Negative news, also known as adverse media, is an important component of any risk-based anti-money laundering solution. On 11 May 2022, the Wolfsberg Group, a highly trusted global banking association, published an FAQ setting out relevant negative news screening (NNS) considerations that financial institutions should take into account in order to improve risk-management ‘across the sector’.

While there is no universal definition of negative news, it is generally understood to refer to publicly-available information (often derived from news stories and other sources) that can be used to gauge a customer’s level of compliance risk. In a financial context, firms may use negative news to inform anti-money laundering (AML) and counter-financing of terrorism (CFT) risk assessments, and subsequently make important compliance decisions.

With the Wolfsberg Group FAQs as a starting point, we’re taking a closer look at the role NNS plays in risk-based AML/CFT and how it adds value to your compliance solution.

What is Negative News Screening?

Negative or adverse news takes a variety of forms, and ranges from conventional printed and televised news, to online content such as websites, blogs, and social media posts. Negative news may be formatted as traditional reportage, such as a printed column in a newspaper or website, or a segment on a news television show, or presented in a less-structured or even unstructured digital format such as an online video, or a post in an online forum.

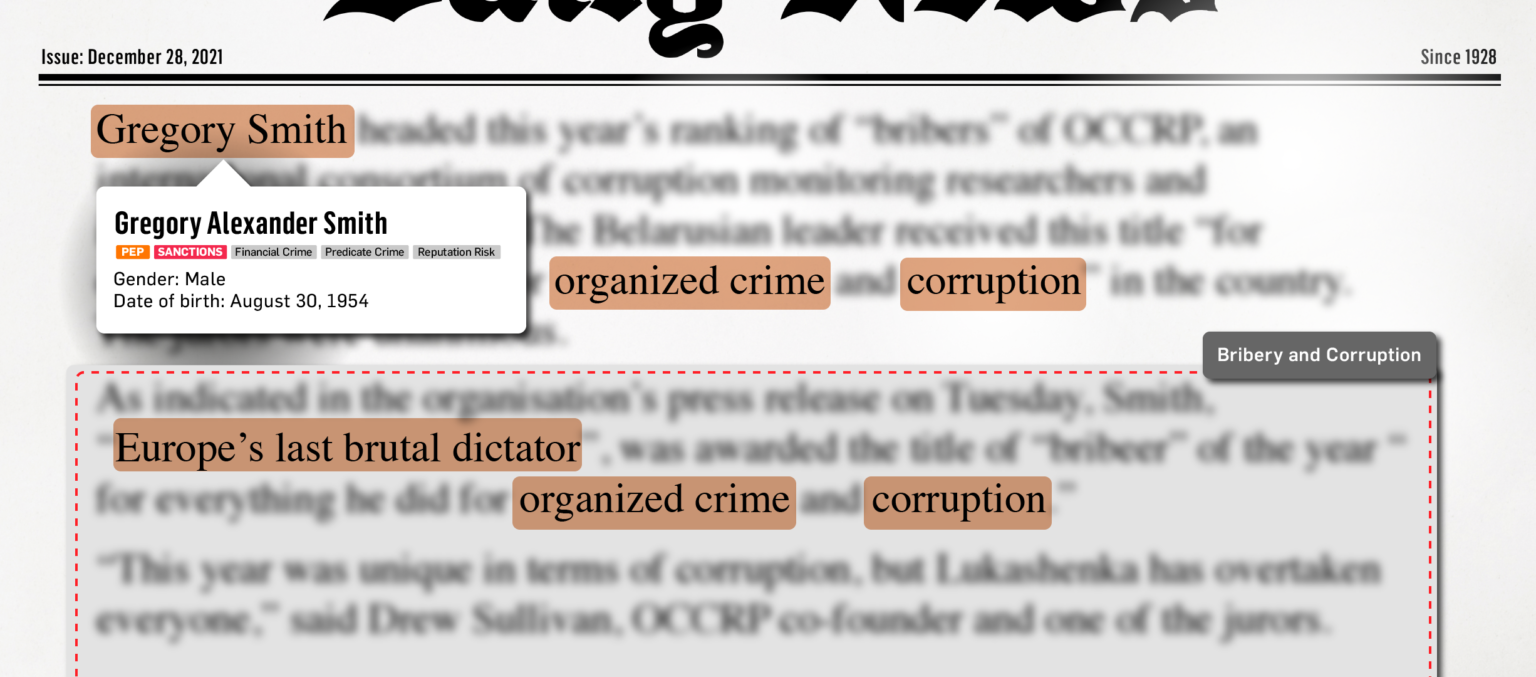

Negative news screening refers to a process of checking for customer involvement in adverse media by screening against a range of stories and sources. While negative news screening is essentially a complex name-matching process, it must also take into account a range of challenges. These include understanding the context of specific articles, the use of different language systems, nicknames, aliases and alternative spellings, the reliability of news sources, and the potential for political bias. With that in mind, negative news screening solutions should be developed to meet the unique risk-management needs of the businesses they serve, ideally incorporating suitable technology controls to accommodate the variables of a global media landscape.

Why Should Businesses Use NNS?

The risk-based approach to compliance recommended by the Financial Action Task Force (FATF) relies on businesses being able to build as complete a picture as possible of their customers’ AML/CFT risk exposure. This process – also referred to as the Know Your Customer (KYC) process – requires businesses to collect and analyse a range of important data, including customer names, addresses, place of residence, company incorporation documents, and more. Customers’ status as politically exposed persons (PEP) or their designation on sanctions lists is also relevant to their risk exposure.

When a financial institution needs more, or more detailed, information about a customer in order to perform a more thorough risk assessment, news media can provide a broad range of easily accessible data to inform the process. A firm may leverage news media insight to inform, for example, a customer’s identity, or the identity of their business partners. Similarly, news media may help companies to uncover beneficial ownership information where customers are using corporate structures to conceal potentially relevant connections to high risk considerations.

How Does NNS Enhance AML/CFT Compliance?

Risk-based compliance relies on more than just isolated snapshots of data and, when a customer’s risk exposure changes, firms must ensure they are informed as soon as possible. With that requirement in mind, official sources, such as government publications, may not reflect changes in customers’ risk profiles in a timely manner due to procedural and administrative delays. By contrast, breaking news stories offer up-to-date insight into a customer’s risk exposure and, importantly, may reveal that information prior to confirmation in official sources.

The kind of information that negative news stories reveal may be specifically relevant to the AML/CFT process and enable firms to make important compliance decisions more quickly. In particular, adverse media screening may enhance the AML/CFT compliance process by:

- Revealing a customer’s involvement in criminal activity, and so enabling a financial institution to apply enhanced due diligence, or examine previous transactions for indications of financial crime.

- Adding depth to a customer risk assessment and any subsequent risk categorisation, and informing the level of ongoing monitoring a customer may warrant.

- Initiating customer due diligence ‘trigger events’ that prompt the application of further AML/CFT resources.

- Providing additional, contextual information for suspicious activity investigations.

- Helping firms develop a better understanding of a customer’s source of wealth or source of funds as a factor in future compliance decisions.

Your negative news screening solution should be capable of meeting your business’ unique regulatory challenges. To find out how Ripjar’s next generation risk management technology can help your business optimise its AML/CFT compliance response, get in touch today.

Last updated: 16 August 2024