Our industry-leading AI Risk Profiles now offer the option of new AI Summaries, providing a short, clear overview of the relevant adverse media risks associated with a profile.

What are AI Summaries?

AI Summaries are now available within our industry-leading AI Risk Profiles. While the profiles provide you with a holistic view of a customer’s risk across sanctions lists, watchlists, adverse media and PEPs, new AI Summaries make the adverse media risks quicker and easier to understand. Taking the most relevant media articles highlighted in the AI Risk Profiles, AI Summaries provide you with a short, clear summary of the risks, capturing everything you need to know in order to make a decision.

How do AI Summaries Help Analysts?

AI Summaries have been designed to help compliance teams in a number of ways:

Review Adverse Media Risk Quickly and With Confidence

To fully understand risk, analysts need to review potential matches against vast quantities of data. This is particularly challenging when it comes to adverse media – also known as negative news – where identification of risk is further complicated by varying data availability and reporting standards between different languages and jurisdictions.

AI Risk Profiles already tackle this challenge by analysing millions of adverse media articles to identify those which contain the most useful, relevant risk information. New AI Summaries then use generative AI to produce concise, easy-to-read summaries of the risk highlighted in these key articles, written in a clear, chronological format. This enables analysts to gain a fast, accurate picture of the risk and to make decisions quickly and with confidence.

When used together, AI Risk Profiles and AI Summaries reduce the average time to assess new and existing customers by over 90%. By reading a profile summary, analysts save up to eight minutes compared to reviewing significant media extracts, and even more time compared to reading the articles in full.

Ensure Nothing is Missed

One of the greatest challenges with adverse media screening is ensuring you don’t miss vital risk indicators in the vast amount of adverse media data available – the larger the quantity of data, the more likely key evidence will be missed. Pinpointing relevant risks can be like finding a needle in a haystack. AI Risk Profiles have already been doing this incredibly well, improving screening accuracy and recall while reducing false positives.

New AI Summaries build on this existing industry-leading technology and help surface relevant risk even faster, by distilling the facts down into a well-written narrative summary for analysts to review. This not only increases analyst efficiency but also improves effectiveness by reducing the risk of you missing a small but vital piece of information when reviewing multiple articles.

Explainable AI Technology for Regulatory Compliance

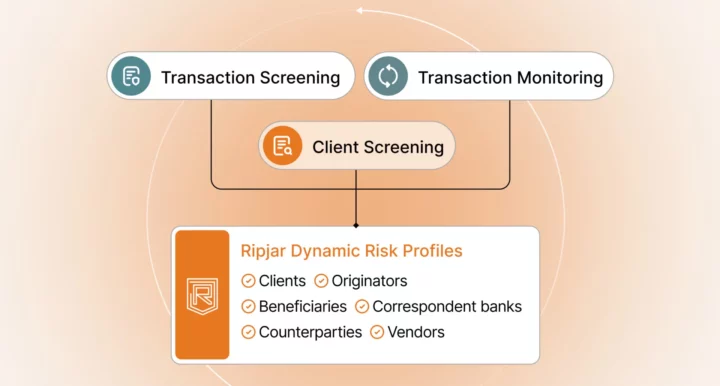

AI Risk Profiles and AI Summaries work together to redefine compliance and customer screening best practices. AI Risk Profiles are built on established AI technology, which we have developed to meet complex screening requirements. AI Summaries then enhance this by harnessing newer generative AI technology to achieve the most effective summarisation.

It is the combination of these two different AI technologies that achieves the best screening results and helps you comply with adverse media screening regulations as efficiently and effectively as possible.

The newer AI technology used to generate the summaries has been specifically developed to help you comply with adverse media screening requirements, and our large language model has been rigorously tested to ensure accurate output. Sitting within our AI Risk Profiles, AI Summaries provide you with a trusted, fully explainable solution using the latest generative AI technology bound by clear constraints to ensure maximum reliability.

Unlike general purpose generative AI and large language models, our AI Summaries technology has been specifically designed for this purpose, and provides full traceability, with links back to all sources used in each summary. In addition, it has been thoroughly tested and validated to ensure risk is not missed or misrepresented in the output.

What’s Next?

AI Summaries forms part of Ripjar’s wider RiskGPT offering which will be launched over the next few months. With several exciting new features in development, we’re continuing to work on combining the latest generative AI technology with proven machine learning techniques to revolutionise customer screening and drive further improvements in efficiency and effectiveness.

Set to launch in early 2024, our next addition will utilise large language model technology to better support analysts in reviewing and dispositioning financial crime alerts, with further innovations set to launch soon after.

Discover more about Ripjar’s AI Risk Profiles, now featuring AI Summaries

Last updated: 6 January 2025