AI-driven protection for communities

Enhance your trust and safety with proven technology

Your trusted partner in trust and safety

Trust is everything. Whether you’re safeguarding online communities, securing physical assets, or ensuring confidence in online marketplaces, trust forms the foundation of success. Ripjar empowers businesses to maintain trust by leveraging cutting-edge AI to detect risks, identify malicious actors, and ensure compliance, at scale.

Build trust with support from advanced AI tools

Take a comprehensive approach to protecting your users and community with Ripjar’s advanced AI-powered software. From generating a unified view of risk to identifying criminal threats in real time, Ripjar can find connections and pinpoint risk in huge volumes of data.

A holistic approach to trust and safety

With extensive experience across hospitality, online marketplaces, social media platforms, and more, Ripjar is trusted globally to tackle the unique challenges and requirements of trust-driven businesses.

Serving trust-driven industries worldwide

Ripjar’s solutions are designed for businesses that prioritise trust, safety and compliance. Whether you operate in hospitality, online marketplaces, social media platforms, or another trust-centric industry, our technology can effectively support your operations.

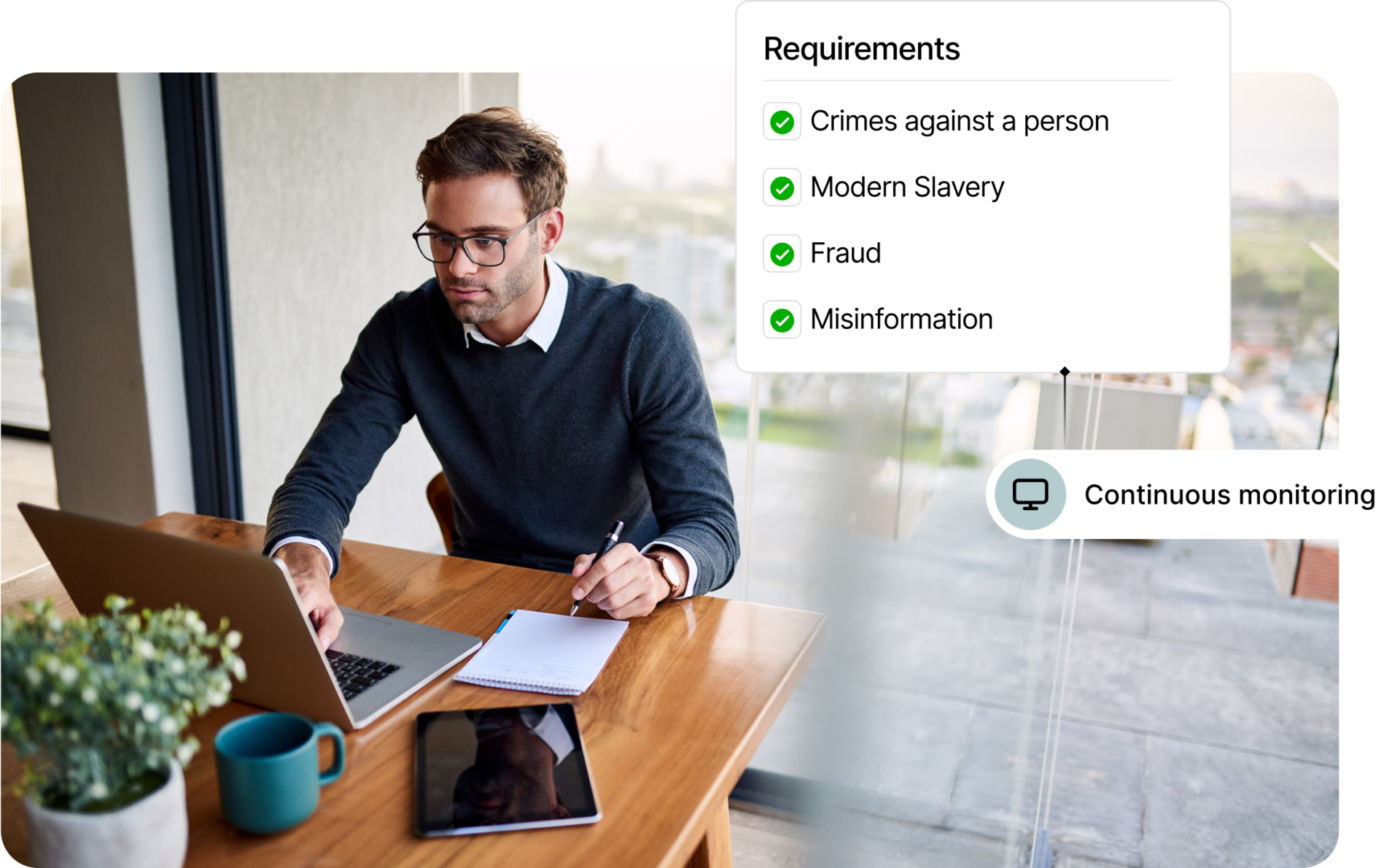

A solution for every requirement

Ripjar provides powerful solutions to meet the unique needs of trust-focused businesses. Whether you need advanced screening, detailed verification, or actionable community intelligence, our tools are here to help you deliver on your promise of safety and trust.

See it in action

Discover how Ripjar can transform trust and safety for your business.