After financial disasters like Enron in 2001, and Worldcom in 2002, and more recent scandals such as the collapse of Wirecard in Germany in 2018, public focus on the behaviour of corporations has increased significantly. That focus has translated into governmental pressure, and the introduction of environmental, social, and governance (ESG) regulations to prevent these kinds of incidents from reoccuring.

In 2024, global ESG momentum is increasing, forcing firms to adjust their compliance posture to accommodate a changing risk landscape. In this article we’re going to explore what ESG means, why it’s an essential compliance concern, and how effective screening can mitigate ESG risk. We’ll also explore the latest key ESG regulatory developments from around the globe.

What is ESG?

The financial scandals of the 21st century shook public confidence in financial systems. To prevent that kind of corporate misconduct, governments began to introduce regulations that set higher ethical standards for businesses, and placed new legal responsibilities on executive-level employees. The US’ Sarbanes-Oxley Act (2002), also known as the ‘SOX Act’, is an early example of this kind of ethics-focused legislation.

In the two decades since SOX, the scope of ESG regulations has expanded to take in not just financial activities but a spectrum of labour, health, climate, sustainability, and community concerns. With those issues in mind, ESG may be defined as:

- Environmental: Environmental factors such as carbon emissions, sustainable business practices, waste disposal, and impact on wildlife and plantlife.

- Social: Treatment of its employees, customers, and the communities in which a company operates. Social factors may include workplace diversity and inclusion, health and safety performance, and charitable initiatives.

- Governance: The way that a company makes decisions about itself, including avoiding conflicts of interest, acting in the interests of shareholders, and upholding both the letter and spirit of jurisdictional laws.

There’s a lot of overlap between ESG factors. For example, although carbon emissions are typically characterised as an environmental issue, they may also be understood as a social concern because excessive air pollution can cause respiratory illnesses in employees.

Why is ESG Important?

Climate change, social equality, and fair labour practices have never been more prominent in public discourse, and the rise of ESG reflects the global community’s desire to see corporations play their part addressing these challenges.

To that end, government regulatory activities have focused on executive level compliance controls and responsibilities, and on new reporting requirements that force firms to publicly disclose their progress towards the relevant ESG objectives. Under these regimes, firms not only face financial and legal penalties for noncompliance but have their ESG performance made visible and comparable to competitors, increasing the likelihood of reputational consequences.

ESG and Supply Chain Screening

Many ESG regulations require firms to consider not only their own ESG compliance risk but the risk presented by their supply chain and third-parties. Consider the following examples of supply chain risk:

- Firms in the oil and gas industry face elevated sanctions risks because of supply chains that transit high risk countries.

- Firms that source their products, such as clothing, from unscrupulous global manufacturers risk being connected to forced labour practices.

- Financial services firms with international customers may be doing business with politically exposed persons (PEPs) who are involved in crimes such as corruption and bribery.

Since firms may be penalised if they do business with persons that violate ESG regulations, they must factor supply chain risk into their compliance solutions. This typically means integrating some form of supply chain screening capability.

ESG Compliance Regulations Around the World

The global ESG landscape is evolving. Noteable regulatory developments from around the world include:

The European Union

Corporate Sustainability Reporting Directive (CSRD): Taking a broad ESG focus, the CSRD imposes reporting rules on obligated firms across the EU. The CSRD requires firms to conduct a double materiality assessment of ESG risk, considering the impact on both internal operations and on external stakeholders such as customers or nearby communities. The CSRD is now in effect and will expand in scope in the coming years.

Corporate Sustainability Due Diligence Directive (CSDDD): Passed by the EU Parliament in 2022, the CSDDD (or CS3D) focuses on strengthening corporate supply chain due diligence as a way of protecting global human rights and reducing carbon emissions. The CSDDD will initially apply to larger firms, inside and outside the EU, with reporting rules likely to come into effect in 2027.

EU Deforestation Regulation (EUDR): Passed in 2023, the EUDR imposes strict supply chain due diligence rules that require firms to ensure their products are ‘deforestation free’. The scope of the EUDR includes products such as cattle, cocoa, palm oil and coffee, and the regulation will come into effect on 30 December 2024.

