In a volatile global political climate, effective sanctions screening isn’t optional – spotting potential supply chain sanctions evasion is critical for global organisations.

The United States, for example, added over 3,000 names to its Specially Designated Nationals (SDN) list in 2024, compared to 2,500 in 2023. Similarly, in May 2025, the European Union imposed its 17th package of Ukraine sanctions, expanding restrictions against Russia and Vladimir Putin’s regime.

Long story short, the complexity of the global sanctions landscape, the severity of penalties for violations, and impact of ensuing reputational consequences, have increased the compliance burden significantly.

For global firms with a network of cross-border business relationships, that means it’s no longer sufficient to screen only customers and clients for sanctions risk. Instead, the scope of their screening solutions must expand to cover their wider third-party networks and supply chains, taking in suppliers, partners, distributors, contractors, and so on.

Meeting that expanded screening obligation requires firms to not only adjust their compliance tech stacks, but understand their third-party risk exposure. However, the sanctions risk posed by a supply chain or a third-party relationship is not always obvious or intuitive, and may even be hidden from basic sanctions screening processes.

With that in mind, we’ve put together a guide to some of the key red-flag indicators of supply chain sanctions risk. If you’re looking to strengthen your screening process, it’s worth becoming familiar with these red flags so that you can optimise your compliance performance from the ground up, and avoid unnecessary regulatory friction.

Why Are Supply Chains Vulnerable to Sanctions Evasion?

While most organisations are familiar with the immediate risks posed by their customers and clients, the need to factor in supply chains and third-party risk management makes things more complicated.

That’s because, in a global professional landscape, most firms operate amidst sprawling physical and digital networks, which span borders, industries, and regulatory environments. As part of that connected world, firms necessarily face a higher volume of sanctions compliance threats, and consequently, a greater exposure to risk.

Unfortunately, in this context, compliance isn’t quite as easy as checking a customer’s name against the relevant sanctions list (or lists). Third parties pose significant hidden sanctions risks because they may operate to different regulatory standards, may be concealing their liability, or, in worst case scenarios, attempting to evade sanctions and thwart scrutiny.

The only way to effectively manage that expanded risk is to implement a robust screening solution, capable of managing vast amounts of third-party data and of adapting to the fluctuations of the sanctions landscape.

Now that we know why it’s important to strengthen supply chain sanctions screening, let’s move on to the things you need to look for.

Common Red Flags for Sanctions Evasion

Proximity to sanctioned jurisdictions

Counterparties that are based in, or that route goods through, a country bordering a sanctioned jurisdiction may be masking the ultimate destination of those goods. Not all countries maintain solid borders, and certain trading entities may attempt to exploit that by covertly moving goods into an adjacent sanctioned jurisdiction.

Changes in trading behaviour

When a counterparty makes abrupt changes to its trading behaviour, the goods and services it offers, or its ownership structure, this may be indicative that it’s engaging in sanctions evasion. For example, a shift away from the trade of electronic goods, which are typically designated on sanctions lists, in favour of trade in textiles, which are not frequently targeted, could be an indicator of risk.

Shell companies

Persons engaging in sanctions evasion may attempt to avoid screening measures by concealing their identities (and, by extension, the true risk they pose) behind shell companies, or behind overly complex corporate infrastructure. Examples of this kind of red flag include companies that have suspiciously little or no online presence, minimal staff, or no physical premises.

Document discrepancies

Discrepancies in documentation, such as mismatches between shipping records and invoices, may indicate sanctions evasion activity – specifically, attempts to conceal the trade of sanctioned goods. Be alert for vague or inconsistent descriptions of shipped goods, or miscalculated quantities of cargo.

Financial holdings in third countries

Be vigilant for companies that hold settlement accounts in third countries with deficient anti-money laundering (AML) and counter-financing of terrorism (CFT) regulations. Lax enforcement in these jurisdictions may create opportunities for sanctions evasion.

High risk and dual-use goods

Certain goods are highly regulated because of their potential for criminal misuse, while others have both civilian and military applications, and so are classified as “dual-use”. Companies that trade in these types of goods pose a higher sanctions risk and should be scrutinised closely during screening.

