“Third-party risk is both daunting and kaleidoscopic.“

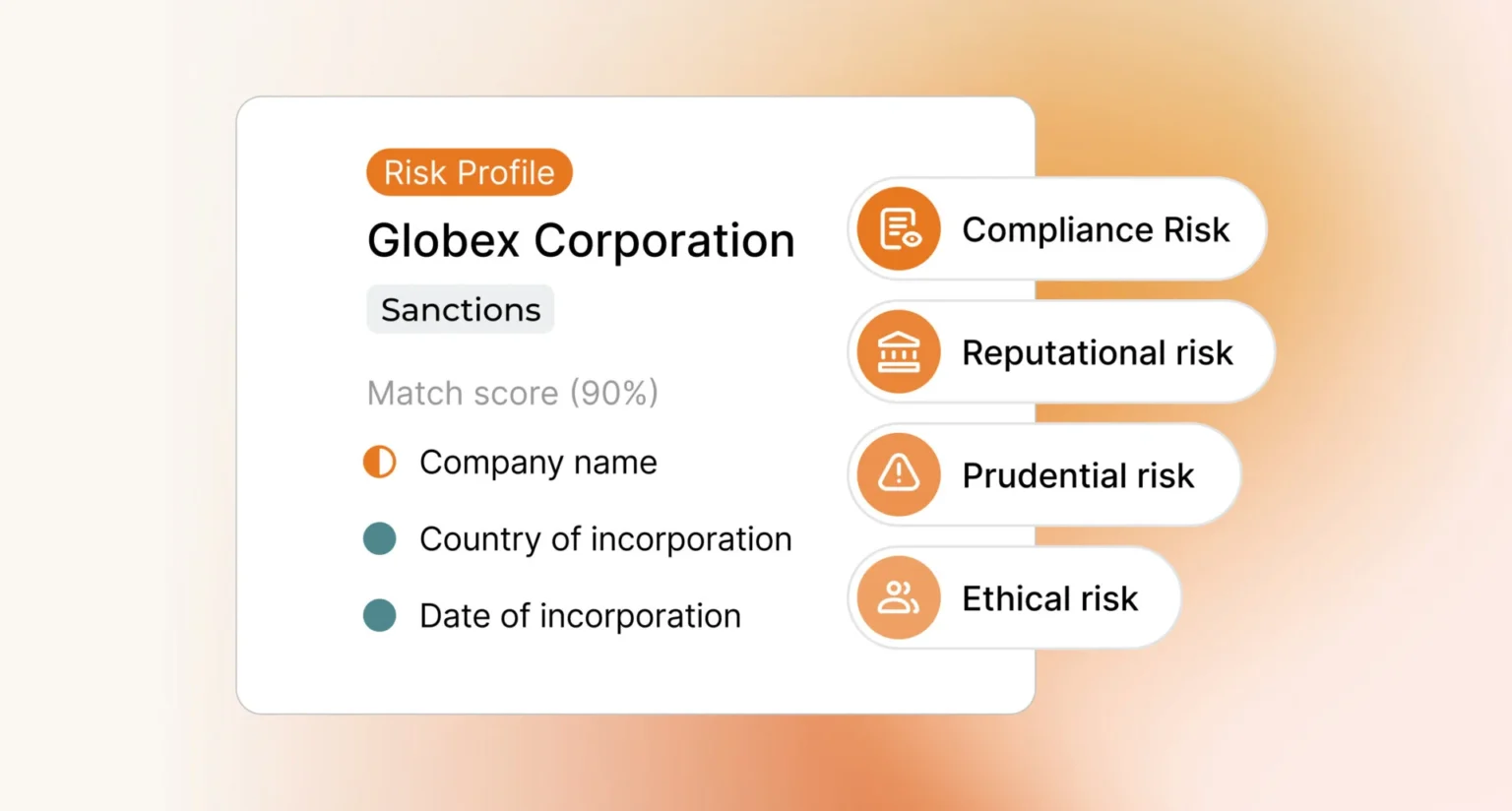

In global businesses, an endless stream of parties must be assessed, from payment counterparties to the value chain of suppliers and distributors. Furthermore, each party is examined for a growing list of risks, including compliance, ethical, reputational and prudential.

