Dynamic Risk Profiling

The future of AML risk management: real-time, dynamic, intelligent

Transform your AML risk management with dynamic risk profiling

Static risk profiles are a thing of the past. Ripjar has shifted the goalposts by combining data from client screening, your customer data and transaction monitoring alerts to give you a real-time profile view of risk.

-

Clients

-

Originators

-

Beneficiaries

-

Correspondent banks

-

Counterparties

-

Vendors

Step into the future with Dynamic Risk Profiles

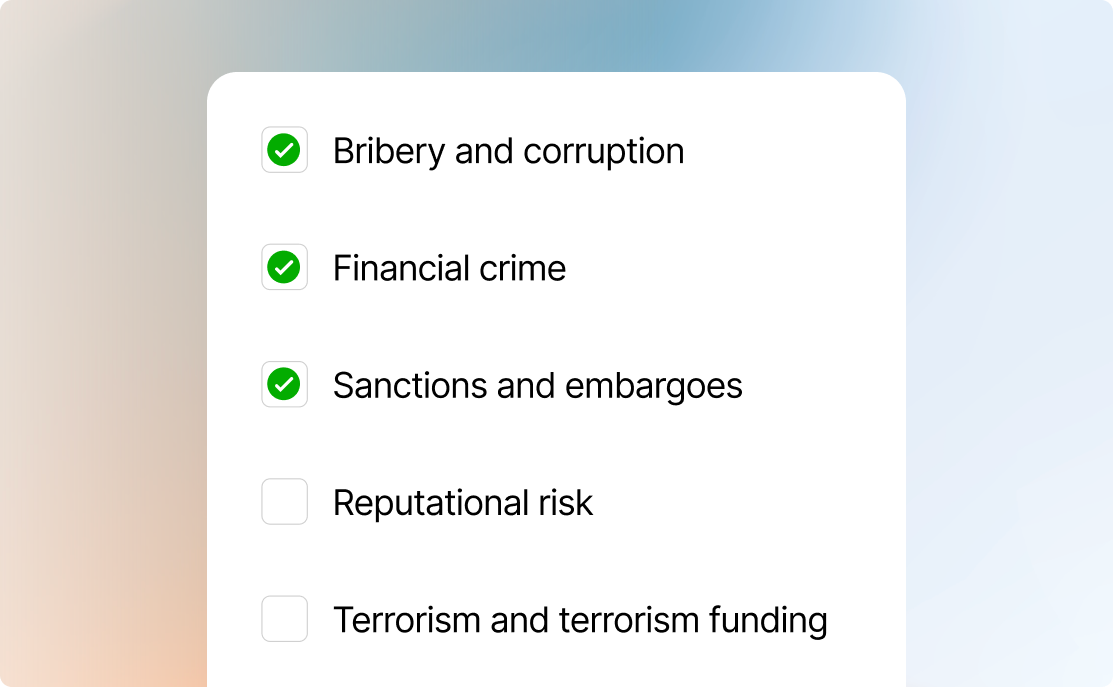

Screening has barely changed in decades, resulting in missed risks, costly inefficiencies, and generic profiles that fail to capture real threats. We’ve turned customer profiling on its head, transforming screening and transaction monitoring into a live risk management process that delivers real value.

