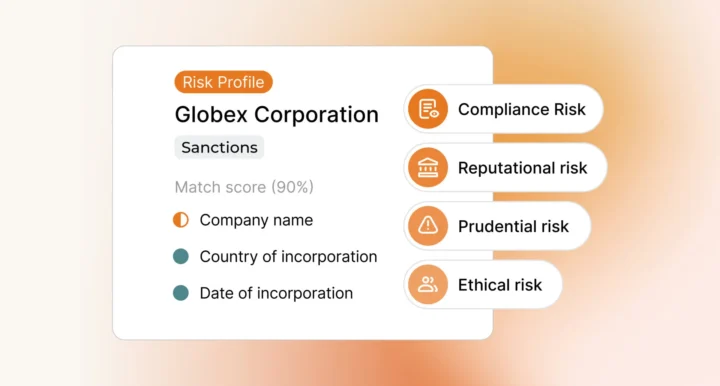

In response to the ML/TF threats set out in the report, the HKMA emphasised the need for banks to take a risk-based approach to AML/CFT. The risk-based approach requires banks and financial institutions to assess their customers individually to determine the level of risk they present, and then deploy an appropriate AML/CFT response.

With that process in mind, the HKMA has issued numerous guides and advisories to financial institutions in the city and made AML/CFT resources available, such as the Anti-Money Laundering and Counter-Financing of Terrorism Guideline, which was updatesd in 2018. In response to the increasing complexity of the financial landscape, the HKMA has focused heavily on virtual banks and other fintech service providers – including taking steps to ensure that these entities establish ‘robust ML/TF risk management controls and comprehensive independent assessments of their AML/CFT systems’.

Hong Kong’s Securities & Futures Commission introduced a licensing regime in 2019 to manage the growth of the city’s VA trading platforms. The licensing criteria includes requirements to implement a range of ML/TF compliance controls, including know your customer (KYC), cybersecurity, and risk management measures. Similarly, Hong Kong’s government has introduced a proposal for a licensing regime for all virtual asset service providers (VASP): the regime will include a ‘fit and proper test’ that will require VASPs to appoint AML/CFT officers responsible for ensuring regulatory compliance.

Implement Next Generation Risk Management

Achieving compliance with Hong Kong’s AML/CFT regulations requires banks, financial institutions, and VASPs to collect and analyse vast amounts of customer and transaction data in an increasingly complex and challenging regulatory landscape. Ripjar’s next generation Labyrinth risk management solution has been developed with that capability in mind, integrating cutting edge compliance technology and real time data screening to ensure your business stays ahead of criminal trends, and is able to adapt to incoming regulations.

To learn more about AML/CFT risk management in Hong Kong and around the world, get in touch with Ripjar today.

Last updated: 16 August 2024