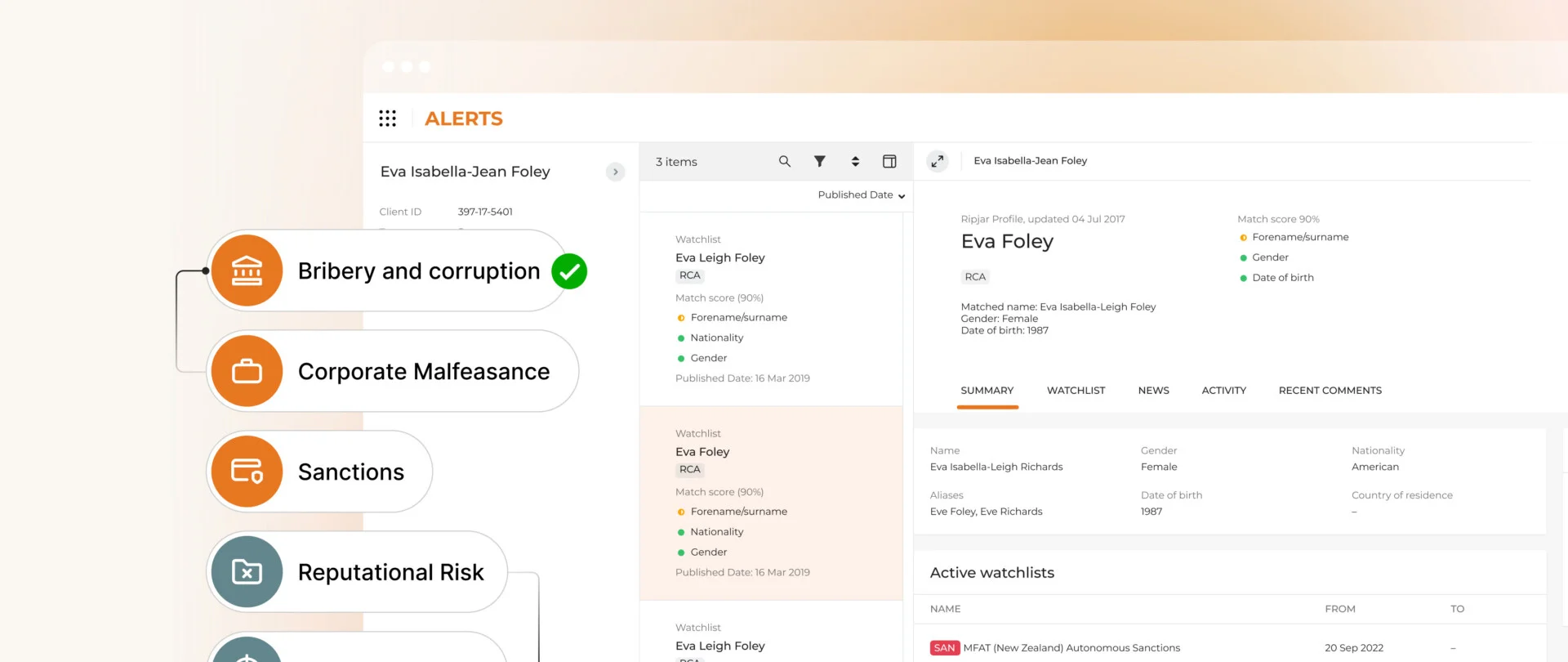

More than ever, businesses need a comprehensive and flexible risk management tool that scales up and down as needed to assure a consistent risk process and a singular library of all third-party risk. Welcome to Ripjar 3P60.

Different risks, different challenges

There are four key categories of third-party risk, each presenting distinct operational challenges:

Compliance risk

Legal obligations to comply with sanctions, restricted party classifications and export controls all bring compliance risks. Businesses typically assess this risk through simple screening tools in a low latency environment, such as customer onboarding or counterparty payments. False positives proliferate here due to difficulties with name matching and entity resolution.

It’s vital that businesses have the know-how and tools they need to spot potential sanctions evasion and build a sanctions-ready supply chain.

