In June 2025, the Financial Action Task Force (FATF) released new guidance on Financial Inclusion and Anti-Money Laundering and Terrorist Financing Measures.

The guidance focuses on facilitating access to formal financial services for unserved and underserved persons, including those in low-income groups, or groups that may struggle to verify their identities easily.

Commenting on the release of the guidance, FATF President Elisa De Anda Madrazo pointed out that inclusion doesn’t just help disadvantaged people gain access to legitimate financial services, but contributes to the global fight against financial crime because it “reduces the size of the black and informal markets where criminals and terrorists hide their operations.”

As national governments adopt the new guidance, firms may need to adjust their anti-money laundering (AML) and counter-financing of terrorism (CFT) solutions. With that in mind, let’s take a closer look at the issues and risks surrounding financial exclusion, and explore the key takeaways of the 2025 guidance for domestic compliance teams.

What is Financial Exclusion?

While AML/CFT measures are a critical part of the global fight against financial crime, if they’re applied too rigorously as part of a risk-based approach to compliance they can have unintended consequences – namely, excluding persons from the financial system unfairly.

The over-application of AML/CFT measures is known as de-risking and is typically a result of firms seeking to manage a high level of compliance risk. De-risking is more likely in high risk industries and regions, and can affect vast groups of people with no connection to criminal activity, especially if they are from underprivileged backgrounds where other risk factors, such as a lack of formal identification (driving licences, passports, etc.), create additional barriers to financial services.

Why is Financial Exclusion a Compliance Issue?

Financial exclusion is often unfair, but it can also be harmful because it can actually increase the risk of financial crime, rather than reducing it. People who are excluded from the financial system are left with no choice but to use unregulated alternatives, either turning to black markets, or engaging in crime themselves and attempting to launder the proceeds.

These alternatives are, by definition, harder to monitor, and support wider criminal networks, not to mention ultimately adding to the AML/CFT compliance burden that firms face.

That’s why the new guidance from the FATF is so valuable. By turning a new regulatory focus on financial inclusion, firms can, in theory, bring more people into the legitimate financial system without compromising the integrity of AML/CFT controls.

The Key Takeaways

So, how does the new FATF guidance achieve its financial inclusion objectives? Let’s explore the key takeaways.

Proportional AML/CFT Measures

The FATF recommends that firms take a risk-based approach to AML/CFT compliance. Under previous guidance, that approach entailed a “commensurate” response to risk. Under the 2025 guidance, that term has been updated to “proportionate”.

The change reflects the need for countries to avoid imposing a uniform “one size fits all” AML/CFT regime on obligated entities. Under the proportionate risk-based response, firms have the flexibility to adjust their compliance solutions to match the “level and nature” of the risk they face, rather than simply excluding customers immediately.

Digital Onboarding Legitimacy

The guidance highlights the legitimacy of digital and non-face-to-face onboarding methods for financial services, providing that appropriate safeguarding measures are in place, and that the level of risk is manageable. The option of conducting digital and non-face-to-face onboarding makes it easier for some customers to open bank accounts where travel or other issues relating to physical distance might represent a barrier.

Automatic Risk Classification

The FATF guidance states that financial institutions should not automatically classify unserved and underserved persons as presenting a low AML/CFT risk, but points out that “risk assessments often conclude that they present a lower risk.”

It goes on to stress that financial inclusion initiatives must be predicated on the proper application of the risk-based approach, including an effective risk assessment process with “enhanced measures for higher risk” and “simplified measures for lower risk.”

De-risking Sectors and Populations

The guidance emphasises that the FATF has “long recognised the harmful impact” of de-risking, and that the practice is “not in line” with the risk-based approach that it mandates. It specifically warns against the “wholesale cutting loose of entire classes of customers” without properly taking their risk into account – in other words, applying appropriate risk mitigation measures on the level of individual customers.

Financial Inclusion Goals

The FATF recommends that governments formally incorporate financial inclusion goals into their National Risk Assessments (NRAs).

While it recognises that there is “no single or universal methodology” for conducting an AML/CFT risk assessment, the FATF suggests that NRAs should set out key concepts and stages involved in the process, in order to support “effective, proportionate implementation”. It also emphasises that NRAs should be coordinated at a national level, and be “comprehensive in scope”.

Financial Inclusion with Ripjar One

The FATF guidance suggests firms should reframe financial inclusion as an important part of their risk management strategies. However, in order to achieve better compliance outcomes for unserved or underserved customers, compliance teams need to be able to collect and analyse vast amounts of risk data accurately and efficiently, and make decisions with confidence.

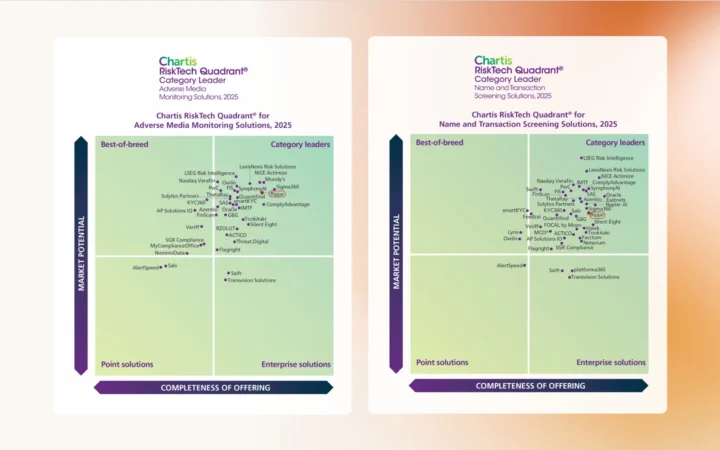

Ripjar One is designed to address that challenge. Powered by cutting-edge artificial intelligence, Ripjar One is a next-generation AML risk management platform that creates a comprehensive view of customer risk, consolidating static and dynamic risk data from thousands of sources, including sanctions lists and watchlists, adverse media, and more.

Segment and tailor your AML screening in line with your risk-based approach.