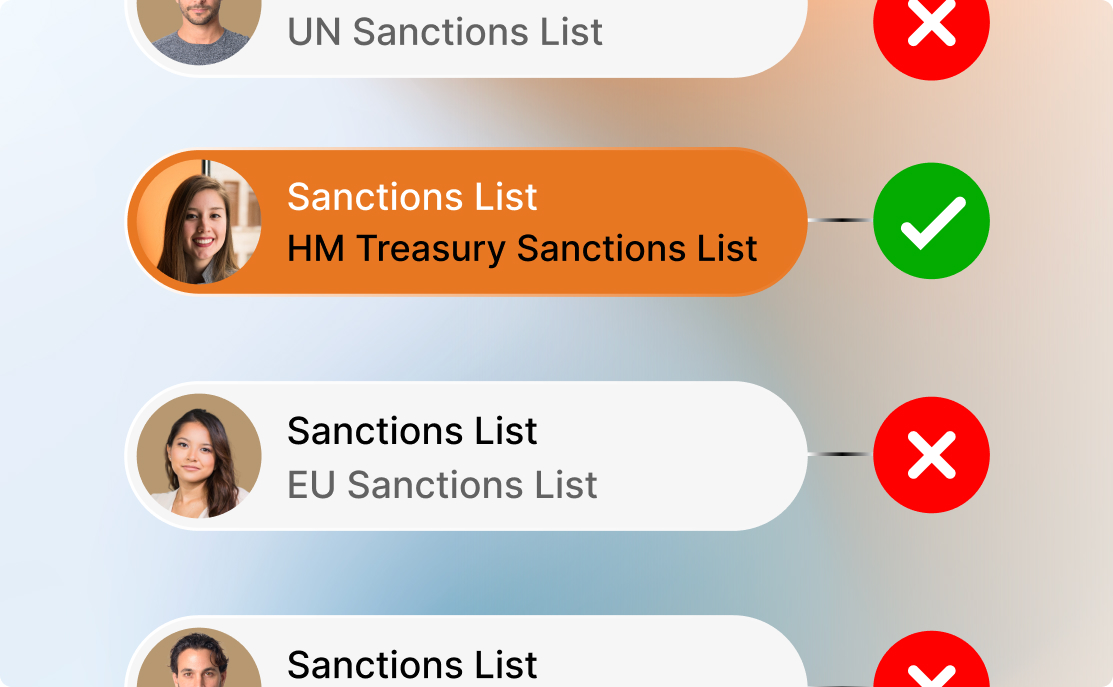

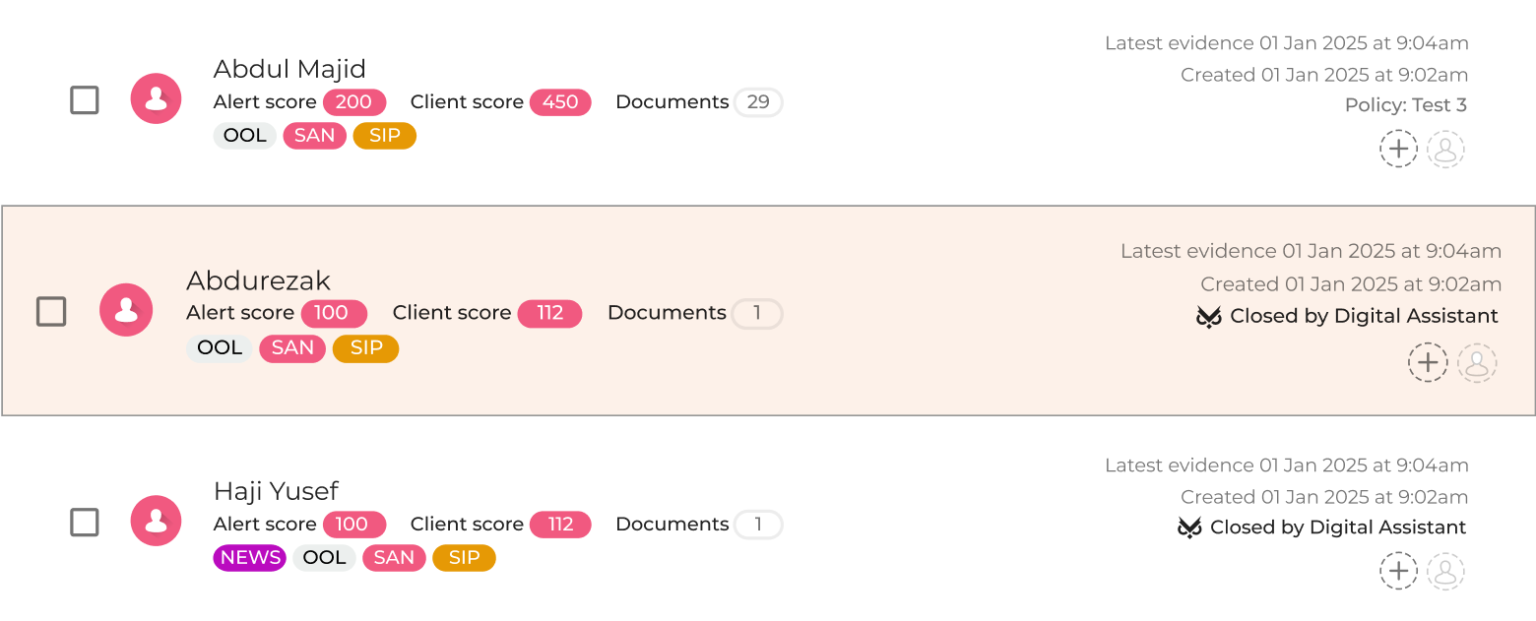

Slash false positives with Ripjar’s Digital Assistant

Is your compliance team wasting time battling false positives? Poor quality data and generic matching criteria often require large teams to review unnecessary alerts. Free your team from the burden of false positives and see real return on investment with Ripjar.

Proven results

Improve screening results, boost your ROI, and reduce the analyst burden with Ripjar.

Why customers choose us

“We demonstrated a 13% improvement in recall and simultaneously a 91% reduction in false positives as measured by our model validation team on an unseen dataset.”

Tier 1 Bank

“We found that the number of false positives had gone down in all regions by an average of 80% after go-live.”

Tier 1 Bank

Avoid the danger of false negatives

Effective screening requires the use of multiple data sources containing both structured and unstructured data. This large amount of diverse data presents a huge task for compliance teams, and can result in risks easily getting missed.

Ripjar offers a 94% improvement over fuzzy matching technology

International name matching expert

Stay ahead of regulatory demands

In a highly regulated environment, banks and financial services need to stay on top of changing regulations, fast-moving sanctions, and spot potential risks quickly to ensure regulatory compliance.