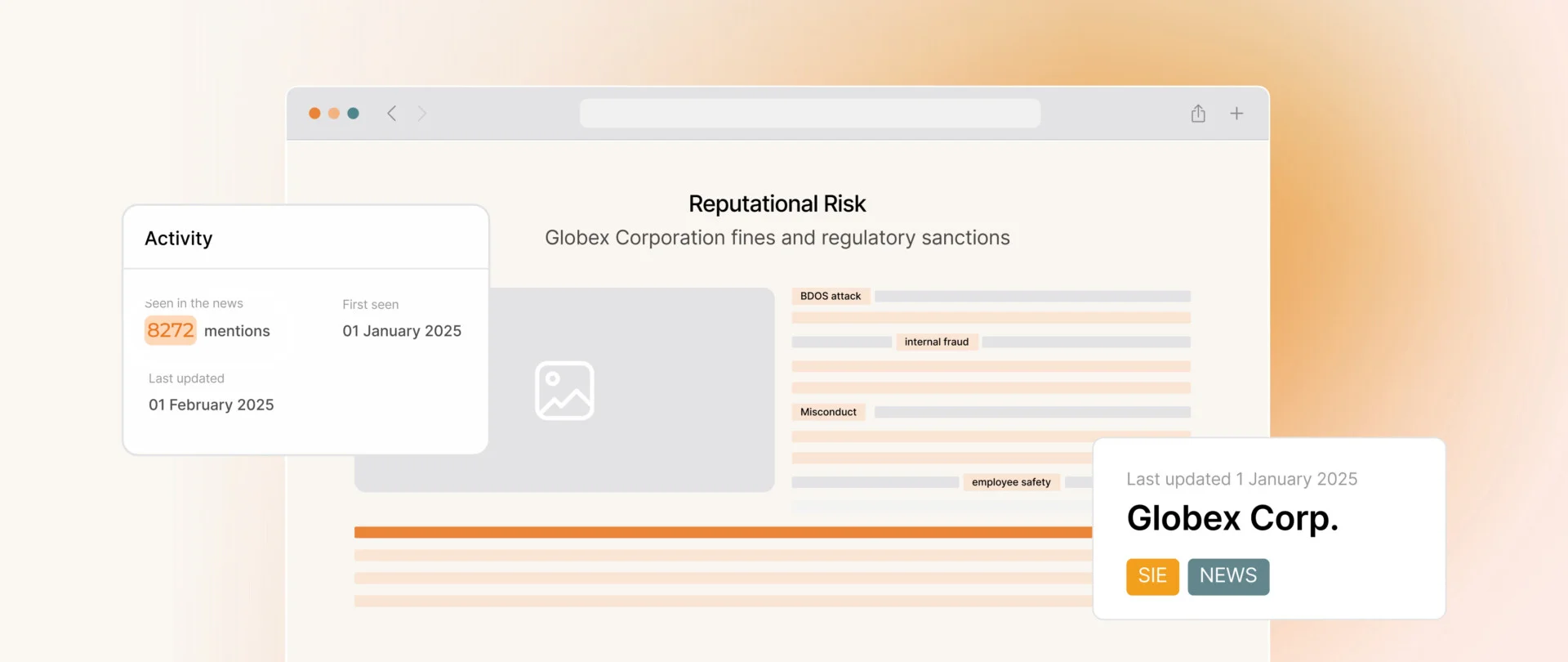

Reputational risk

Potential headline risk associated with customers, suppliers, distributors or other third parties can impact your reputation. In recent years, this type of risk has taken on a life of its own, especially in relation to forced labour, child labour or human trafficking. But risk coverage goes beyond these disturbing topics to cover areas including corruption, fraud, non-delivery and potential criminal wrongdoing.

Risk assessment here involves screening against wrongdoer lists and adverse media. False positives abound, due largely to ineffective entity resolution, especially among commonly used names.

Prudential risk

How well do you know your value chain? That indispensable group of suppliers and distributors? Do you know who controls them? Do you know all beneficial owners? Do you know their reputation in the market? Do you know their performance history? Do you know what political, corruption and sovereign currency risks may affect them?

Corporate entities tend to manage this risk through a largely manual process of researching, mapping and assessment. Ownership structures are identified and assessed. Political risk environments and supply routes are identified and assessed. These assessments, plus reputational risk gauging, are brought together and scored. The process is incredibly complex, heavily manual and needs to be continuously updated. In short, it is very expensive to fully implement.

Ethical risk

Do the parties you deal with share your values? Do they, or will they, follow your ethical policies and procedures? Often, risk is managed here through the use of certifications. Businesses will require suppliers and distributors to certify – usually annually – that they follow the firm’s ethical policies or procedures, or at least follow similar ones of their own. This annual certification process is tedious, time-consuming and full of manual tracking processes.

