The UK’s sanctions landscape has evolved dramatically since 2022, primarily in response to Russia’s invasion of Ukraine. During that time, the Office of Financial Sanctions Implementation (OFSI) has worked to ensure the UK government’s sanctions against Russia are enforced effectively, and that entities within the UK understand their compliance responsibilities.

With the UK’s Russia sanctions programme ongoing, in February 2025, OFSI released its Financial Services Threat Assessment. The report is intended to help UK firms deal with the changing global sanctions landscape, and, in particular, with the complexity of the restrictions against Vladmir Putin’s regime. To that end, the Threat Assessment focuses on the risks associated with Russia sanctions violations, including the need to accurately identify designated persons (DPs), the enablers of sanctions violations, the use of alternative payment methods to avoid restrictions, and failures in internal compliance solutions.

The report serves as an essential resource for all UK-based financial services firms, which should now review their compliance solutions in order to ensure alignment.

To help you navigate your UK sanctions obligations, we’ve put together a list of key takeaways from the report.

Key OFSI Takeaways for Financial Services

Failure to self-disclose

OFSI monitors suspected breaches of UK sanctions rules on a sectoral basis, and suggests that, while most reports are self-disclosed by financial institutions in a timely manner, the standard varies across different sectors and across the UK’s various sanctions regimes.

The report reveals that OFSI observed breaches that did not lead to self-disclosure by “some” UK financial services firms and non-bank payment service providers (NBPSPs). OFSI’s assessment implies a regulatory risk for firms that are not being fully transparent or rigorous in executing their sanctions compliance obligations.

Enablement activity

OFSI suggests that it is “almost certain” Russian designated persons (DPs) are using both professional and non-professional enablers to help them breach UK sanctions, and that activity has “significantly increased” since 2023.

OFSI defines non-professional enablers as individuals or entities that act on behalf of DPs to breach sanctions. These enablers have “close personal ties” to DPs and may include family members, spouses and ex spouses, and professional associates.

The report classifies three types of enabler activity:

- Making payments to maintain the lifestyle or assets of DPs.

- Fronting on behalf of a DP to claim ownership of frozen assets.

- Money laundering to provide DPs with liquidity.

The Threat Assessment adds that Russian DPs are using “increasingly sophisticated methods” to breach sanctions, and that banks and financial institutions are in particularly advantageous positions to spot this kind of activity and report it to the authorities.

Compliance teams can address enabler activity by monitoring any new movement of assets and applying enhanced due diligence to the persons involved.

Fronting risks

The report suggests that it is “likely” that “a small number of enablers” have engaged in fronting activities on behalf of Russian DPs.

Fronting is defined as the act of professional enablers coming forward to claim ownership of assets that have been frozen under UK sanctions rules. The enablers typically target frozen assets that have unclear ownership – such as those associated with insolvency and complex corporate structures (shell companies), or situations in which significant liquidity is involved.

Enablers engaged in fronting present themselves as legitimate business persons, and often have links to DPs which they seek to conceal. These links are not necessarily obvious and may involve previous employment with a DP, or past membership of a shared community.

OFSI sets out a number of red flag indicators of fronting activity, which include:

- Individuals with limited public profiles and little relevant experience to the professional roles they hold.

- Inconsistent spellings of names – particularly those derived from Cyrillic.

- Recent changes of name.

- Recently-acquired non-Russian citizenships.

Maintenance payments

The Threat Assessment suggests that it is “highly likely” that enablers have used NBPSPs to help Russian DPs maintain their lifestyle and assets in the UK – in violation of sanctions restrictions. Maintenance activity involves payments that relate, for example, to DPs’ superyachts, personal security services, school fees, concierge services, and high value goods.

Enablers involved in maintenance payments “are typically small companies” engaged in services for “ultra-high-net-worth lifestyles”, and have relationships with the DPs which predate their designation on the UK sanctions list. Maintenance payments may also be made by DPs’ family members and close associates.

The report points out that financial services firms are, again, well placed to spot maintenance payment activity, which often leverages multiple payment methods, including cash and cryptocurrencies. OFSI has set out a number of red flags for maintenance activities, including:

- Regular payments previously made by a DP now made by a new individual.

- Family members and close associates of DPs receiving significant funds without adequate explanation.

- Frequent payments between entities controlled by a DP.

- Individuals attempting to deposit large sums of cash without adequate explanation.

- Family members and close associates of DPs engaging in cryptocurrency transactions.

Next Steps: Strengthening Russia Sanctions Compliance

In the wake of OFSI’s Threat Assessment report, compliance teams should take the following steps:

- Strengthen due diligence: Financial institutions should ensure they establish and verify the identities of their customers by performing adequate customer due diligence. In addition to collecting identity documents, firms should seek to scrutinize assets ownership and beneficial ownership, complex corporate structures, and cashflow sources.

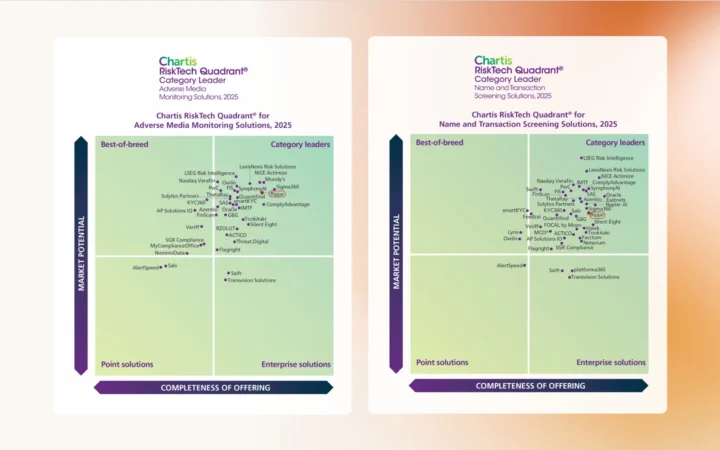

- Improve screening and monitoring: Financial institutions should review their sanctions screening solutions to ensure they are capable of capturing Russia sanctions risk effectively. In practice, this means integrating an automated screening solution, with global scope, and multi-language name search capabilities.

- Proactive self-reporting: Given OFSI’s focus on failure to self-disclose, financial institutions must review their sanctions breach reporting process.

Russia Sanctions Screening Advantages

Russia sanctions are only a component of an evolving global landscape, which hosts thousands of potential threat vectors. In this environment, UK banks and financial institutions must remain agile and adaptable, without compromising the rigorousness of their sanctions screening capabilities.

With that in mind, automated screening technology should be a critical part of any sanctions compliance solution. Automated screening tools not only add speed and accuracy to sanctions list name searches, but reduce the potential for costly human error, and enable organisations to scale their response to their unique needs.

Screening tools enable organisations to search thousands of global sanctions lists and watchlists in seconds, along with other indicators of risk such as adverse media stories that can reveal changes in customer risk profiles long before official designation. Screening technology may also leverage artificial intelligence tools, to help compliance teams work with vast amounts of data, eliminate false positive alerts, generate meaningful intelligence, and ultimately, make stronger, faster decisions.

To discover how Ripjar’s products can support your sanctions compliance, book a meeting with our team.