Unusual intermediaries

Companies that engage multiple intermediaries or third-party consignees to facilitate trade, without explanation, may be attempting to distance themselves from buyers and end-users in an attempt to avoid sanctions. A sudden engagement of a new intermediary may be similarly indicative of risk.

Lack of end-use documentation

End-use of goods is a critical sanctions consideration. Legitimate trading partners should be able to provide documentation to support the end-use of the goods they are importing or exporting. Therefore, failure to provide end-use documentation may indicate an attempt to evade sanctions restrictions.

In isolation, each of the listed red-flag indicators doesn’t necessarily confirm that an organisation or individual is engaging in sanctions evasion. Collectively, however, or in combination they may inform a compliance response, and represent the difference between a decision to initiate enhanced screening, to freezing a transaction and alerting the relevant authorities.

Supply Chain Sanctions Screening Best Practices

Understanding red-flag indicators of supply chain risk is fundamental to implementing an effective compliance response and building a sanctions-ready supply chain. To optimise that response, firms must take a proactive, data-driven approach to screening, and adopt the following best practices.

Risk-based due diligence

Firms should perform risk assessments on third parties in their supply chain. That process will necessarily involve data collection and analysis, and a need to obtain a range of identifying information from third parties, including names, addresses, company incorporation documents, financial records, and so on. Where that information points to a higher level of risk, firms may seek to perform enhanced due diligence.

Continuous monitoring

The shifting geopolitical landscape means that third-party risk exposure can change quickly. To account for this change, firms must conduct ongoing sanctions screening of third parties (rather than just at onboarding, periodically or the start of a business relationship), in order to ensure the accuracy of established risk profiles.

Harness external data

To perform risk assessments on targets up and down the supply chain, firms need to be able to collect and manage vast amounts of external data. That data should be of a sufficient quality, and broad enough scope, to support effective compliance decision-making. In practice, this means screening not only official sanctions lists and watchlists, but a range of credible global adverse media sources, including screen and print media, and social media.

Leverage technology

Screening solutions are key to the sanctions data management challenge. Firms should aim to automate as much of the process as possible in order to manage the thousands of data sources necessary to build accurate risk profiles. Artificial intelligence (AI) systems offer a significant advantage in supply chain screening: not only do they provide speed and accuracy, but can spot hidden patterns and connections in risk data to help build a comprehensive overview of a firm’s risk exposure.

Build a culture of compliance

Screening technology is only as effective as the human experts using it. To ensure optimal third-party risk management, firms should support their employees’ roles in the compliance effort by offering regular training and skill development. That process will ultimately contribute to a company-wide culture of compliance that can only enhance the contribution of compliance teams as they adapt to new regulations and new sanctions evasion strategies.

Spot More Red Flags With Ripjar 3P60

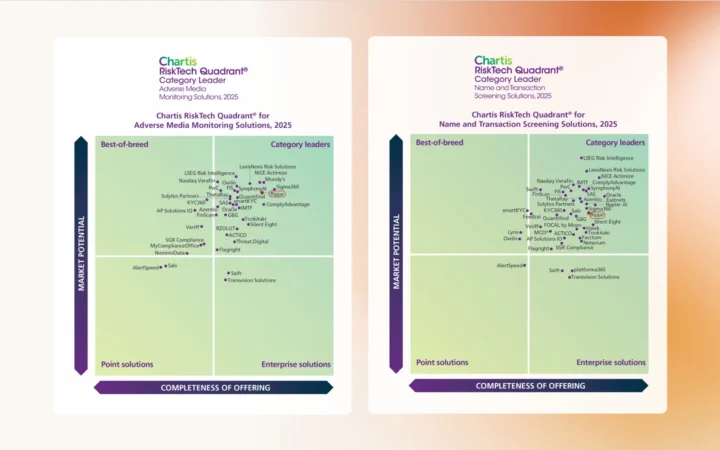

Ripjar’s AI-powered screening platform Ripjar 3P60 is designed to help firms meet their third-party and supply chain compliance challenges in jurisdictions around the world. A comprehensive third-party risk management solution, Ripjar 3P60 builds flexibility and resilience into your screening process from the ground up, and leverages advanced AI analytics to help you deal with risks whenever and wherever they emerge.

Find out more about Ripjar’s supply chain screening solutions.