Risk strategy vs business reality

While the types of third-party risks are straightforward, the methods businesses use to assess these risks are anything but. Not every firm believes managing all these risks is prudent or commercially reasonable. No two businesses face the exact same risks, while risk tolerances – or “acceptable loss norms” as they are more broadly known – differ widely.

Some firms, therefore, make the commercially reasonable decision not to incur management expense related to particular risks, such as hiring personnel to manage the process, eliminate false positives and update results accordingly. And, even those that manage all four types of risk across the board rarely do so in a similar manner. Certain risks receive substantial management attention, while others are relegated to a “compliance only” status.

“Clearly, this is a market where one size does not fit all.”

You need a tool that fits your specific risk tolerance and enables you to scale up and down as needed. All risks and risk parties potentially need to be covered, even if you address each in your own bespoke way. You need a single, consistent and configurable way to assess and view risk, as well as an easily accessible central library providing single risk panes for all parties.

The good news is that current technology makes all this possible. A single, scalable platform is much more achievable now, and the latest AI has substantially lowered investment costs, as the number of employees required to run your system is a fraction of what it used to be.

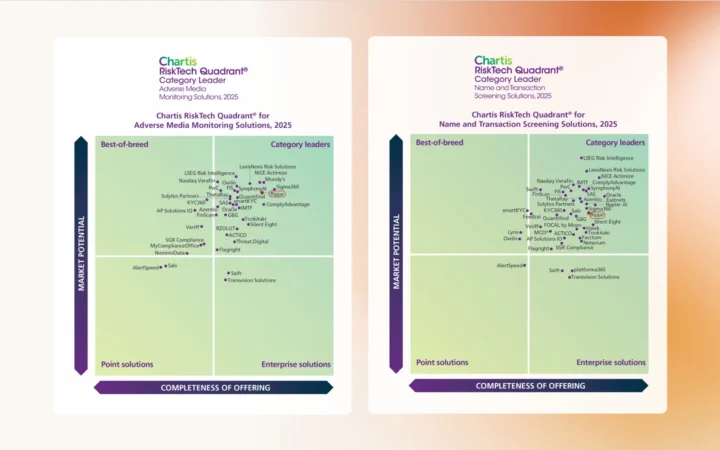

Welcome to Ripjar 3P60

Ripjar 3P60 is the only tool on the market to afford you this convenience. The tool comes in three variations, each sharing configurable workflows which can be tailored specifically to your organisation, a common risk assessment schema, and an AI-powered Digital Assistant to double check your team’s work, reduce false positives, and constantly update your results.

“Thoroughness, consistency, flexibility, efficiency and tailoring is what you need.”

Ripjar 3P60 comes in three options to suit different third-party risk management requirements:

Ripjar 3P60 Screen

This dual low and high latency screening engine enables you to satisfy your regulatory compliance obligations. Screening against a potentially limitless group of sanctions, restricted party and export control lists, Ripjar 3P60 Screen utilises the latest in probability-driven entity resolution and AI digital assistant technology to significantly reduce false positives and work to avoid all false negatives. Its configurable scoring matrix allows you to customise your risk assessments to meet your needs, enabling all results to be scored properly and consistently.

Ripjar 3P60 Assess

This option meets your compliance and reputational risk needs as well as covering baseline prudential risk management. Screen all counterparties for compliance purposes, screen all suppliers and distributors (and potentially some or all customers) for reputational risk concerns, and identify all beneficial owners and control persons across your value chain.

Ripjar 3P60 Assess is backed by the same technology and features as Ripjar3P60 Screen, while enabling you to cast the net wider to assess a broader range of risks. Your AI-powered Digital Assistant will continuously monitor and update records, scores and approvals as needed, and will create the building blocks to establish your global value chain map.

Ripjar 3P60 Intelligence

This comprehensive solution covers all your third-party risk management needs. Everything in Ripar 3P60 Screen and Assess is included, plus a full value chain map listing vulnerabilities from political, sovereign and transport route risks. All parties are thoroughly vetted and assessed, with your Digital Assistant working continuously in the background and supporting your team to avoid false negatives and positives.

Your Digital Assistant ensures that all work is up to date and properly assessed according to your configured scoring rules. Furthermore, our ethical certification engine configures certifications for your needs, with Ripjar’s Digital Assistant constantly tracking and ensuring compliance across your supplier and distribution chains.

For superior risk management, combined with the latest in AI technology, discover Ripjar 3P60.