United Kingdom

Forest Risk Commodities (FRC): While the regulation has not yet been finalised, the FRC regime will be similar in application to the EUDR in that it will impose due diligence requirements on larger firms trading products like cattle, cocoa, and palm oil.

Corporate Governance Code (CGC): Sometimes known as ‘UK SOX’, the UK CGC sets out financial reporting obligations on larger UK businesses, with an emphasis on executive-level responsibility and compliance. An updated version of the UK CGC is scheduled to come into effect in late 2024.

ESG Rating Regulation: In 2024, the UK government announced plans to regulate ESG ratings agencies. The law will align UK ESG ratings with international counterparts, introduce oversight and transparency, and build industry confidence in the wider ESG regulatory regime.

Sustainability Disclosure Requirements (SDR): Similar to the CSRD, the UK SDR will impose ESG reporting and transparency requirements on larger UK businesses. Phased implementation of the SDR will begin in 2024.

United States

Customs enforcement: The US has strengthened existing customs rules in order to combat imports of goods that may have been produced using forced labour. A key example is the introduction of the Uyghur Forced Labour Prevention Act in 2022.

SEC Climate Disclosure rules: On 6 March 2024, the US Securities’ and Exchange Commission introduced federal regulations to standardise climate-related disclosures for public firms operating in the US. On 15 March 2024, following legal challenges by several US states, the SEC stayed the introduction of the rules.

APAC

China: In May 2024, China introduced ESG disclosure rules for its biggest companies. Known as the Self Regulatory Guidelines, the rules broadly align with the standards set out in the EU’s CSRD, and emphasise double materiality.

Singapore: The Monetary Authority of Singapore (MAS) has issued several ESG regulations, including a January 2023 Circular on Disclosure and Reporting Guidelines for ESG funds, and an ESG Code of Conduct in December 2023 outlining governance best practices.

Australia: In January 2024, the Australian government introduced plans for mandatory climate-related financial disclosures. The reporting rules will come into effect from 1 January 2025.

Adverse Media Screening and ESG

Adverse media stories typically offer firms a significant compliance advantage as they adjust to their ESG risk landscape. Environmental, governance, and financial scandals may be reported widely by news organisations (and in other media) before any official confirmation, giving firms that are vigilant an opportunity to gauge their risk exposure and take prompt action to avoid penalties.

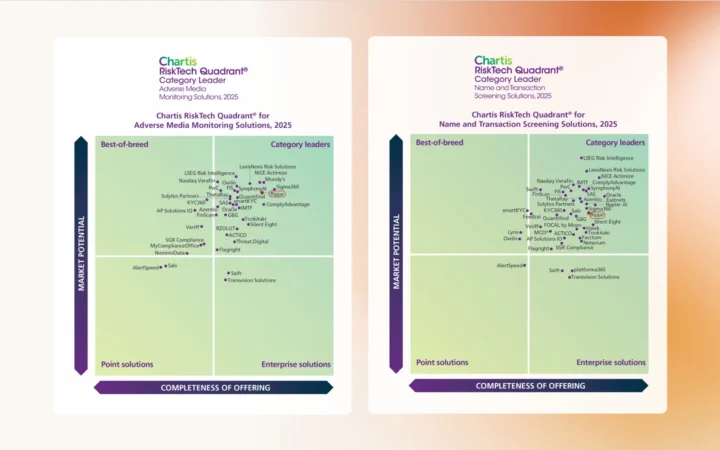

With this in mind, automated adverse media screening solutions can transform the ESG compliance challenge, offering an expansive global perspective on risk and the flexibility to adjust quickly when the landscape changes.

Ripjar’s Labyrinth Screening platform provides this kind of screening power, enabling name searches across thousands of unstructured data sources, including global news outlets, sanctions lists, and watchlists, and delivering actionable intelligence in seconds. Explore an array of powerful screening features designed to enrich your ESG risk data: extract only the most relevant information and minimise false positives with AI Risk Profiles, and use AI Summaries to generate concise prose paragraphs for each target in order to make faster, stronger compliance decisions.

Learn more about adverse media screening from Ripjar

Last updated: 6 January 2025