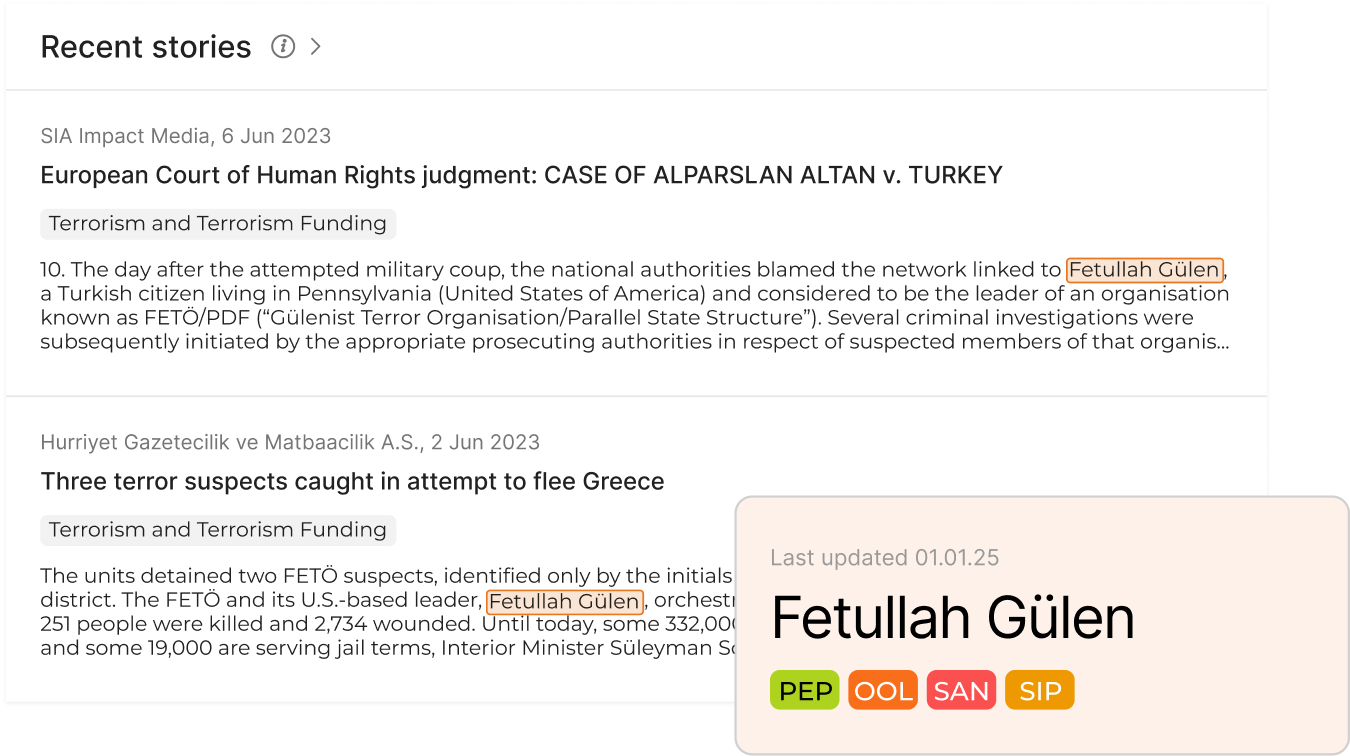

Continuous monitoring

From rapidly changing sanctions to emerging risks, Ripjar proactively spots risks as they develop, keeping you up to date and ensuring your regulatory compliance.

-

Save time

Avoid the need for resource-heavy periodic reviews -

Stay ahead

Always have access to the most current risk information

Enhanced with adverse media

Adverse media screening is increasingly being expected by regulators. Ripjar enhances sanctions and watchlist screening with adverse media data, providing additional context.

-

Predict risks

Spot potential risks sooner with early mentions in the media -

Enhance profiles

Improve accuracy and build detailed profiles with industry-leading identity matching -

See clearly

Get a clearer picture with AI Summaries of adverse media risk

Multi-territory screening

Ripjar’s industry-leading data security options simplify screening in complex global organisations, enabling you to meet the strictest requirements across different regions.

-

Control centrally

Store, access and screen data separately in different locations, while maintaining central control -

Screen geographically

Comply with different locations’ regulations by screening against regional lists

Ripjar has a pedigree in supporting European financial institutions, as well as those that run operations across the globe. This made them the perfect fit to support the requirements of VP Bank.

Markus Reinacher, Head Group Compliance & Operational Risk, VP Bank Group

Which solution is right for you?

Whether you’re looking for pure, high-quality name and media screening, have a focus on gaining a wider view of risk, or want a fully comprehensive approach with dynamic risk profiling, there’s a Ripjar solution to suit your organisation’s requirements.

Ready to

get started?

Our experts are available to talk through your requirements, answer questions, and set up a demo.